- Total long-term mutual fund flows continued their positive track record for the two weeks ended March 6, marking the longest streak of net inflows since the start of 2017. Exactly $2 billion of net inflows were registered in the past two weeks, largely due to strong demand for bonds.

- Equities again experienced outflows for the two weeks ended March 6, a total of $11.3 billion, up from $5.5 billion in the prior two weeks.

- Bonds enjoyed strong inflows and have been posting positive flows for six consecutive weeks, with taxable bonds particularly strong.

- Uncertainty in the Brexit saga is likely to extend until the last day before Britain is expected to leave the European Union on March 29. With Parliament rejecting an exit without a deal, the two possibilities are the acceptance of the deal Prime Minister Theresa May proposed or an extension of the exit day. The European Union, tired of the never-ending brinkmanship, said an extension would be granted only if May has a clear plan how to break the impasse.

- The European Central Bank cut its growth forecast and unveiled a new lending program in the hope lenders will boost the number of loans to consumers and businesses. The feeble European recovery is at risk and the ECB is desperate to put economic growth back on track, as its 2% inflation target proves increasingly elusive.

- With U.S. President Donald Trump making clear he is in no rush to sign a deal with China, expectations for a trade agreement between the world’s biggest economies is expected to come to fruition in April if all goes according to plan.

- The February jobs report largely disappointed economists with only 20,000 jobs added compared with 180,000 expected. To be sure, in the previous two months, the U.S. economy added around 650,000 jobs combined.

We provide this report on a fortnightly basis. To stay up to date with mutual fund market events, come back to our news page here.

