There’s a lot of uncertainty going around these days. The economy continues to be in a mixed position, with various data points showing growth but also plenty of slippage. At the same time, inflation continues to rise. This has put tremendous pressure on the Federal Reserve with regard to its interest rate policy. For fixed income investors, this has put them between a rock and a hard place.

But it doesn’t have to be that way.

It turns out short-term bonds are perfect no matter what the economic and interest rate scenario. With these bonds, investors can score hefty yields, lower volatility, and return potential if the economy does take off.

The Current Environment

It’s hard to be an investor these days. Volatility and uncertainty have quickly become the norm. On the one hand, the economy seems to be doing well. Consumer spending is high. Measures of the manufacturing and services economy continue to show expansion. Even housing remains robust despite high interest rates.

Speaking of those interest rates, the Federal Reserve has been forced to keep them high. Inflation, while cooling from peaks not seen since the 1980s, has remained above the central bank’s key 2% target.

The problem is that data has continued to drift lower. While we’re not near recession just yet, we have seen all of the economy’s bullish indicators turn lower. And yet, inflation remains high.

This is quickly becoming an issue for fixed income investors. The Fed hasn’t been able to cut and investors have started to sell longer-dated bonds and move into cash once again. Real yields on the 10-year and other longer-term bonds have begun to rise to reflect that the Fed may need to raise rates to combat high inflation. But doing so will put the economy in danger considering the slowing data.

For fixed income investors, this is a real pickle. How do you get solid high yields without interest rate risk and market economy risks?

Short-Term Bonds to the Rescue

Investors may want to think short, as in short-term or low duration bonds for the answer. As the name implies, these bonds mature within one to three years. They can come in a variety of credit ratings—investment-grade or high yield—as well as tax variety, such as muni or taxable bonds. For the current environment, short-term bonds could be the best spot to be. That’s because they provide a host of benefits.

If the Fed is forced to cut rates, cash and cash-like bonds such as T-bills will be forced to slash their yields quickly. However, short-term bonds lock-in their rates for roughly two years. And considering they are paying just lower than T-bills, this is a great spot to be.

Second, short-term bonds feature lower economic and market-induced volatility than other longer-term bonds. There’s less risk that investors won’t be paid back. This helps them on the returns front.

Data supports this idea across a variety of scenarios, including a soft landing, hard landing, and higher for longer economic conditions.

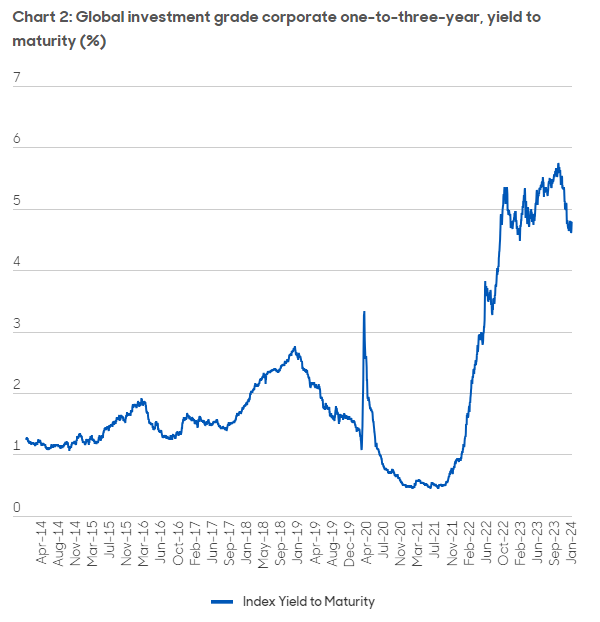

According to investment manager abrdn, short-term bonds win out in a soft-landing scenario. If the Fed can guide the economy and inflation lower without raising rates anymore, potentially cutting rates, short-term bonds will produce a positive return. Part of that is due to their high starting yields. This chart from the asset manager highlights the current yield environment for global short-term investment-grade bonds.

Source: abrdn

If the Fed cuts, T-bills and such will quickly reflect the interest rate change. However, because of their similarly high yields and the ability to lock-in that income for longer, short-term dated bonds will provide positive returns.

