Central banks have been purchasing government and corporate bonds in an effort to provide liquidity to the financial markets. These actions have depressed bond yields and support a record number of new bond issuances around the world but may have in turn created a moral hazard in high-yield markets where there’s an elevated risk.

Let’s take a look at how investment-grade debt has performed thus far during the COVID-19 pandemic and where the market may be headed over the coming quarters.

Use the Mutual Funds Screener to find the funds that meet your investment criteria.

Narrowing Spreads With Treasuries

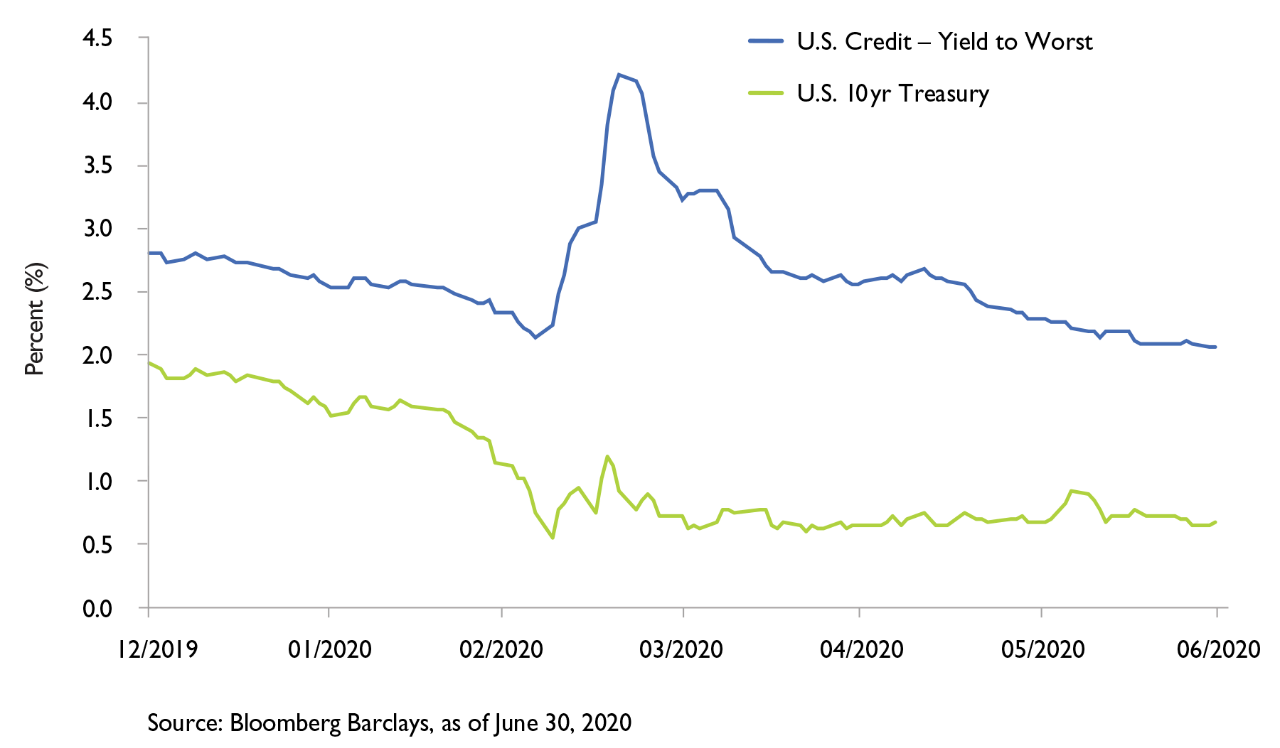

On March 23, 2020, the yield on corporate debt reached its highest level in more than a decade, particularly in the junk bond market. The Federal Reserve quickly established a Primary Market Corporate Credit Facility and Secondary Market Corporate Credit Facility to purchase corporate bonds and even corporate bond exchange-traded funds (ETFs).

The result was a sudden narrowing of yield spreads between Treasuries and corporate bonds. Between March 23 and the end of the second quarter, yields nearly halved from their highs, leading to a significant rally across the corporate bond market. Both Treasuries and corporate bonds enjoy unlimited financial support from the central bank at the moment.

