In our latest edition, we take a closer look at hedge strategy funds. These types of funds use a variety of trading strategies that may combine long and short positions, options, and more to generate profits while hedging against strong downside movements. Portfolios may hold a variety of assets as well, such as equities, bonds, currencies, and more, to accomplish this goal. Because these funds hedge their portfolio assets against downside movements, total returns tend to be smaller than other funds that don’t use hedging strategies. However, volatility can be considerably lower, making returns more stable over time.

Our breakdown of each fund includes key aspects such as one-year performance, fund expenses, hedge strategy incorporated, and credibility of the management team to give you an overview of how these funds hold up against their peers.

Be sure to check out the Hedge Strategies Funds page to find out more about the other funds in this category as well.

Trending Funds

1. PIMCO Global Bond Opportunities Fund (PAIIX)

PIMCO is a company with a reputation for outstanding bond investment funds and PAIIX is no different. It has a one-year return of 4.42% and a 10-year return of 4.30%.

As a bond fund, it also comes with a dividend yield currently listed at 2.03% and a relatively low expense ratio of just 0.97%. Its primary investment strategy is to select global investment-grade fixed income products that are then hedged against the U.S. dollar. The fund is benchmarked to the Bloomberg Barclays Global Aggregate (USD Hedged) Index.

The fund’s primary manager, Andrew Thomas Balls, is PIMCO’s CIO of Global Fixed Income and oversees the company’s European, Asia-Pacific, emerging markets, and global specialist investments teams. Having joined PIMCO in 2006, he has been managing the fund since September 2014 and is supported by Sachin Gupta and Dr. Lorenzo Pagani.

The portfolio contains a mixture of bond maturities with nearly 47% weight in 3- to 5-year maturities and a 33% weight in 5- to 10-year maturities. The effective duration of bonds held comes out to 4.84 years. As an international fund, holdings are diversified in multiple countries with nearly 42% exposure in the U.S, 13% in Italy, 10% in Spain, 9% in Australia, and 7% in China.

Learn more about different Portfolio Management concepts here.

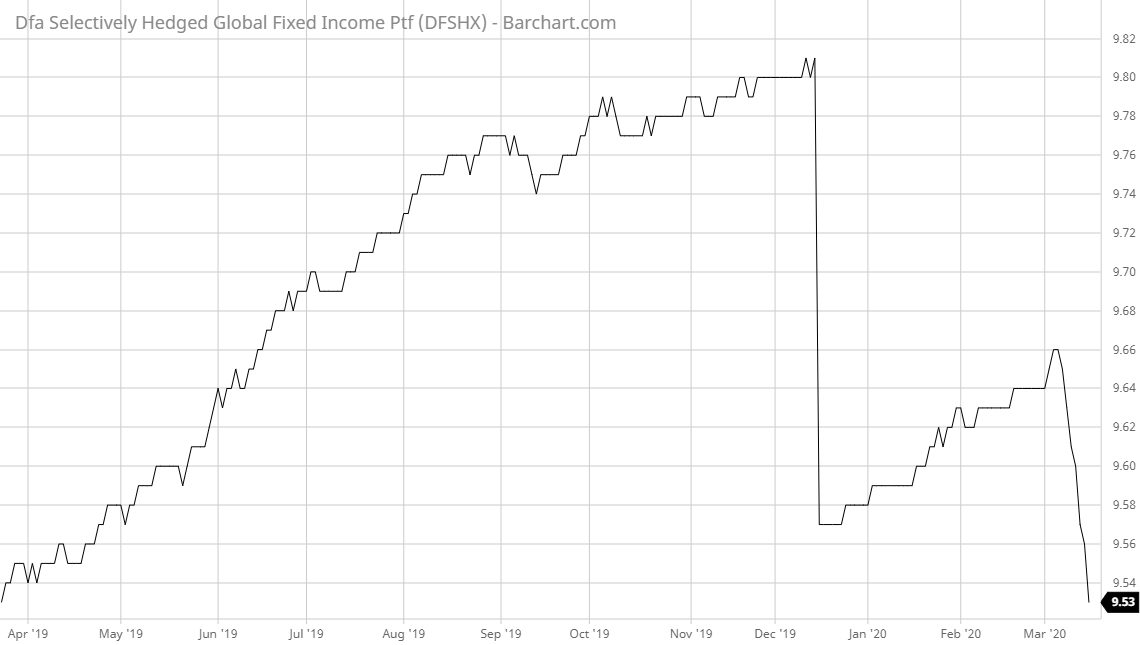

Another fixed income portfolio on our list is DFSHX. It has a one-year return of 3.81% and a 10-year return of 1.67%. It should be noted, however, that the returns consistently beat the benchmark FTSE World Government Bond Index 1-3 Years in all timeframes. It carries a low 0.17% expense ratio, maximizing investors’ returns as well. The fund’s investment strategy is to select investment-grade fixed income products both in the U.S. and internationally and enter into forward currency contracts to hedge against foreign exchange and credit risks.

