- Long-term flows were in negative territory in the two weeks ended April 3, ending a multi-week streak of inflows. More than $10 billion were withdrawn over the past two weeks, with equities leading the outflows.

- Equities experienced around $20 billion in outflows in the April 3 fortnight, with domestic large-cap stocks particularly hit. Meanwhile, bonds saw positive flows of $13.5 billion, largely thanks to strong inflows in taxable bonds.

- The European Union extended the Brexit date until October 31, temporarily avoiding Britain’s crash out of the union without a deal. Prime Minister Theresa May, however, hopes to deliver on her promise to take the country out of the EU much sooner and is holding talks with the opposition Labour Party after disagreements within her Conservative Party failed to lead to a positive outcome.

- The U.S. Federal Reserve has indicated that it may raise interest rates again this year, if circumstances improve, according to the central bank’s minutes. The decision to keep interest rates unchanged at the last meeting was unanimous, however.

- Across the pond, the European Central Bank left interest rates unchanged at zero, admitting that the risks to the EU economy are tilted to the downside. Meanwhile, the International Monetary Fund downgraded forecasts for eurozone economic growth.

- The Federal Reserve has faced criticism from U.S. President Donald Trump, who said rising interest rates are preventing stock markets from continuing their rally and choked off economic growth. Fed Chair Jerome Powell was quiet on the criticism, but his euro-area counterpart Mario Draghi said he was concerned about the political pressure on the central bank of the most important jurisdiction in the world.

- In March, the U.S. economy added 196,000 jobs, comfortably beating analyst forecasts of 172,000. Meanwhile, the downbeat figure for February was revised up to 33,000 from 20,000.

- The U.S. Consumer Price Index (CPI) advanced 1.9% year-over-year in March, picking up from 1.5% in the prior month, largely due to higher energy and food prices.

