First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and unavailable for investment outside registered accounts such as retirement or 529.

In this edition, we look closely at trending Micro-Cap Equity Funds, which are often overlooked by investors when considering conventional market cap-weighted portfolios, creating an opportunity for investors to capitalize on pricing anomalies. While they are usually riskier and more volatile than large-cap stocks, experienced fund managers can identify undervalued opportunities and help investors increase the diversification of their larger portfolios.

Be sure to check out the Micro-Cap Equity Funds page to find out more about the other funds in this category as well.

Trending Funds

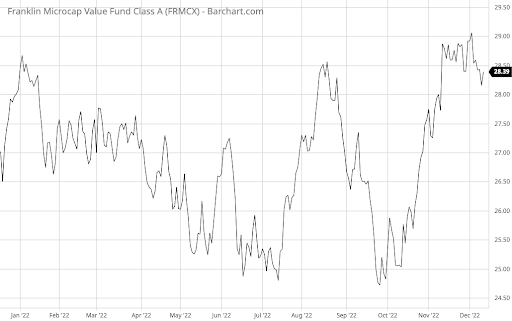

The Franklin MicroCap Value Fund (FRMCX) comes in first place with a 1.15% return over the trailing 12-month period. With a 1.23% expense ratio and 0.26% yield, the fund comes in the middle of the road in terms of cost and yield.

The fund managers use a long-term, bottom-up approach to build a portfolio of micro-cap companies with solid operating results and an attractive valuation. In particular, they look at factors like earnings, cash flow, or sales relative to competitors, as well as intangibles like franchises, understated assets, or patents/trademarks.

Currently, the fund holds a concentrated portfolio of 77 securities with a weighted average market cap of $520 million. The largest holdings include banks like First Business Financial Services Inc. (2.21%) and Peapack-Gladstone Financial Corp. (2.09%), but the fund also holds tech companies like Digi International Inc. (1.89%) and other sectors.

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com.

2. RBC Microcap Value Fund (TMVAX)

The RBC Microcap Value Fund (TMVAX) comes in second place with a 7.77% decline over the trailing 12-month period. With a 1.32% expense ratio and a 0.37% yield, the fund is the most expensive but highest-yielding option on the list.

The fund managers seek to build a diversified portfolio of the smallest companies neglected by institutional shareholders. Unlike FRMCX’s hands-on approach, the fund uses a quantitative process to identify value-oriented investments. Their goal is to find long-term growth opportunities with some protection from market volatility.

Currently, the fund holds over 400 equities, making it a much broader portfolio than the FRMCX fund. That said, the portfolio consists of about 22.4% bank stocks, with the remainder spread across retail (6.96%), diversified financial services (6.15%), REITs (5.09%), and others. Currently, the largest holding is Ducommun Inc. at 1.23%.

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com.

3. Paradigm Micro-Cap Fund (PVIVX)

The Paradigm Micro-Cap Fund (PVIVX) comes in third place with a 16.94% drop over the trailing 12-month period. With an expense ratio of 1.25% and no yield, it’s not the most expensive option, but it offers no yield to shareholders.

The fund aims to provide investors with carefully-selected exposure to the smallest segment of the U.S. equity market. With experience dating back to 1972, the fund managers have decades of experience dedicated to investing in the micro-cap space.

Currently, the fund holds a concentrated portfolio of 58 equities. Unlike the previous two funds, PVIVX holds 47% of its portfolio in technology companies and 27.8% of its portfolio in healthcare companies, with no allocation to financials. The largest holdings include Caleres Inc. (5.1%), Axcelis Technologies Inc. (4.2%), and MaxLinear Inc. (3.9%).

Learn more about different Portfolio Management concepts here.

Source: Barchart.com.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete Best High Dividend Model Portfolio.

All data as of December 8, 2022.