The fund is primarily managed by David A. Plecha, Vice President, and Senior Portfolio Manager of Dimensional Fund Advisors, who has been managing the fund since its inception in January 2008. More recently, Joseph F. Kolerich, Vice President, and Senior Portfolio Manager, joined the fund’s management team.

The fund’s portfolio holds a mixture of fixed income products with a higher weight in short-term maturation. The fund holds nearly 37% in 1- to 3-year bonds, 35% in 0- to 3-month bonds, and 22% in 3- to 5-year bonds. The average duration of assets held is 1.62 years.

Find out about the funds suitable for your portfolio by using our free Screener.

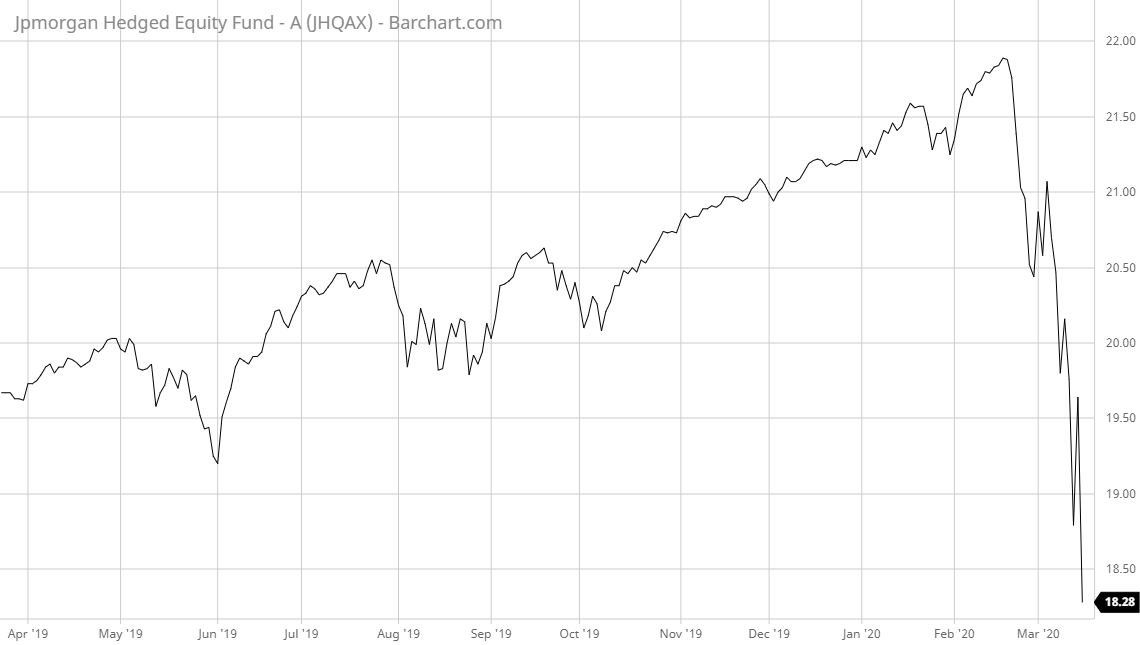

The final fund on our list is JHQAX with a one-year return of 3.76% and a total return of 6.17% since the fund’s inception. The fund comes with a 0.85% expense ratio, making it slightly cheaper than comparable funds. Unlike most funds in the hedged strategy category, the JPMorgan fund uses the S&P 500 Index as its benchmark. The fund’s investment strategy uses put and call options in addition to investing at least 80% of its assets in long equity positions to hedge against downturns in the markets.

The fund is co-managed by Hamilton Reiner and Raffaele Zingone, CFA, who have both been making investment decisions for the fund for the past seven years. Reiner is a portfolio manager and head of U.S. Equity Derivatives at J.P. Morgan Asset Management. Zingone is head of the U.S. Structured Equity Group.

The fund’s top five holdings include Microsoft (MSFT), S&P 500 Index, Apple (AAPL), Amazon (AMZN), Mastercard Class A (MA), and Alphabet Class A (GOOGL).

Want to know more about portfolio rebalancing? Click here.

The Bottom Line

And don’t forget to visit our News section to catch up with the latest news about mutual fund performance.

Note: Data as of March 10, 2020