In this article, we’ll look at what makes CLOs attractive and why you might consider the CLOZ ETF for exposure.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

What Are CLOs?

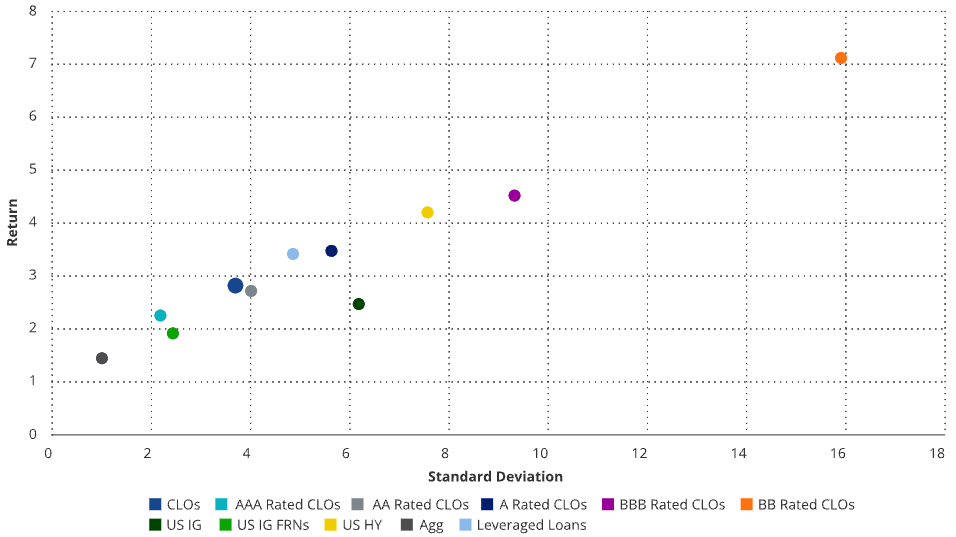

CLOs Track Record of Strong Risk-Adjusted Returns vs. Other Asset Classes – Source: VanEck

As you can see from the above chart, historically CLOs have provided investors better risk-adjusted yields than similarly-rated corporate bonds. At the same time, they offer valuable diversification from highly-correlated stock and bond markets. They even survived the 2008 global financial crisis and the COVID-19 pandemic with far fewer defaults than similarly-rated corporate bonds.

Until recently, small investors have had limited access to the CLO market, which banks, insurance companies, and hedge funds dominate. Fortunately, exchange-traded funds (ETFs) have started to democratize niche corners of the market previously only available to high-net-worth individuals who could afford to invest in hedge funds.

An ETF for CLOs

The fund’s portfolio consists primarily of BBB- and BB-rated CLO bonds expected to pay a monthly dividend. And the managers mitigate risk by investing in loans across many issues and industries. Finally, with a 0.50% expense ratio, the active ETF is cheaper than many unconventional fixed-income ETFs.

In addition to CLOZ, investors may also want to consider the VanEck CLO ETF (CLOI). Unlike CLOZ, the fund focuses on investment-grade CLO tranches, although it may invest up to 20% in BB-rated CLOs. The actively-managed fund offers an attractive 5.99% 30-day SEC yield with monthly distributions and a modest 0.40% expense ratio.

Another option is the AXS First Priority CLO Bond ETF (AAA), which invests exclusively in AAA-rated CLOs. With its low 0.25% expense ratio, the fund is the cheapest of the major CLO ETFs, but the focus on AAA issuers means that it offers a yield of around 2.75%. That said, it may be a better option for risk-averse investors with less yield requirement.

The Bottom Line

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.