First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. From the top trending category, we select the top three funds with the highest one-year trailing total returns. To ensure the quality and staying power of funds, we only look at those mutual funds with a minimum of $250 million in assets and a track record of at least three years. We also remove those mutual funds that are closed to new investors and are not available for investment outside registered accounts such as retirement or 529 accounts.

In this week’s edition, we analyze the top three precious metals equity funds. These funds invest in the stocks of companies engaged in the mining or refining of gold, silver, platinum, and palladium and generally are not restricted to a single region, giving them geographic diversity as well.

As the COVID-19 pandemic wanes and new political concerns are added into the markets, volatility and uncertainty continue to rise. As economists look ahead to what 2021 might bring, investors have been favoring a defensive position in safe haven assets like gold, which protect against inflation and swings in the stock market.

Our breakdown of each fund includes key aspects such as one-year performance, fund expenses, investment style, and management teams to give you an overview of how these funds hold up against their peers.

Be sure to check out the Precious Metals Equity Funds page to find out more about the other funds in this category as well.

Trending Funds

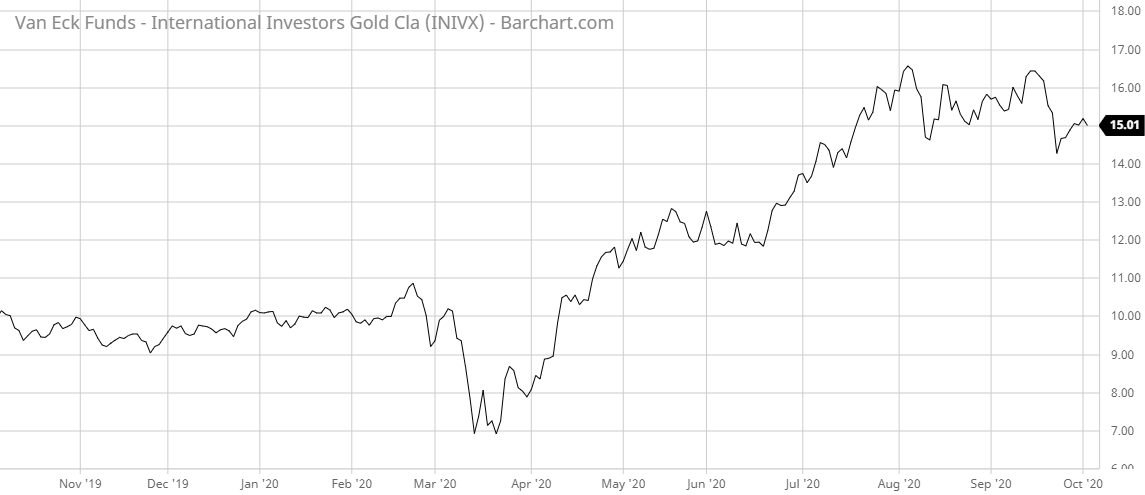

1. Van Eck International Investors Gold Fund (INIVX)

Topping the list for precious metals equity funds is the International Investors Gold Fund (INIVX) from Van Eck. It has a staggering trailing one-year performance of 47.08%. It has an expense ratio of 1.45%, however, making it the most expensive when it comes to investor fees on our list.

The investment strategy of the fund is to invest at least 80% of its assets in companies primarily engaged in gold mining, refining, or production. At least 25% is directed specifically to gold mining companies and may diversify among many different mining stocks or allocate a larger portion to a single issuer. It is benchmarked to the NYSE Arca Gold Miners Index.

The fund’s primary portfolio manager is listed as Joseph Foster, Portfolio Manager and Strategist.

The fund’s portfolio weight is primarily gold at 92.2%, with 3.1% in other precious metals and minerals and 3.7% marked as “other.” The top five holdings include B2Gold Corp (7.9%), Kirkland Lake Gold (7.8%), Barrick Gold Corp (7.1%), Newmont Corp (7.1%), and Wheaton Precious Metals Corp (5.2%).

Learn more about different Portfolio Management concepts here.

2. Invesco Gold & Special Minerals Fund (OPGSX)

Coming in at number two for the week is Invesco’s Gold & Special Minerals Fund (OPGSX). It comes with a strong trailing one-year performance of 45.07%. It carries a 1.20% expense ratio, placing it solidly in the middle of the pack compared to similar fund types.