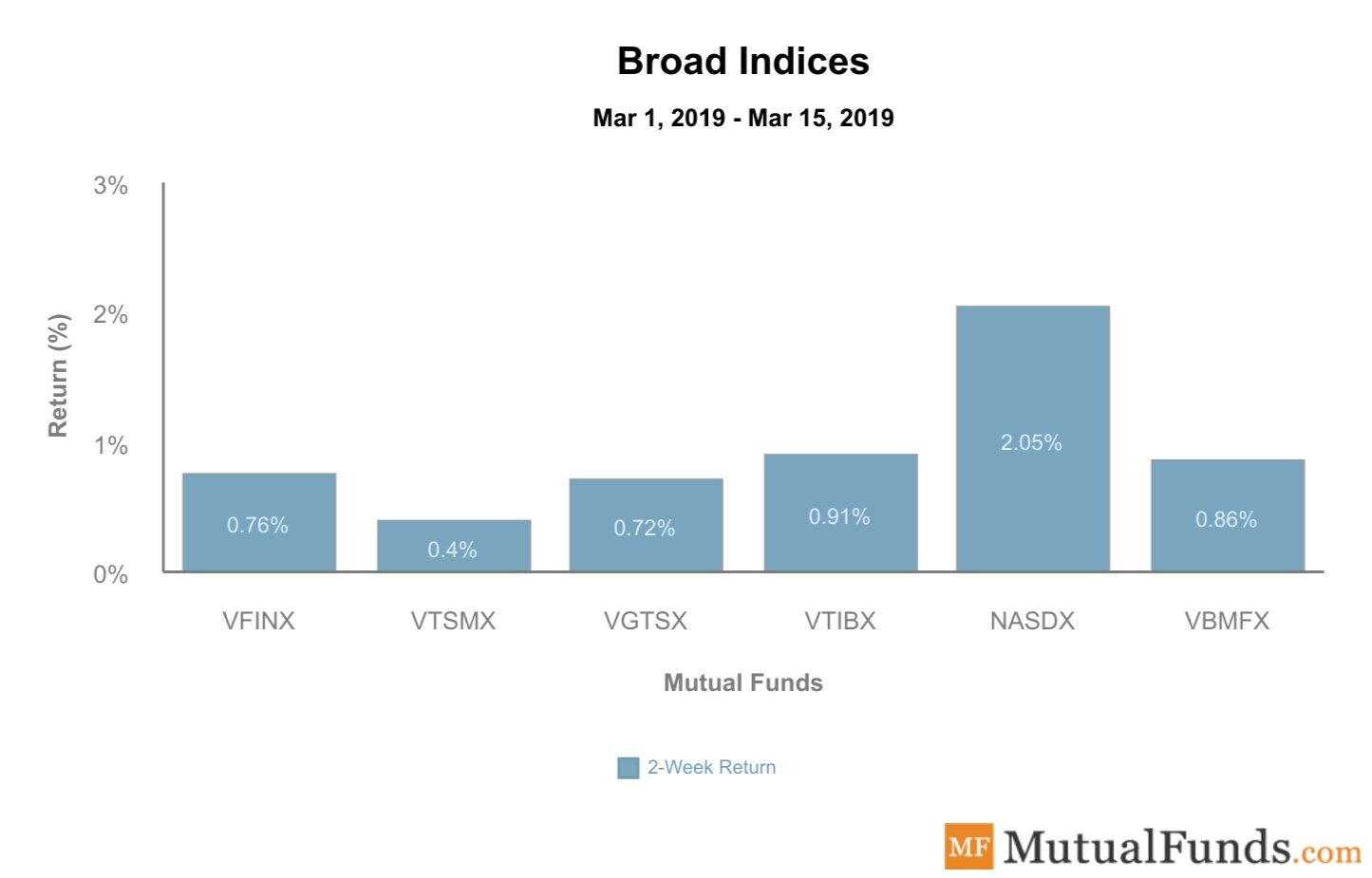

Broad Indices

- Broad indices were all positive for the past two weeks, with technology stocks especially shining on the back of strong results posted by some companies, including Broadcom and the upcoming initial public offerings of ride-hailing services Uber and Lyft.

- Technology equities fund (NASDX) was by far the best performer for the past two weeks, gaining more than 2%.

- Vanguard’s total stock market fund (VTSMX) gained only 0.40%, representing the worst performance from the pack.

Check out our previous edition of the scorecard here.

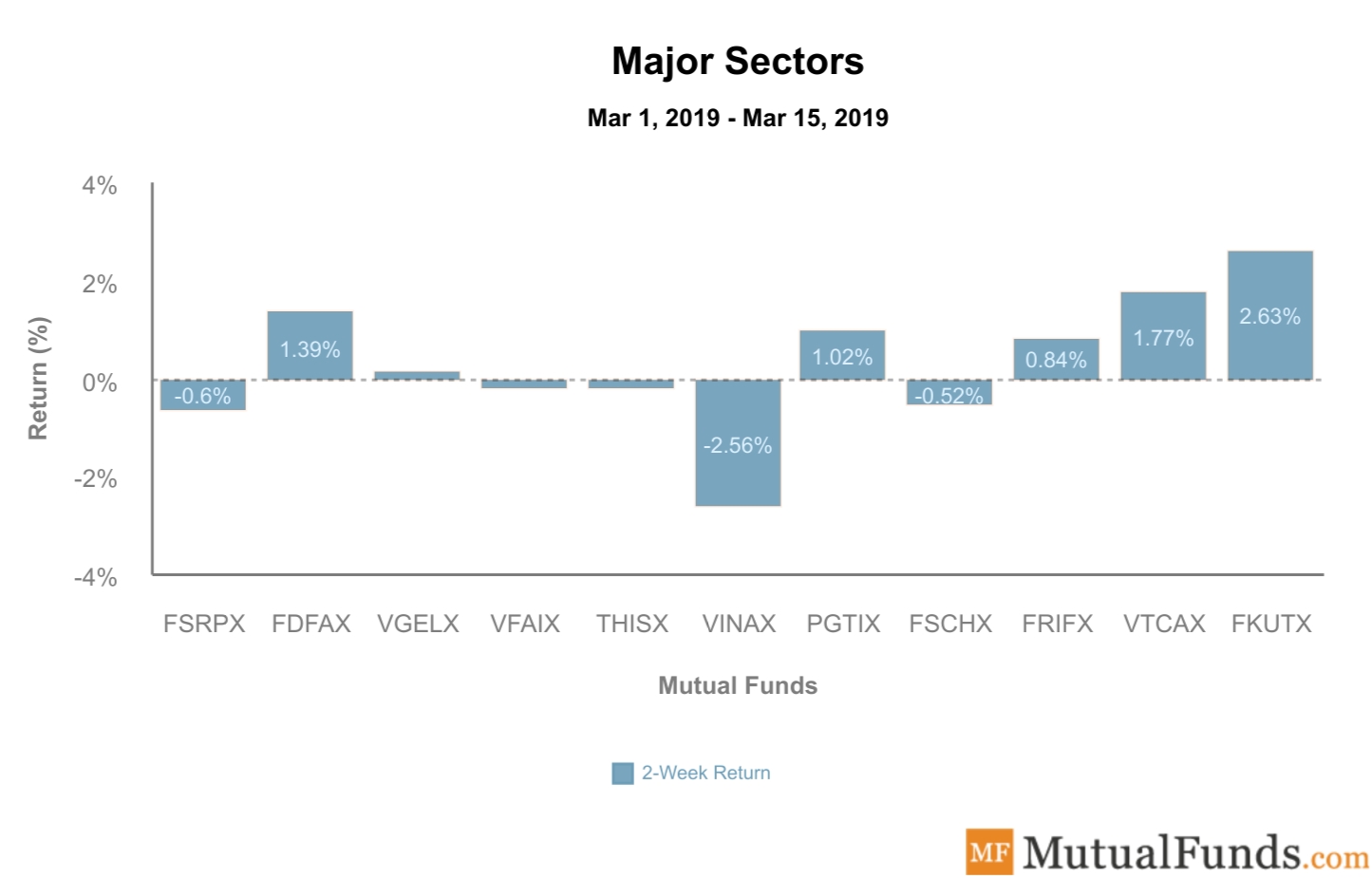

Major Sectors

- Sectors were rather mixed, with industrials, retail and chemicals all having a tough week, and utilities, technology and consumer staples gaining.

