Inside the Fund

This fund is an open-ended retail mutual fund with a $1,000 minimum investment requirement for both standard and IRA accounts.

Manager Profile

Dan Chamby co-manages the fund and is a CFA charter holder. Previously employed with Merrill Lynch Investment Management and Fujitsu in Japan, Chamby’s global experience is invaluable. He has also worked in credit and money market roles at Bank of New York Mellon.

Historical Performance

Dividend Analysis

The fund is not an income vehicle, with a conservative dividend yield of 0.3% and a semi-annual payment frequency. Payment months are July and December.

Asset Allocation Weightings

The attractiveness of this fund is its diversified approach to asset allocation. Current weightings are:

- 56.19% Stocks

- 19.82% Bonds

- 18.27% Cash

- 2.76% Other

- 1.56% Preferred Stocks

- 1.41% Convertible Bonds

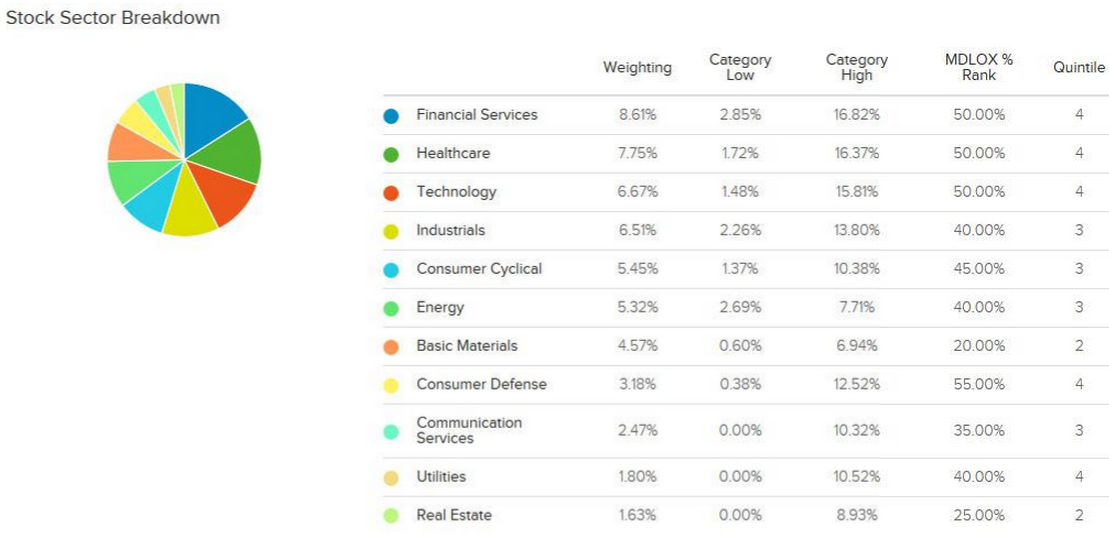

Portfolio Sector Weightings

Top 10 Holdings

The top holdings for the fund are made of a combination of bonds, preferential and common stock. There is no weighting over 1.7% with the fund holding U.S., Australian, British, Italian and Mexican government debt.

Concerns

The primary concern of the fund is the exposure to Italy debt. Current developments in Greece could affect debt markets globally. On the equity side, the fund has a 4.57% basic materials weighting, which could influence overall performance.