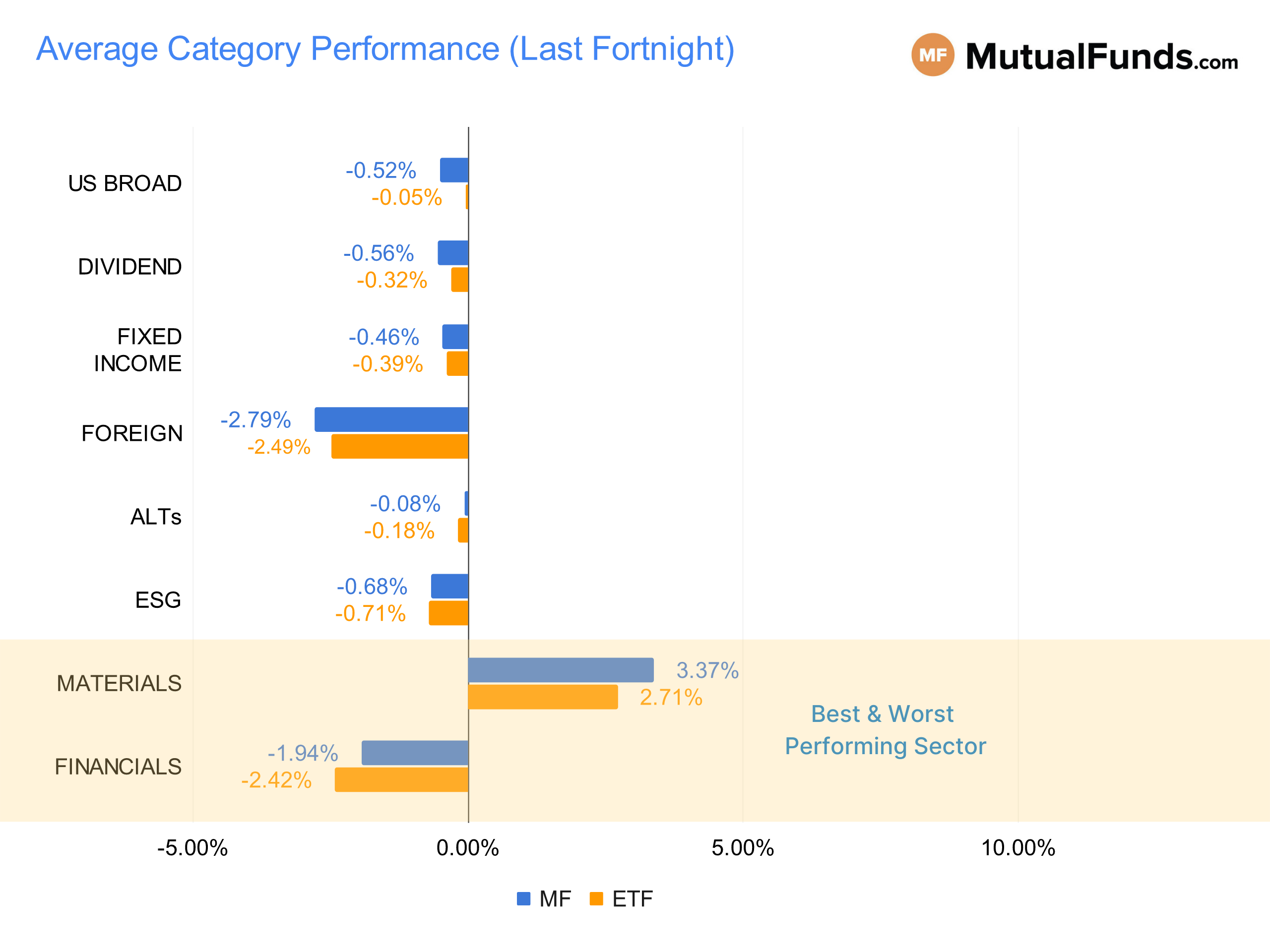

Performance Scorecard

US Broad mostly includes funds focussed on US equities and can cover different investing styles (growth/value) and market capitalizations (small/mid/large). Fixed Income includes funds focused on debt securities and can cover different geographies (US/foreign) and security types (corporate/municipal/high-yield/investment-grade/government/structured). Alternatives cover funds focussed on non-traditional investment strategies (currency, hedge fund strategy, derivatives), leveraged/structured products, real estate, and commodities. Dividend funds focus on generating income via equities and not through debt.