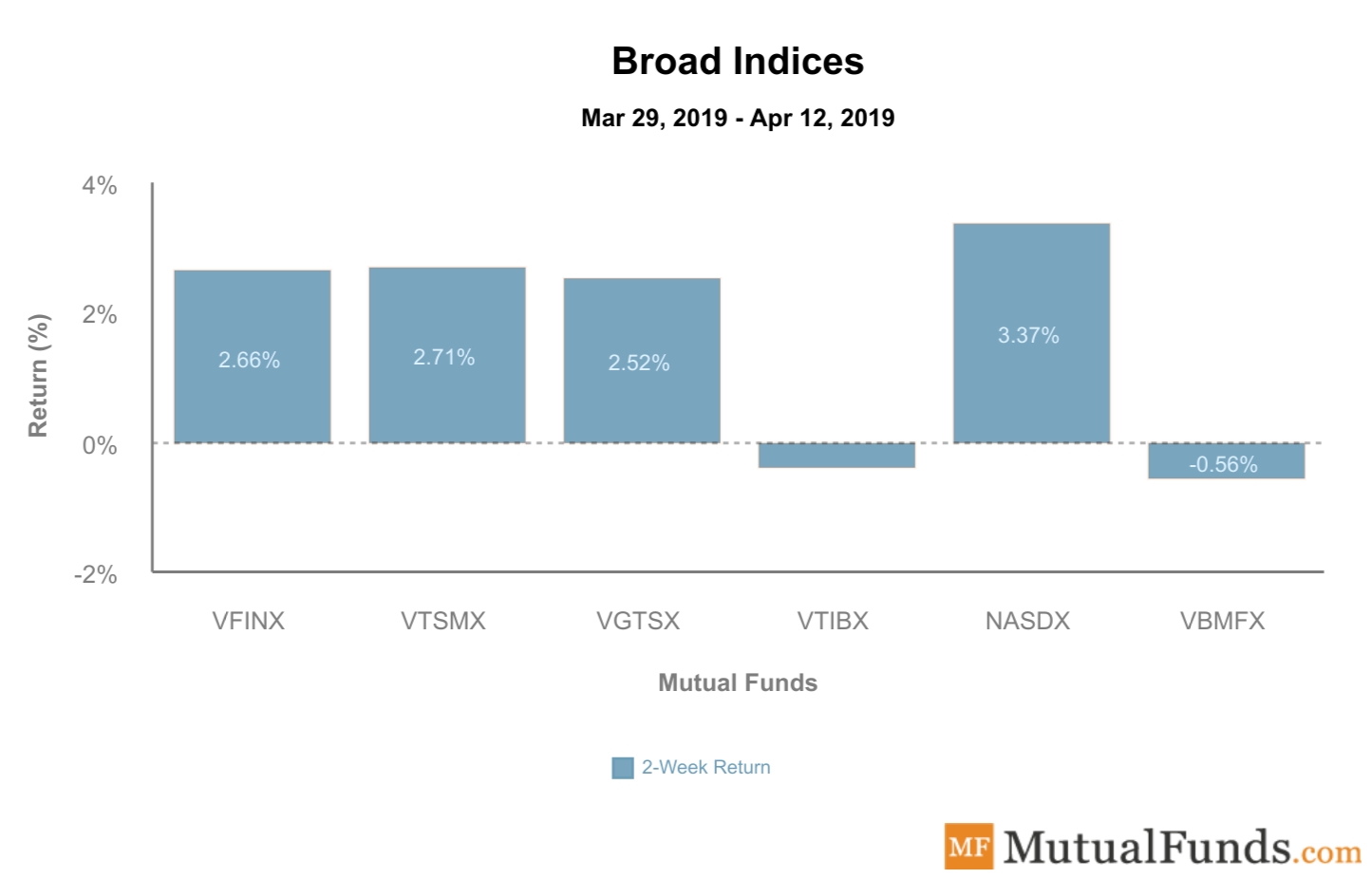

Broad Indices

- Broad indices were mixed, with stocks and bonds posting diverging performance.

- The technology sector fund (NASDX) was up 3.37% over the two weeks ended April 12, representing the best performance from the pack.

- Vanguard’s total bond market fund (VBMFX) declined 0.56% over the past two weeks after the index was the best performer in the prior fortnight. Treasury yields have been on the rise in April, as U.S. inflation unexpectedly picked up.