When it comes to a hard landing and outright recession, abrdn again shows that short-dated credit should win out. Thanks to rising credit quality and lower default rates, short-term bonds should be okay and produce positive returns again. Looking at data, in every recession, spreads between investment-grade bonds and U.S. Treasuries move comfortably north of 200 bps. But because short-term bonds are currently yielding in the mid-single digits, there’s a wide margin of safety with these bonds. Moreover, because of the low default rate on these bonds, investors should have no trouble being made whole when the bonds mature. 1

As for the ‘higher for longer’ scenario, short-term bonds win out again. If inflation continues to be stubborn and the Fed is forced to keep rates the same or worse raise them slightly, short-term credit will still produce positive returns.

Unlike a 30-year bond, short-term bonds don’t lose as much during rate hikes. That’s because investors can quickly roll over their holdings to new higher-yielding bonds. Again, high starting yields help produce positive returns.

Keeping rates the same also produces a positive return for short-term bonds, albeit slightly less than T-bills and cash. However, the negligible difference in yield and positive outperformance in a hard- or soft-landing scenario is worth this potential for underperformance according to abrdn.

Balancing Risk and Opportunity with Short-Term Bonds

All in all, the uncertainty of the market, Fed policy, and economic conditions make short-term bonds a no-brainer. By focusing their fixed income portfolios in this manner, investors have the potential to win no matter what direction the economy/Fed/markets take.

There are plenty of ways to get your short-term bond fix. Purchasing individual bonds—particularly when it comes to Treasuries and government debt—is pretty easy. The majority of brokerage platforms allow for easy trading of these bonds, while Treasury Direct allows purchases for as little as $100.

For corporate, munis, and high-yield bonds, it pays to go with an ETF or fund. Wide bid-ask spreads are commonplace in the bond market. As such, it pays to go with a professional. Luckily, there are numerous ETFs—active and passive—that cover short-term and low-duration bonds.

Short-Term Bond ETFs

These ETFs are selected based on their ability to tap into short-term duration bonds at a low cost. They are sorted by their YTD total return, which ranges from -0.7% to 0.8%. Their expense ratio ranges from 0.03% to 0.55%, while they yield between 2% and 4.8%. They have AUM between $730M and $58B.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| LDUR | PIMCO Enhanced Low Duration Active ETF | $989M | 0.8% | 4.8% | 0.51% | ETF | Yes |

| SPSB | SPDR Portfolio Short Term Corporate Bond ETF | $7.3B | 0.5% | 4.8% | 0.04% | ETF | No |

| DFSD | Dimensional Short-Duration Fixed Income ETF | $1.55B | 0.5% | 4.5% | 0.17% | ETF | Yes |

| FSIG | First Trust Limited Duration Investment Grade Corporate ETF | $731M | -0.4% | 4.7% | 0.55% | ETF | Yes |

| SHY | iShares 1-3 Year Treasury Bond ETF | $26B | -0.2% | 4% | 0.15% | ETF | No |

| SCHO | Schwab Short-Term U.S. Treasury ETF | $12.4B | -0.2% | 4.2% | 0.03% | ETF | No |

| SUB | iShares Short-Term National Muni Bond ETF | $8.8B | -0.4% | 2% | 0.07% | ETF | No |

| BSV | Vanguard Short-Term Bond ETF | $58B | -0.7% | 3.2% | 0.04% | ETF | No |

All in all, short-term bonds could be the best place to hide out in the fixed income sector. Offering high yields and low volatility, short-term debt should win out no matter what the scenario. In the end, it has the perfect blend of attributes to get through the current malaise and uncertainty.

The Bottom Line

Mixed economic data, stubborn inflation, and a confusing Fed are all hallmarks of the current environment. That’s a tough place to be for fixed income investors. Luckily, short-term bonds could offer the best place to hide during all the uncertainty. Offering the best blend of benefits, these bonds will produce positive returns no matter what the market throws at them.

1 abrdn (February 2024). The value of short-dated credit