U.S. Broad

Small-cap equities were the best performers from U.S. stocks during the past fortnight, as they are more immune to foreign geopolitical shocks than large-cap companies. Growth-oriented and foreign funds were some of the worst performers.

Top Performers

Worst Performers

- Tactical Offensive Equity Fund (TCOEX) , down -6.87%, and Pear Tree Polaris Foreign Value Small Cap Fund (QUSIX), down -4.66%.

Dividend

Small-cap and dividend growth-focused funds continued to outperform while global dividend funds suffered.

Top Performers

- Principal Small-MidCap Dividend Income Fund (PMDIX) , up 0.81%, and Neuberger Berman Equity Income Fund (NBHAX), up 0.56%.

Worst Performers

- Janus Henderson Global Equity Income Fund (HFQAX) , down -1.98%, and PGIM Jennison Global Equity Income Fund (JDEZX), down -1.53%.

Fixed Income

Short-term treasuries and inflation-linked bond funds were outperforming emerging market-focused debt funds.

Top Performers

- Eaton Vance Income Fund of Boston (EVIBX) , up 1.31%, and American Century Short Duration Inflation Protection Bond Fund (APOGX), up 0.92%.

Worst Performers

- Stone Harbor Emerging Markets Debt Fund (SHMDX) , down -4.87%, and JPMorgan Emerging Markets Debt Fund (JEDAX), down -4.5%.

Sector

The metals and mining sector, as well as gold, surged over the past fortnight, largely in response to the Russia-Ukraine crisis. Technology stocks were at the other end of the spectrum.

Top Performers

- Invesco Gold & Special Minerals Fund (OPGSX) , up 5.81%, and Franklin Gold and Precious Metals Fund (FGPMX), up 4.38%.

Worst Performers

- American Beacon ARK Transformational Innovation Fund (ADNYX) , down -6.36%, and T. Rowe Price Global Technology Fund (PRGTX), down -6.28%.

Foreign

Asian equities have posted gains as they seemed to be a relative safe haven compared with European equities, which have been among the worst performers due to the war that broke out in Ukraine. Emerging market equities, in general, performed poorly last fortnight.

Top Performers

- DFA World ex U.S. Government Fixed Income Portfolio (DWFIX) , up 0.1%, and Wasatch International Growth Fund (WAIGX), up 0%.

Worst Performers

- Virtus KAR International Small-Cap Fund (VCISX) , down -7.26%, and Harding Loevner Institutional Emerging Markets Portfolio (HLEZX), down -6.92%.

Alternatives

Gold and silver jumped double digits as investors sought safe havens following Russia’s military invasion of Ukraine. Several funds focused on tactical and long/short strategies performed poorly last fortnight.

Top Performers

- Fidelity® Select Gold Portfolio (FSAGX) , up 5.64%, and Vanguard Commodity Strategy Fund (VCMDX), up 3%.

Worst Performers

- PIMCO RAE Worldwide Long/Short PLUS Fund (PWLBX) , down -1.88%, and BlackRock Tactical Opportunities Fund (PCBAX), down -1.87%.

ESG

ESG funds have performed poorly over the past fortnight with none of them registering positive gains.

Worst Performers

Key Economic Indicators

The UK’s inflation rose slightly to 5.5%. Federal Reserve minutes showed policymakers’ increased willingness to raise interest rates as inflation in the U.S. has reached the highest level in 40 years.

Fund performance data for the period between February 11, 2022 and February 25, 2022.

We provide this report on a fortnightly basis. To stay up to date with mutual fund market events, come back to our news page here.