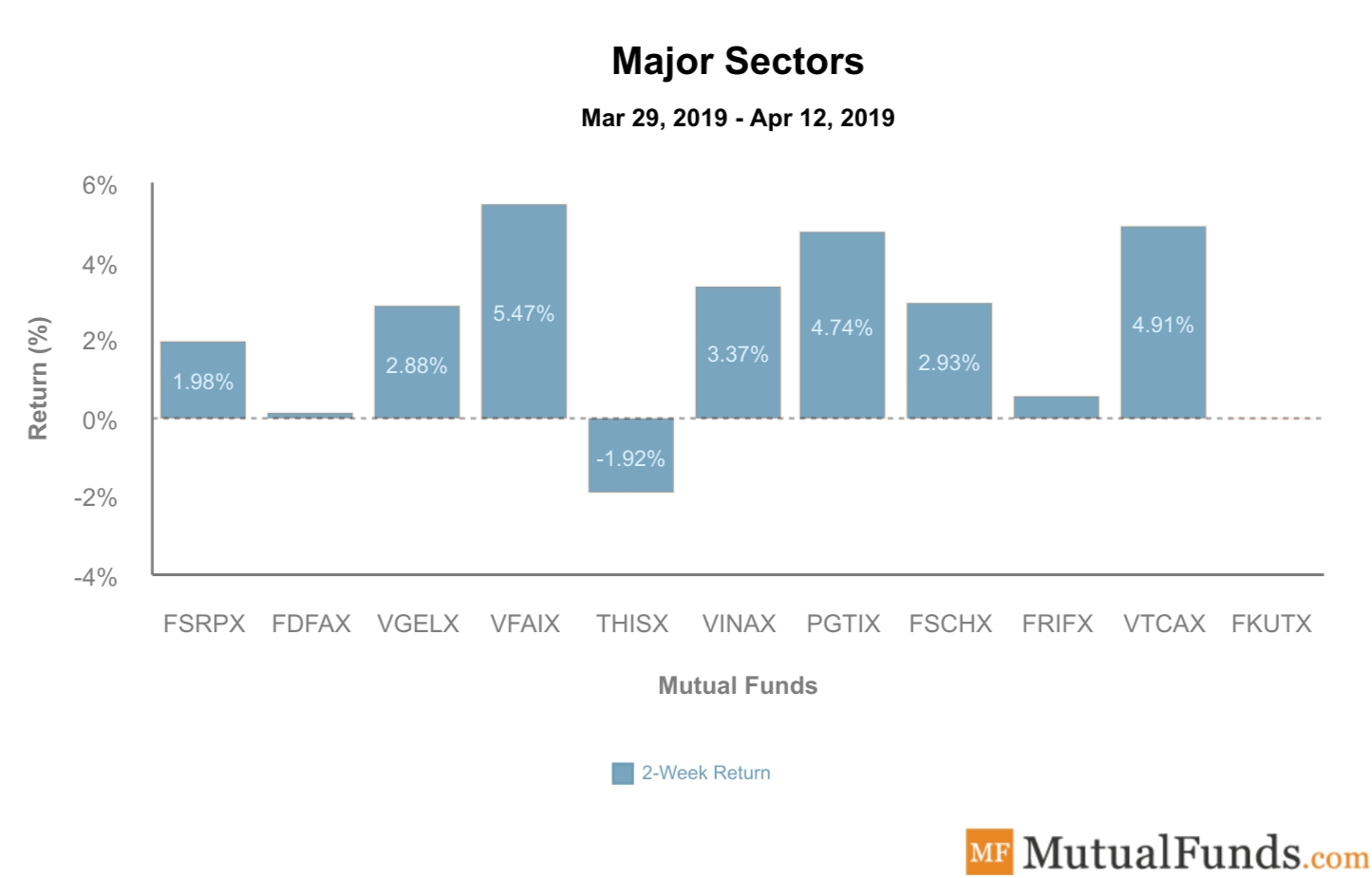

Major Sectors

- After a rough streak, Vanguard’s financials fund (VFAIX) is finally back in fashion, having staged a rise of 5.5% over the past two weeks.

- At the other end of the spectrum is T. Rowe Price’s healthcare fund (THISX), which declined nearly 2% over the past two weeks, as government pressure on the sector to lower drug prices is increasing, particularly as the election campaign for 2020 heats up.

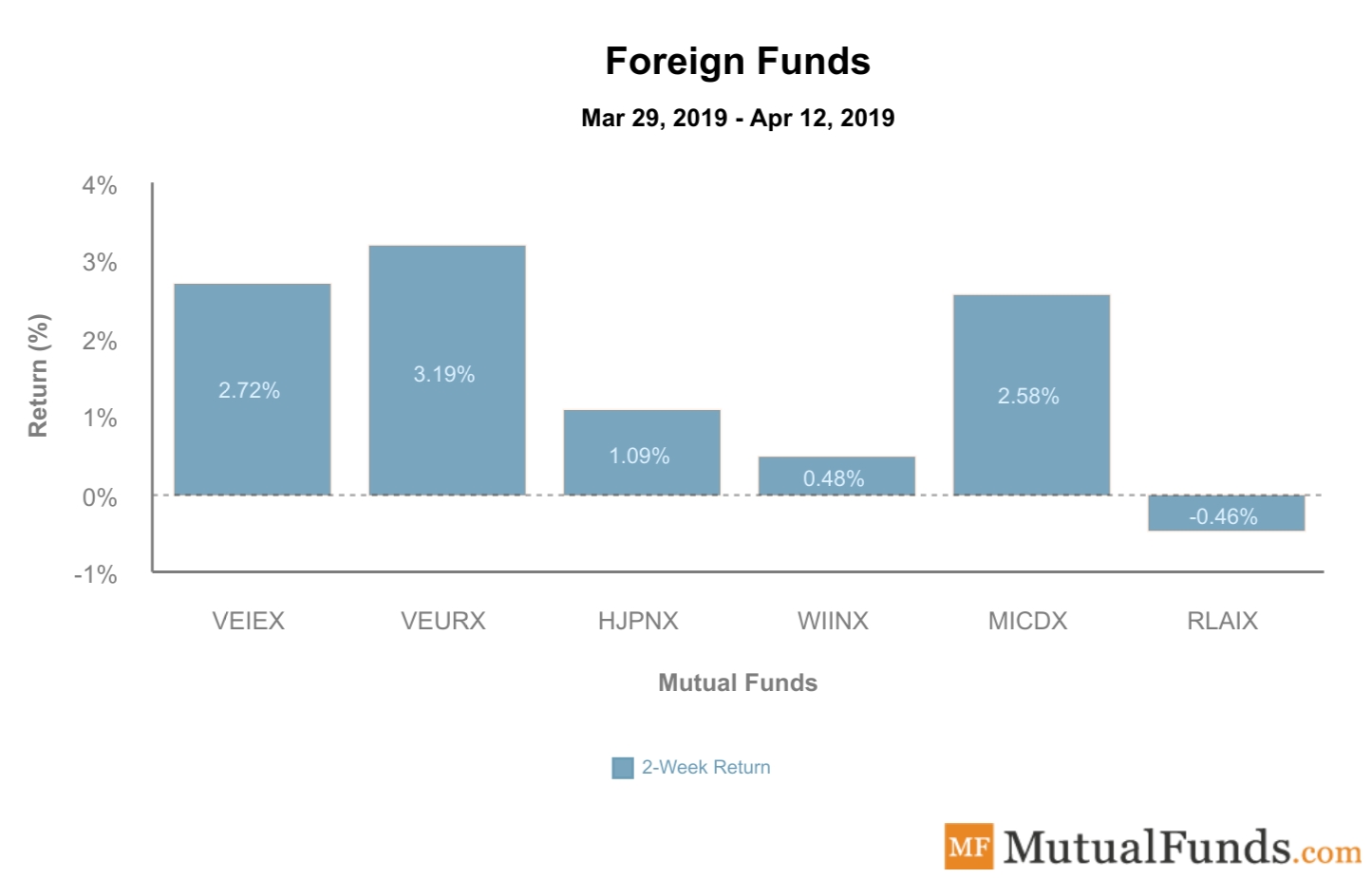

Foreign Funds

- Foreign funds were all up with the exception of Latin America.

