It’s no secret that exchange-traded funds (ETFs) have transformed portfolio construction and investment management. These daily tradable baskets of stocks, bonds, and other assets provide a host of benefits to investors, both large and small. As such, they’ve quickly become the main ways to build a portfolio. This includes core and tactical asset allocations.

And now, ETFs are quickly becoming the way investors get their active management fixes.

This news comes from the latest Tracksight Global ETF survey. These days, investors are quickly turning to ETFs for active management. That comes at the expense of traditional mutual funds. It’s easy to see why. With ETFs allowing active management to truly shine, going forward they could become the only game in town.

A Big Surge in Asset Gathering

Active ETFs have been part of the conversation for a long time. The first active ETF was launched in 2008. However, the most active ETFs were outliers and weren’t necessarily popular with investors. That all changed in 2021. Driven by new rules and changes regarding transparency, the number of actively managed funds has blossomed over the last few years. In addition, costs have continued to sink, making active ETFs on par with passive funds in terms of expenses.

The result is a huge surge in the number of funds and asset gathering.

According to Tracksight, total North American—U.S. and Canada—assets under management in active ETFs surged to $664 billion at the end of 2023. That’s a huge 500% increase over 2018’s active ETF assets. In just five years, active ETFs’ share of total ETF assets has gone from 2.8% to 7.5%. That’s impressive considering there is more than $8 trillion in total ETF assets.

The best part is there is plenty of potential for active ETFs going forward. It looks like investors are starting to choose active ETFs over their mutual fund twins.

Tracksight’s Latest Survey

For the fifth time, researcher and investment data provider Tracksight released its Global ETF survey. The survey, dubbed "50+ Charts on Worldwide ETF Trends’’, interviewed 500 ‘seasoned’ investors. Those investors oversee ETF assets totaling more than $900 billion and include family offices, financial advisors, and asset managers. So, their opinions matter and they have serious weight in the industry.

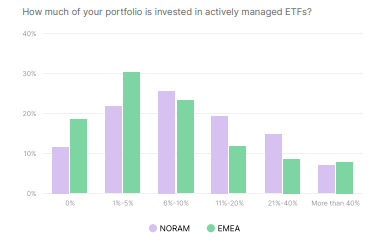

And it looks like that weight is quickly going toward active ETFs. More than 73% of respondents were currently invested in active ETFs or were keen on adding them to a portfolio in the near future. Of those that invest in active ETFs, these funds are quickly becoming a bigger part of their overall pies. This graph from Tracksight shows that active ETFs in North America make up significant weightings in many investors’ asset allocations.

Source: Tracksight

The fund type continues to draw investors. Tracksight’s data also showed that investors are planning on increasing their allocations to active ETFs by 5% to 20% over the next two to three years.

However, the next piece of the survey is where it gets interesting for active ETFs.

Active management has long been the realm of mutual funds. Trillions of assets continue to sit in mutual funds that are actively managed for returns. But Tracksight’s survey shows that this dominance is quickly slipping.

The survey shows that 80.1% of respondents said they would go active if the strategy/fund was packaged in an ETF rather than a mutual fund. Moreover, nearly 82% of those investors surveyed would be willing to transfer assets out of a mutual fund and into a copycat or ETF-share class of the same fund. This could be a huge blow to mutual funds and a win for the active ETF structure. 1

Many asset managers have launched copycat funds of their popular mutual funds in recent years. The expiration of Vanguard’s patent is also being seen as a game changer and could set off a gold rush into active ETFs with mutual funds being the major losers.

Better Benefits

It’s easy to see why investors love active ETFs and are looking to abandon mutual funds.

For starters, there’s the lower fee hurdle and expenses with an active ETF versus a mutual fund. Most active managers can beat the market. However, those extra gains are only a few percentage points per year. Very few can crush returns. Funds’ costs come directly out of returns. If a fund charges high expenses, a manager must consistently clear that amount to generate additional returns for the fund’s shareholders. Throughout the history of mutual funds, that often hasn’t been the case and active strategy has underperformed passive.

But with many active ETFs now charging as little as some passive ETFs, the fee hurdle is slowly becoming manageable.

The second win for active ETFs over mutual funds is taxes. In a mutual fund, no matter what happens inside the fund, investors are on the hook for those taxes. Again, active management tends not to be buy & hold. If an active manager sells a stock or bond, even if an investor doesn’t sell their shares of the fund, they get hit with a capital gains distribution and are forced to pay the tax.

Thanks to their structure, ETFs are different. The secondary market and authorized participant structure allow taxes to be passed through and avoided by portfolios. Investors only pay gains tax when they choose to do so and sell their shares. As such, active ETFs are far more tax-efficient.

Finally, cash-drag is eliminated. Because managers don’t have to hold cash, unless they want to meet investor redemptions or share sales, they can be fully invested in whatever assets they choose. This allows them to have better returns versus a mutual fund with the same strategy. You can see this with copycat ETFs and their mutual fund sisters.

No Stopping Active ETFs

With Tracksight’s survey in tow and investors now embracing active ETFs, there’s no stopping the fund type. And now with more investors looking to jettison their mutual fund holdings for active ETFs, growth is assured.

Popular Active ETFs

These ETFs are sorted by their YTD total returns, which range from -2.7% to 7.8%. They have expense ratios between 0.17% to 0.36% and have assets under management between $5B to $30B. They are currently yielding between 0.8% and 9.7%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| JEPQ | J.P. Morgan Nasdaq Equity Premium Income ETF | $5.58B | 7.8% | 9.7% | 0.35% | ETF | Yes |

| DFUV | Dimensional US Marketwide Value ETF | $8.5B | 6.2% | 1.5% | 0.21% | ETF | Yes |

| DFAC | Dimensional U.S. Core Equity 2 ETF | $20.9B | 5.7% | 0.8% | 0.17% | ETF | Yes |

| JEPI | JPMorgan Equity Premium Income ETF | $29.2B | 4.1% | 7.4% | 0.35% | ETF | Yes |

| MINT | PIMCO Enhanced Short Maturity Active ETF | $9.7B | 2.1% | 5.3% | 0.35% | ETF | Yes |

| JPST | JPMorgan Ultra Short Income ETF | $22.8B | 1.7% | 5.2% | 0.18% | ETF | Yes |

| AVUV | Avantis U.S. Small-Cap Value ETF | $6.7B | 0.80% | 1.4% | 0.25% | ETF | Yes |

| DFAT | Dimensional U.S. Targeted Value ETF | $8.2B | -0.4% | 0.8% | 0.28% | ETF | Yes |

| FBND | Fidelity Total Bond ETF | $5.1B | -2.7% | 4.9% | 0.36% | ETF | Yes |

Ultimately, active ETFs offer plenty of benefits to portfolios, with many of those being wins mutual funds just can’t match. So, it’s no wonder why investors are looking to switch their mutual fund holdings for active ETFs. The Tracksight survey just used hard data to demonstrate what we’ve all been suspecting.

The Bottom Line

Investors are choosing active ETFs in a big way. The latest Tracksight survey shows that adoption continues to grow and future adoption is coming at the expense of mutual funds. More and more investors are now willing to make the switch from mutual funds to ETFs. That is a big win for the fund type and the success of active management.

1 Tracksight (February 2024). 50+ Charts on Worldwide ETF Trends