First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $250 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and not available for investment outside registered accounts such as retirement or 529.

In this edition, we take a closer look at trending Micro-cap Equity Funds for investors.

Micro-cap stocks outperformed large-cap stocks in 2020, with the Russell 2000 index generating a 20% return compared to the S&P 500 index’s 16.3% return. After a strong start to 2021, the micro-cap index began underperforming the S&P 500 benchmark by mid-year, as inflation concerns began to spread. However, they still remain an important tool for creating a well-diversified portfolio.

Our breakdown of each fund includes vital aspects, such as one-year performance, performance from inception, fund expenses, investment strategy, and management team’s profile, to give you an overview of how these funds hold up against their peers.

Be sure to check out the Micro-Cap Equity Funds page to find out more about the other funds in this category as well.

Trending Funds

The number one fund on this weeks’ list is the Royce Micro-Cap Investment Fund (RYOTX). It provided an exceptional trailing one-year total return of 58.81% with a 1.24% expense ratio and no yield, placing it in the middle of the list.

The Royce Micro-Cap Investment Fund is one of the oldest open-end funds dedicated to investing in micro-cap stocks. With just over $400 million in net assets, the fund invests in micro-cap stocks with solid fundamentals or prospects selling at prices that the fund managers believe do not fully reflect these attributes.

The fund is co-managed by Brendan Hartman and Jim Stoeffel, who have been managing the fund for eight and six years, respectively. Beyond their tenure with the fund, the two managers have been with Royce for 12 years.

The fund’s portfolio consists of 130 micro-cap stocks with an average market capitalization of about $600 million. These companies are concentrated in Information Technology (24.2%), Industrials (21.1%), Financials (13.3%), and Health Care (13.2%). In addition, about 11% of the companies are located outside of the United States. On average, the fund’s holdings are undervalued with a 13.67x P/E multiple versus the 15.17x category average.

Want to know more about portfolio rebalancing? Click here.

Source: BarChart.com

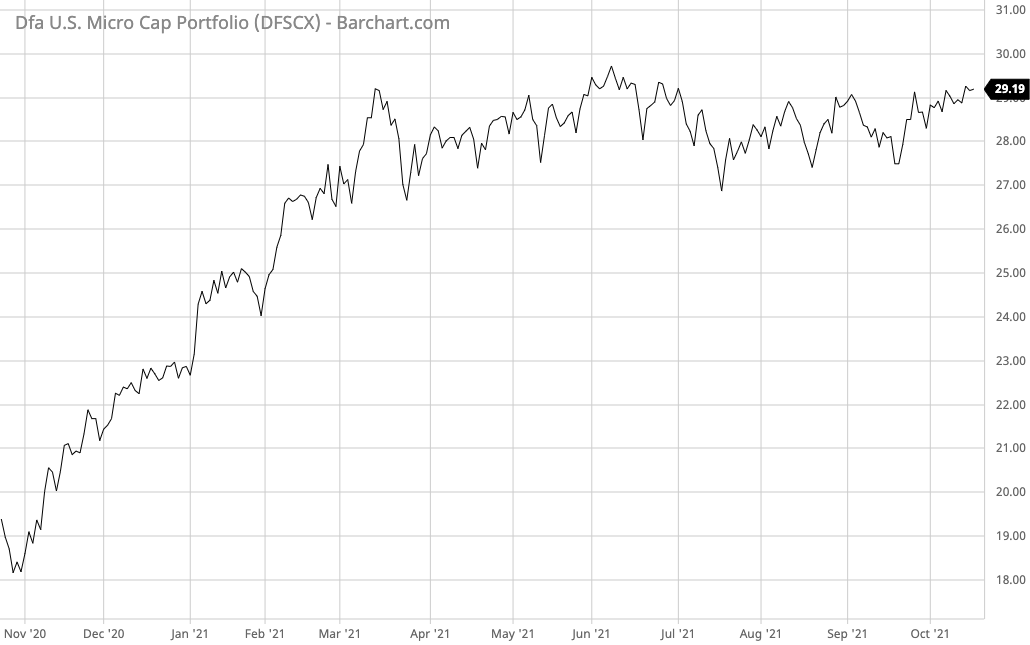

2. DFA U.S. Micro Cap Portfolio Fund (DFSCX)

The DFA U.S. Micro Cap Portfolio Fund (DFSCX) comes in second place. It generated a one-year trailing return of 55.72% with a 0.44% expense ratio and 0.88% yield, making it the lowest cost and highest yielding fund on the list.

The fund invests in a portfolio of micro-cap stocks to achieve long-term capital appreciation. In particular, the firm applies an integrated strategy based on advanced research, methodical portfolio design, and careful execution, while balancing risks, costs, and other trade-offs.

The fund is co-managed by Jed S. Fogdall, Joel P. Schneider, and Marc C. Leblond, who have an average tenure of about six years. Mr. Fogdall is the most senior portfolio manager with a nearly 10-year term. He has an MBA from the University of California Los Angeles and a B.A. from Purdue University.

The fund’s portfolio consists of 1,633 micro-cap stocks with a weighted average market capitalization of about $2 billion. These securities are concentrated in Financials (23.28%), Industrials (18.54%), Consumer Discretionary (12.7%), and Information Technology (11.9%). Like the first fund on the list, the portfolio tends to be undervalued with an average P/E of 13.26x compared to the 15.17x category average.

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com

3. Wasatch Micro Cap Value Fund (WAMVX)

The Wasatch Micro Cap Value Fund (WAMVX) rounds out the list. It has a one-year trailing return of 52.53% with a 1.74% expense ratio and no yield, making it the most expensive fund on the list.

The fund invests in undervalued micro-cap stocks with future growth potential. In particular, the fund managers use a blend of undiscovered growth, value momentum, graduating class, and fallen angel strategies. The fund is also rated five stars by MorningStar in the Small Growth category, making it the highest rated fund on the list.

The fund is managed by Brian Bythrow, CFA, who has been overseeing the fund for 18 years and has 27 years of industry experience. Prior to joining Wasach, he was Portfolio Manager for Monogram and an equity analyst at Parkstone Funds.

The fund’s portfolio consists of 99 small-cap stocks with an average market capitalization of $1.14 billion. These stocks are concentrated in Information Technology (21.5%), Industrials (17.5%), Financials (16.7%), and Consumer Discretionary (14.6%). Unlike the other two funds on the list, the fund has a higher average P/E ratio of 24.77x, suggesting a focus on growth.

Learn more about different Portfolio Management concepts here.

Source: Barchart.com

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete list of Best High Yield Stocks.

Note: Data as of October 14, 2021.