- European stocks fund (VEURX) was the best performer these past two weeks, surging 3.2%.

- Latin American equities fund (RLAIX) was the only loser for the past two weeks, down 0.46%.

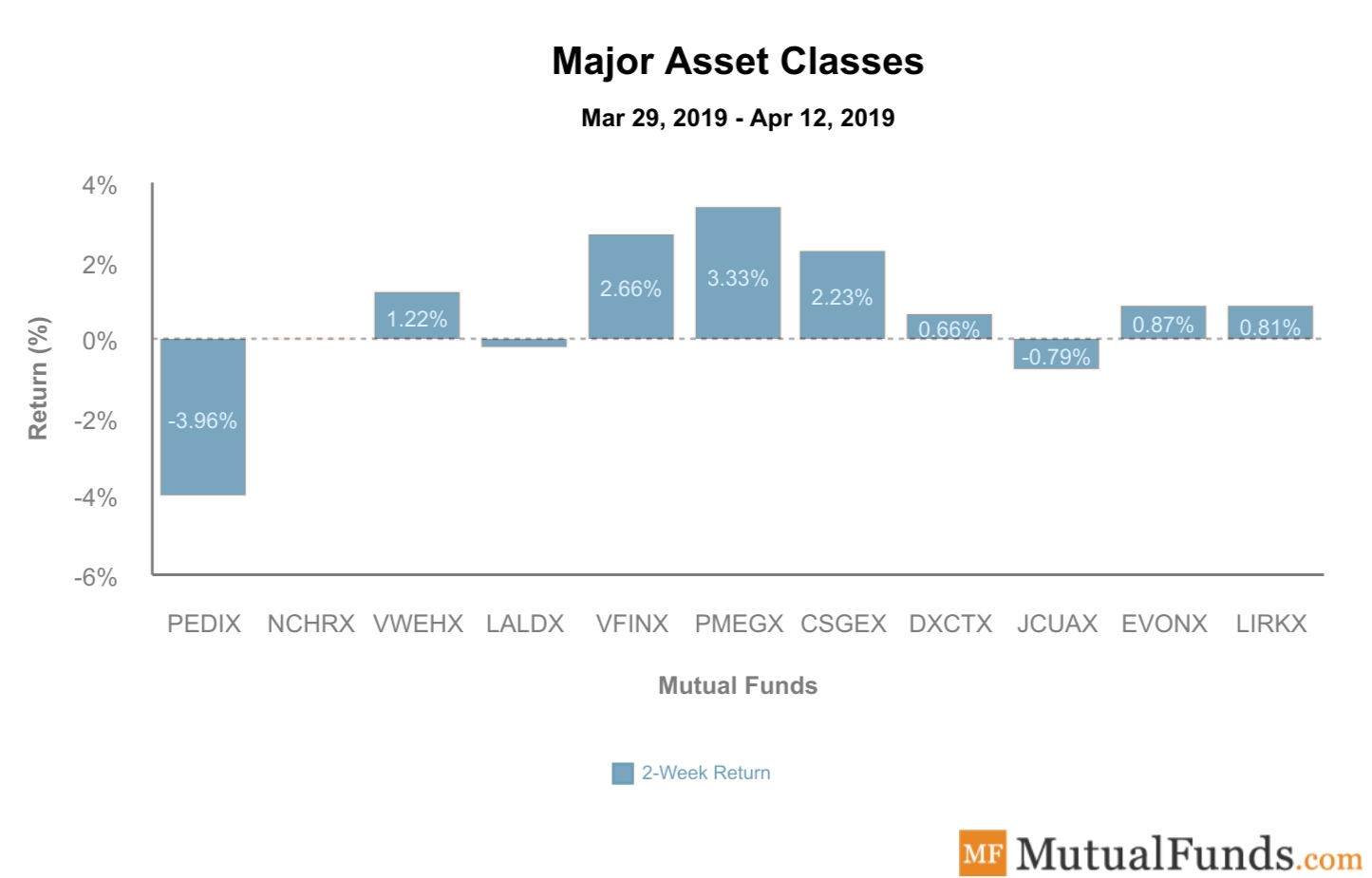

Major Asset Classes

- Long-term bonds fund (PEDIX) reversed its strong gains, losing nearly 4% of their value.

- At the same time, the mid-cap growth fund (PMEGX) rose 3.3%, regaining some of its lost ground of late.

Be sure to sign up for your free newsletter here to receive the most relevant updates.

The Bottom Line

We provide this report on a fortnightly basis. To stay up to date with mutual fund market events, return to our News page here.