But dividend ETFs are just some of the income funds worth consideration. Energy pipeline operators (midstream MLPs) have been among the top performers this year thanks to soaring oil and gas prices.

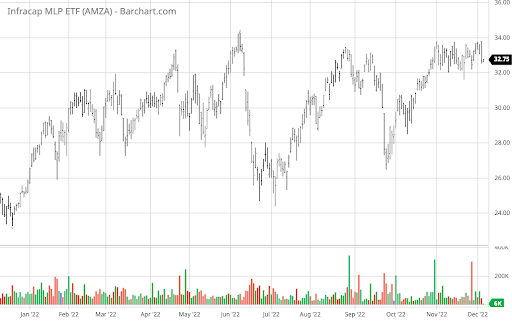

The actively managed InfraCap MLP ETF (AMZA) offers investors exposure to the midstream MLP space, rising more than 23% since January.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

What Makes MLPs Attractive?

In addition to a 20%+ improvement in stock price, midstream MLPs pay out most of their income as dividends, with yields over 7% annually. These yields are more attractive than the S&P 500 index’s roughly 1.7% dividend yield and the 4.2% and 5.9% yields of real estate investment trusts (REITs) and investment-grade bonds, respectively.

Source: GlobalX

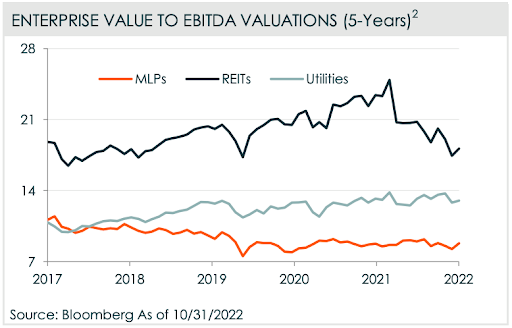

Finally, despite their increase in value, midstream MLPs continue to have a more attractive valuation than other popular sources of dividend income, such as REITs and utilities. MLPs have a five-year EV/EBITDA valuation of well under 10x, compared to nearly 14x for utilities and nearly 20x for REITs, meaning they could have a strong downside buffer.

What’s In the InfraCap MLP ETF?

Using security-level fundamental and technical analysis, the fund managers select securities and weigh them while using opportunistic short positions as an interest rate or oil price hedge. The team also employs modest 20% to 30% leverage to enhance beta and may use options strategies to provide additional income.

Source: Barchart.com

Several of the fund’s top holdings have recently seen strong Q3 earnings boost their performance. For example, Energy Transfer LP (ET) (19.66%), MPLX LP (MPLX) (15.92%), and Magellan Midstream Partners LP (MMP) (12.15%) all reported solid Q3 results and have risen 39.9%, 10.6%, and 10.2% since January, respectively.

Don’t forget to check our Best Energy Dividend Stocks List to explore some of the top performing MLPs.

What’s Next for AMZA & MLPs?

At the same time, attractive relative valuations could limit downside risk, while exceptional yields could drive investment as the economy continues to deteriorate. As a result, investors may want to consider The InfraCap MLP ETF (AMZA) or other MLP-focused ETFs for their portfolios to mitigate downside risk and generate income.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.