First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $250 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and not available for investment outside registered accounts such as retirement or 529.

In this edition, we take a closer look at trending High-Yield Dividend Income Funds for investors.

Interest rates have been on the rise thanks to growing concern over inflation since the beginning of the year. In addition to COVID-19 relief spending, the Biden administration is seeking to spend $3.5 trillion on everything from childcare to alternative energy. Since January, the 10-Year Treasury tripled from 0.5% to its current level of nearly 1.5%. As a result, investors are turning to high-yield dividend income funds as a way to hedge against inflation while protecting themselves from rising interest rates.

Our breakdown of each fund includes vital aspects, such as one-year performance, performance from inception, fund expenses, investment strategy, and management team’s profile, to give you an overview of how these funds hold up against their peers.

Be sure to check out the High Yield Dividend Income Funds page to find out more about the other funds in this category as well.

Trending Funds

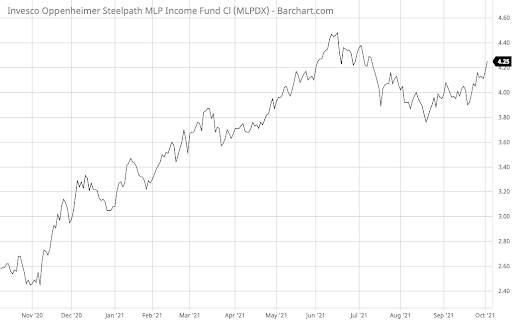

The number one mutual fund on this week’s list is the Invesco SteelPath MLP Income Fund (MLPDX). It provided an exceptional trailing one-year total return of 90.28% with a 1.44% expense ratio and a 9.55% yield, placing it in the middle of the pack in terms of expense and yield.

The fund primarily invests in U.S. energy infrastructure, focusing on midstream Master Limited Partnerships, or MLPs. These companies tend to focus on oil and natural gas pipelines, as well as storage and processing plants.

The fund is managed by Senior Portfolio Managers Stuart Cartner and Brian Watson, CFA. Mr. Cartner joined SteelPath in 2007 before its acquisition by OppenheimerFunds in 2019. Before that, he was a vice president in the Private Wealth Management Division at Goldman Sachs for 19 years. Mr. Watson also worked for SteelPath before the acquisition; before that, he led the MLP research effort at Swank Capital LLC.

The fund’s portfolio consists of about 91% energy assets and 4.4% utility assets. The fund’s top holdings include MLPX (13.52%), Energy Transfer (12.85%), and Sunoco (10.19%). Unlike many of its competitors, the fund focuses on smaller, value-focused holdings with less liquidity, making it potentially riskier than the status quo.

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com

2. PIMCO RAE PLUS Small Fund (PCFAX)

The PIMCO RAE PLUS Small Fund (PCFAX) comes in second place. It generated a one-year trailing return of 85.44% with a 1.21% expense ratio and a 41.06% yield, making it the cheapest and highest yielding fund on the list.

The smart beta fund invests in a diversified portfolio of stocks based on fundamental company size measures, such as sales, cash flows, dividends, and book value. The strategy focuses on undervalued stocks while also incorporating quality and momentum signals.

The fund is managed by Robert Arnott, Chris Brightman, Mohsen Fahmi, Jing Yang, and Bryan Tsu, who have an average tenure of 4.2 years. Mr. Arnott has the longest tenure at 7.1 years and serves as the founder and chairman of Research Affiliates, a sub-advisor to PIMCO.

The fund’s portfolio includes 312 stocks with an average P/E ratio of 12.85x compared to 15.9x for its benchmark index. The portfolio is heavily weighted in Consumer Discretionary (20.44%), Energy (15.32%), Real Estate (14.05%), and Industrials (11.86%).

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com

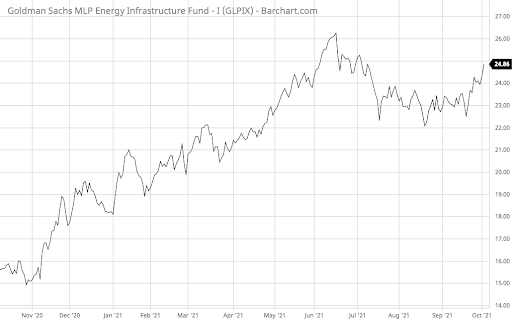

3. Goldman Sachs MLP Energy Infrastructure Fund (GLPIX)

The Goldman Sachs MLP Energy Infrastructure Fund (GLPIX) rounds out the list. It has a trailing one-year trailing return of 76.63% with a 2.35% expense ratio and a 4.54% yield, making it the most expensive and lowest-yielding fund on the list.

The fund invests in the North American energy sector, specifically in energy infrastructure (midstream) assets that satisfy daily energy needs, such as pipelines, storage tanks, and processing plants. They achieve that exposure through MLPs and traditional C Corporations while providing investors with attractive levels of income.

The fund is managed by Kyri Loupis, Ganesh V. Jois, CFA, and Matthew Cooper. Mr. Loupis has the most experience at 21 years and has a nine-year tenure at the fund. Before joining Goldman Sachs, he was an associate at Citigroup Investment Research, covering MLPs. He helped initiate coverage of several MLPs and had coverage responsibility for nearly 20 different companies.

The fund’s portfolio consists of gathering and processing companies (39.5%), petroleum pipelines (24.4%), and natural gas pipelines (19.1%). The most significant holdings include Energy Transfer LP (8%), MPLX LP (7.4%), and Targa Resources Corp. (6.7%). Overall, the fund tends to hold smaller value-focused companies with less liquidity than competing funds in its space.

Learn more about different Portfolio Management concepts here.

Source: Barchart.com

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete list of Best High Yield Stocks.

Note: Data as of September 30, 2021.