- Utilities (FKUTX) advanced 2.63% for the past two weeks, despite lack of volatility in global markets. Utilities typically perform in tumultuous periods.

- At the other end of the spectrum are industrials (VINAX), which lost 2.56% of their value.

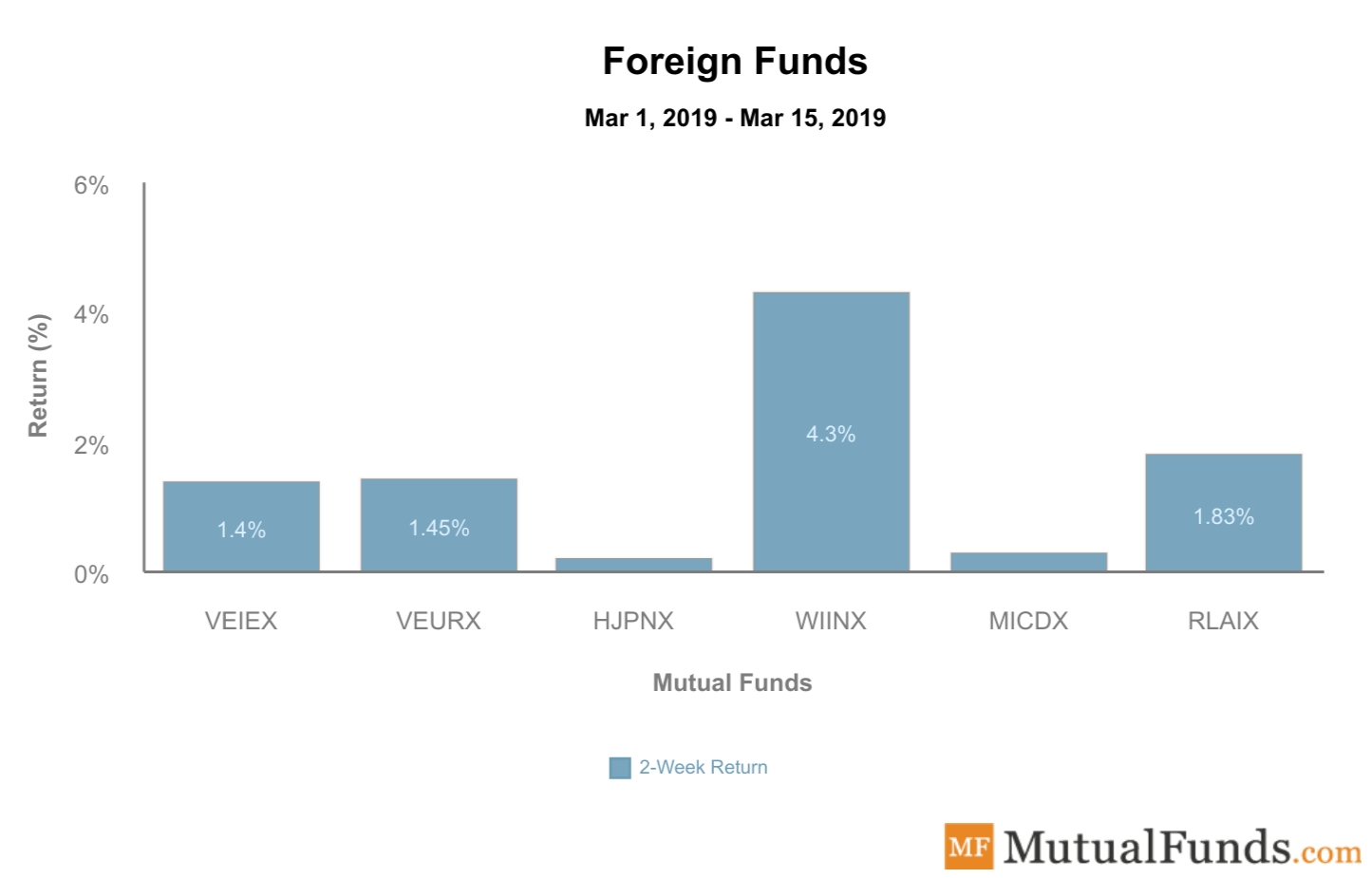

Foreign Funds

- Foreign funds were all up with Indian equities leading the gains.