The fund’s investment strategy is to invest in companies engaged in mining gold or other metals or minerals. It typically holds common stocks or ETFs and diversifies internationally, holding assets from any global region. It is indexed to the Custom Invesco Oppenheimer Gold & Special Minerals Benchmark.

The portfolio manager of the fund is Shanquan Li, who has been managing the fund since 1997.

The fund’s portfolio weights include gold (84.56%), diversified metals and mining (9.82%), copper (3.14%), precious metals and minerals (1.19%), and silver (1.14%). The top five holdings are listed as Gold Fields (5.29%), Anglogold Ashanti (5.02%), Kirkland Lake Gold (4.93%), Newmont Mining (4.58%), and Barrick Gold (4.48%).

Find out about the funds suitable for your portfolio by using our free Screener.

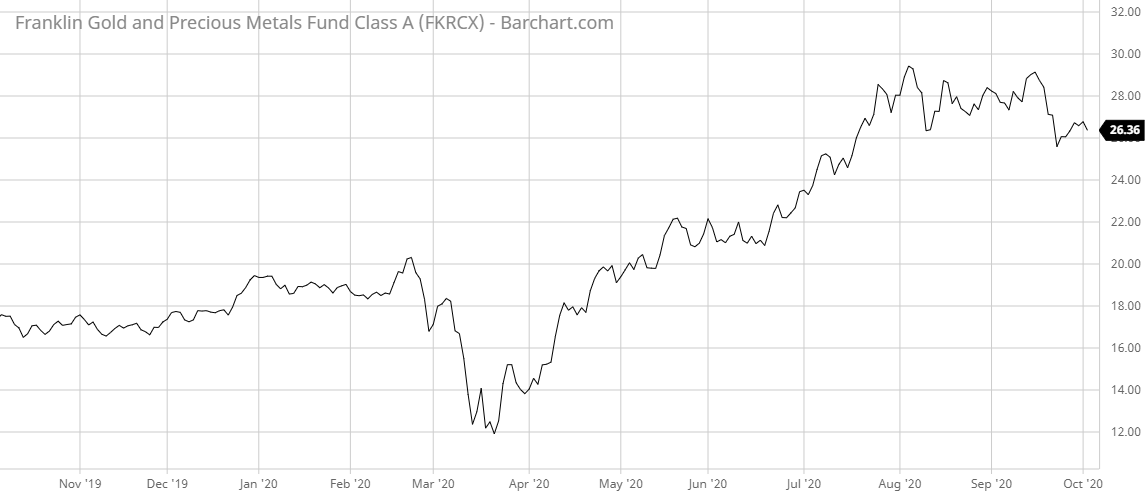

3. Franklin Templeton Gold and Precious Metals Fund (FKRCX)

The final mutual fund on our list this week is Franklin Templeton’s Gold and Precious Metals fund (FKRCX). It has a stellar trailing one-year performance of 44.88%. The low 0.98% expense ratio means it comes with the lowest fees out of our top three list.

The investment strategy stated in the fund’s prospectus is to invest at least 80% of its assets in companies engaged in the mining, refining, production, or operations of gold and other precious metals including silver, platinum, and palladium. It may contain international holdings and allocate a large portion of its assets into a single issuer. It is benchmarked to the FTSE Gold Mines Index.

The fund is primarily managed by Steve Land, CFA, who has been managing the fund since April 1999. He is also supported by Frederick Fromm, portfolio manager of the fund since December 2005.

The portfolio of the fund currently maintains 81 holdings with the majority (79.29%) in gold mining or gold exploration companies. The top five holdings in the fund include Barrick Gold (6.39%), Newmont Mining (4.39%), B2Gold (4.27%), Newcrest Mining (3.91%), and Alamos Gold (3.84%).

Want to know more about portfolio rebalancing? Click here.

The Bottom Line

Our expert analysis of the top three funds will give you insight so you know what the best precious metals equity fund is that fits your portfolio needs.

Make sure to visit our News section to catch up with the latest news about mutual fund performance.

Note: Data as of September 25, 2020.