One of the biggest relationships we’ve seen over the last few years has been that lower bond yields and interest rates propelling stocks higher. This has been particularly true for dividend stocks. As investors haven’t been able to get needed yield from traditional products like bonds or CDs, they’ve been forced to take refuge in dividend payers, REITs and other high-yielding securities.

However, the Treasury market is seeing some unusual activity. Bond yields are actually starting to rise and hit highs not seen for quite a while.

And at first blush, this may scare off some investors. After all, you could argue that the reason why many dividend-paying stocks and broad indices are up big time is because of the shift toward lower rates/yields. However, this time could be different. Thanks to a variety of other factors, the rise in bond yields could actually be very bullish for stocks and dividend payers.

At this point, do you even need bonds? Find the answer here

A Pop in Yields

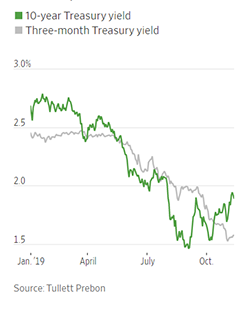

The headlines have focused on the Fed’s recent rate cuts, but you may not see that when looking at the bond market in recent weeks. It’s true that the yields on the 10-year and 30-year bonds have spent much of 2019 declining. This is due to the wave of easing by the U.S. Federal Reserve and other central banks’ move to see negative interest rates. But, lately, yields are rising.

At the beginning of November, the yield on the 10-year rose to a 3-month high of 1.93%. According to Tradeweb, this pop helped widen the spread between the 10-and 2-year yield and uninvert the dreaded yield curve. And since then, the 10-year yield has continued to be robust and hasn’t shifted much lower. Just take a look at this chart from the Wall Street Journal. You can see the shift in action from the 10-year’s August/September lows.

Source: WSJ.com

What’s more is that the yield on the intermediate bond has stayed high. Tradeweb pegs the current yield around 1.815% – well above the lows hit in September. And some analysts peg that the Treasury could rise to as much as 2.5% over the next couple of months.

A Shift in Sentiment

One of the main reasons behind the fall in rates over the last couple of quarters has been the shift toward safety. From trade concerns with China to Brexit as well as slowing growth across the globe, the world is awash in worry. When investors panic, they jump into safe-haven assets. And you can’t get safer than the “full faith and credit” of the United States government. Yield compression in the 10-year was a reflection of this flight to quality. Even with the Fed cutting rates, investors bought bonds because the sky was falling.

And yet, the sky isn’t falling. At least not now anyway.

Yes, growth has cooled, but we’ve seen some rebounds in national and local manufacturing indexes. Meanwhile, consumer spending remains robust, unemployment low and even data out of Europe and China has started to grind ahead. News of the Phase One deal in the trade war has started to eliminate one of the biggest worries facing the market. Heck, even housing is starting to show some real life again.

Simply, investors bought bonds when there was panic, and now, they are selling them. The key is where they are placing that cash. The answer is stocks and, increasingly, dividend stocks.

Thanks to the Fed’s cuts, the short and liquid end of the bond market – i.e. cash – is still paying nothing and continues to see lower yields. So, proceeds from bond sales aren’t going there. We’ve seen this play out as the markets have continued to hit record highs.

Buying Dividend Stocks

With the shift in sentiment and “gloom” now residing, the market has the potential to move higher. This is especially true as rates on cash continue to dip. Even more so when you look at Bank of America Merrill Lynch’s Cash Rule Indicator metric, which shows that portfolios are already holding more cash than 10-year averages.

In the end, you have investors now reversing their bond trades and not picking up cash for those proceeds. The win for dividend stocks is that people still need to get higher yields, real income and some safety. After all, the economy is better, but not yet a raging bull. This a perfect recipe for dividend stocks. With an ETF like iShares Core Dividend Growth ETF (DGRO) or stocks like Home Depot (HD ) already providing higher and growing yields, there’s a real chance for a great total return as bond proceeds continue to flood the market. Our dividend screener can offer plenty of ways to search for “quality” among dividend names.

And as the data continues to get better, prospects for dividend stocks like HD or industrials like Honeywell (HON ) only improve further. The reality is that the rise in bond yields can be seen as a bullish sign that many of the safety trades are finally unwinding.

The Bottom Line

While rising bond yields often come at the expense of stocks, the current environment could be different. With many investors picking up bonds as a safety play in the face of mixed data and trade concerns, rising yields could be a good sign. Investors are simply selling bonds and moving back into the market, which makes dividend stocks a great bet for the months ahead.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.