- Indian equities (WIINX) advanced 4.3% for the past two weeks as investors were optimistic current Prime Minister Narendra Modi will be able to form a government and keep power.

- Japanese equities (HJPNX) recorded the weakest performance, edging up just 0.20%.

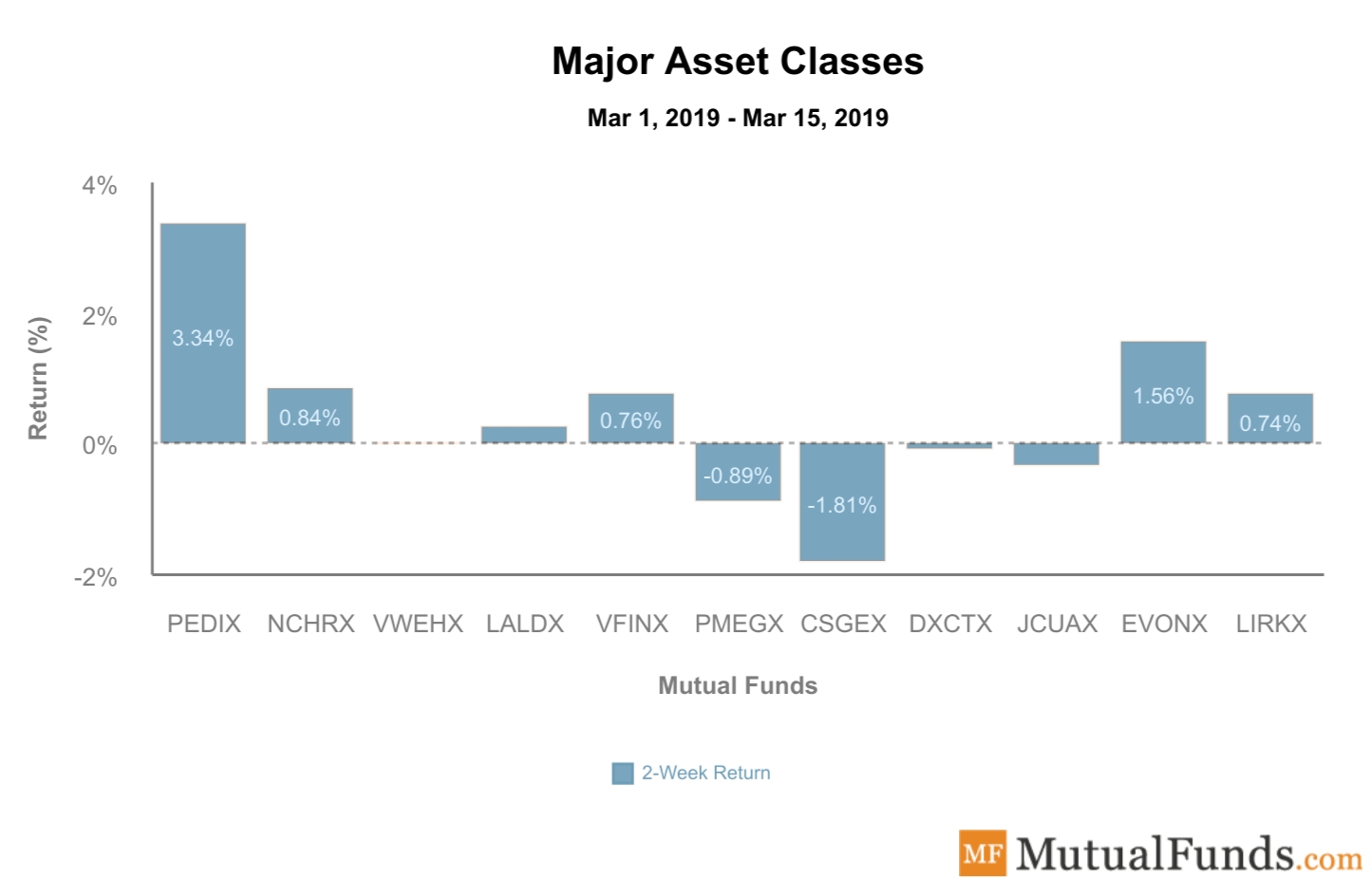

Major Asset Classes

- In major asset classes, performance seemingly reversed, with bonds outperforming and small-cap stocks declining.

- Long-term bonds fund (PEDIX) staged an impressive recovery this past two weeks, surging 3.34%, after declining by a similar amount in the prior period.

- Meanwhile, BlackRock’s small-cap fund (CSGEX) is now the worst performer with a decline of 1.81%, after landing the best performer spot in the prior two weeks.

The Bottom Line

Be sure to sign up for your free newsletter here to receive the most relevant updates.