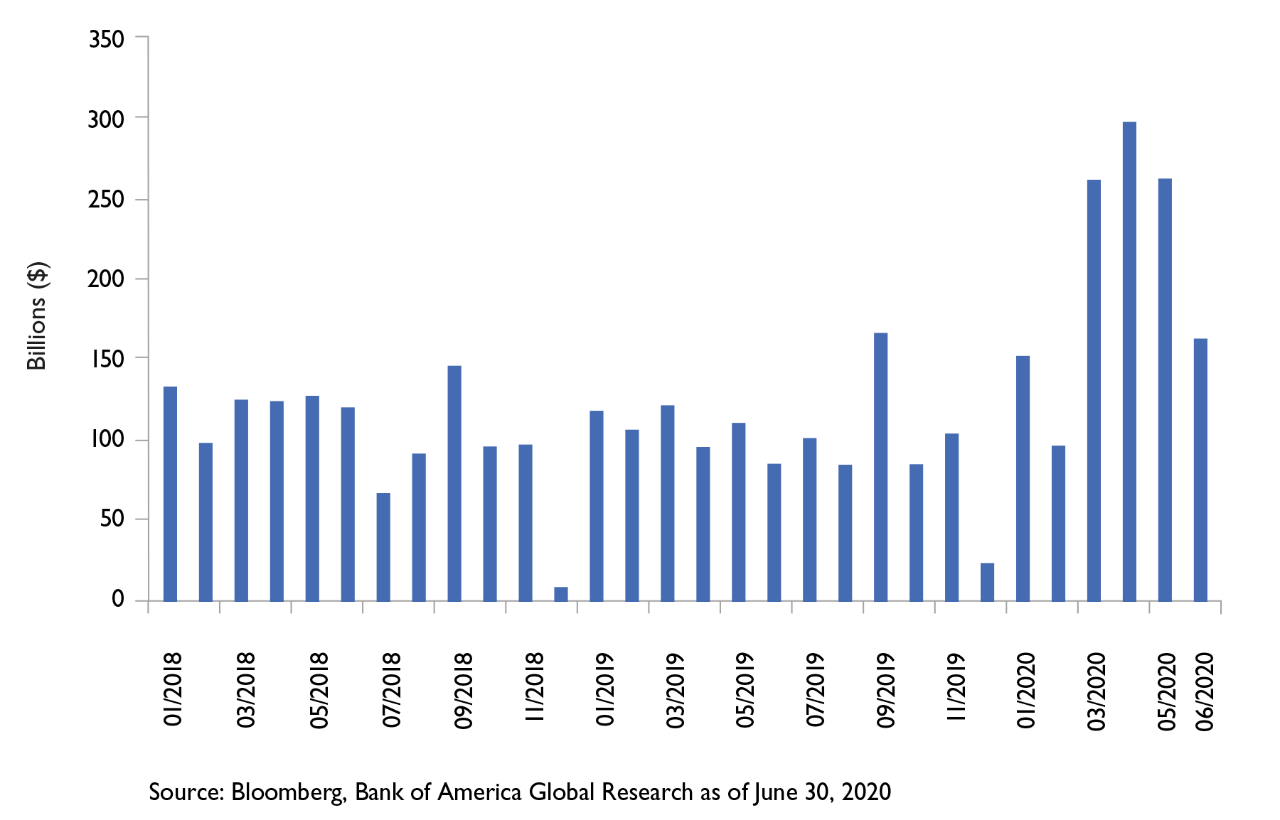

Rising Issuance by Corporations

Learn more about fixed income topics and trends on our Fixed Income Channel.

With so many new issuances during the first quarter, some analysts expect to see a slowdown in second-quarter new issuances. A global economic recovery and rising consumer spending could also push inflation higher, which could lead to higher yields in corporate debt markets and discourage companies from issuing any new debt.

The Federal Reserve hasn’t treated all corporate debt equally when it comes to credit facilities that it has set up during the pandemic. For instance, the central bank has not focused on junk bonds, which means yields have remained high. American Airlines Inc. and other companies have issued some high-yield debt, but issuers rated triple-C or worse have struggled to raise capital without the support of the central bank.

Implications for Investors

Don’t forget to check out our exhaustive list of investment-grade bond funds here.

Some analysts are concerned that the central bank may be creating a moral hazard by purchasing bonds at artificially low prices. When it starts to withdraw support and liquidity, there’s little doubt that the outflows will come from low-quality junk bond issues, and investors that are caught holding the proverbial bag could suffer.

In addition to junk bonds, investors may want to watch out when it comes to certain sectors of the economy that could be hard pressed in a recovery. Airlines and energy companies are two obvious areas where corporate bonds are trading on the edge of distressed and doomed – and investors are likely to start focusing more on separating out the winners from the losers.

Many investors have focused on single-B debt or better-rated bonds to pick up yield rather than dipping into extremely high-yielding triple-C debt. After all, there is still a lot of uncertainty surrounding the macroeconomic outlook, there are depressed prospects for economic recovery rates and retail demand has been weak for most junk bonds.

The Bottom Line

Be sure to check our News section to keep track of the latest updates from the mutual fund industry.