First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and not available for investment outside registered accounts such as retirement or 529.

In this edition, we take a closer look at trending Conservative Allocation Funds for investors.

Conservative allocation funds have become increasingly popular given rising geopolitical and inflationary risks. In particular, retirement investors seeking high levels of inflation-adjusted income seek out these funds to mitigate the risk of capital loss while generating enough income to offset the effects of inflation over time.

Be sure to check out the Conservative Allocation Funds page to find out more about the other funds in this category as well.

Trending Funds

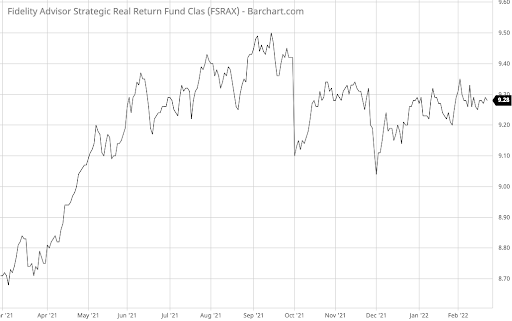

The Fidelity Advisor Strategic Real Return Fund (FSRAX) comes first on this week’s list. It provided an exceptional trailing one-year return of 11.55% with a 1.00% expense ratio and a 5.16% yield, putting it in the middle of the road in terms of expense and yield.

The fund seeks real return consistent with reasonable investment risk by allocating assets across a neutral mix of approximately 30% inflation-protected debt securities, 25% floating-rate loans, 25% commodities-linked derivatives, and 20% REITs and other real estate investments. The portfolio includes both domestic and international issuers.

The fund is co-managed by a team of five fund managers with an average tenure of just over four years. Ford E. O’Neil, a Harvard and Wharton School alumnus, has the longest tenure at nearly 10 years, overseeing various retail and institutional taxable bond portfolios.

The fund’s portfolio consists of over 1,000 holdings concentrated in inflation-protected debt (25.76%), floating-rate debt (23.98%), real estate equities (13.78%), and commodity equities (6.99%). U.S. Treasuries and Notes represent about half of all bond holdings, while specialized REITs account for nearly a quarter of real estate diversification.

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com

2. SEI Multi-Asset Inflation-Managed Fund (SIFAX)

The SEI Multi-Asset Inflation-Managed Fund (SIFAX) comes in second. It offered an 11.10% trailing one-year return, 1.12% expense ratio, and a 7.66% yield, making it the most expensive and highest-yielding fund.

The fund seeks to generate real return by selecting investments from a broad range of asset classes, including fixed income, equities, and commodities, based on fundamental, technical or valuation measures. Depending on market conditions, the fund may adjust these allocations over short periods and may be diversified or concentrated.

The fund uses a multi-manager approach under the general supervision of SIMC, allocating its assets among one or more sub-advisors using different investment strategies. SIMC may also directly manage a portion of the fund’s portfolio at its discretion.

The fund’s portfolio consists of about 67% fixed income and 16% equities, with the remainder in derivatives or other securities. The fund’s equity portfolio is concentrated in energy (29%), consumer defensive (24%), and healthcare (19%), while its fixed-income portfolio holds primarily government and AAA-rated corporate bonds.

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com

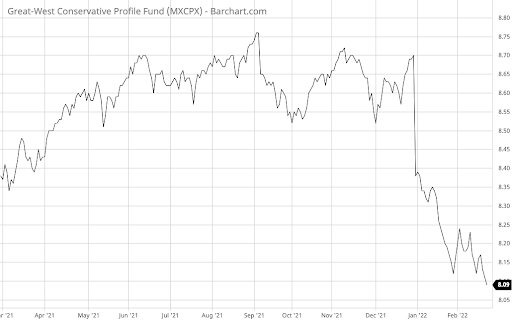

3. Great-West Conservative Profile Fund (MXCPX)

The Great-West Conservative Profile Fund (MXCPX) rounds out the list. It provided a 0.85% trailing one-year return, a 0.78% expense ratio, and a 2.49% yield, making it the cheapest fund on the list.

The fund seeks income and capital appreciation through fixed-income and, to a lesser degree, equities.

The fund is co-managed by Andrew Corwin and Maria Mendelsberg, who have an average tenure of about six years. Mr. Corwin has the longest tenure at about eight years.

The fund’s portfolio consists of 43% fixed-income, 22% equities, and 22% derivatives and other securities. The bond portfolio includes about 43% corporate bonds, 26% government bonds, and 25% securitized fixed-income securities. Meanwhile, the equity portfolio is diversified across real estate (20%), financial services (15%), and technology (13%).

Learn more about different Portfolio Management concepts here.

Source: Barchart.com

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete Best High Dividend Model Portfolio.

Note: Data as of February 22, 2022.