First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and unavailable for investment outside registered accounts such as retirement or 529.

In this edition, we look closely at trending Emerging Market Funds for investors.

China’s move to reopen its economy and hopes for looser global financing conditions helped emerging markets post substantial gains over the past few months. For example, the iShares MSCI Emerging Markets ETF (EEM) is up more than 15% since November 1, 2022, compared to just 6% for the SPDR S&P 500 ETF (SPY). However, U.S. inflation remains a problem, and emerging market fundamentals lack significant improvements.

Be sure to check out the Emerging Market Funds page to find out more about the other funds in this category as well.

Trending Funds

The Matthews China Dividend Investor Fund (MCDFX) comes in first place with a -1.71% return over the trailing 12-month period. With a 1.12% expense ratio and 3.34% yield, the fund is also the cheapest and highest-yielding fund on today’s list.

The fund invests at least 80% of its net assets in dividend-paying securities, including convertible debt and equity securities, of companies located in China. With about $220 million in assets under management, the fund managers employ a bottom-up, fundamental investment philosophy focusing on long-term investment performance.

Currently, the fund holds a concentrated portfolio of 38 companies with a weighted average market cap of $85 billion. The portfolio’s largest allocations belong to consumer discretionary (29.5%), communication services (15.4%), and financials (11.4%). Meanwhile, the fund’s most significant holdings include names like Tencent and Alibaba.

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com.

2. ALPS/Kotak India ESG Investor Fund (INDAX)

The ALPS/Kotak India ESG Investor Fund (INDAX) comes in second place with a -13.46% trailing 12-month return. With a 1.33% expense ratio and no yield, the fund is the lowest-yielding option on today’s list.

The fund invests at least 80% of its net assets in equities and equity-linked securities of Indian companies that satisfy specific environmental, social, and governance criteria. In particular, the fund managers focus on large blue-chip leaders by taking a top-down sector-driven and bottom-up stock-driven approach using fundamental and ESG requirements.

Currently, the fund holds a concentrated portfolio of 57 companies. The portfolio has significant allocations toward financials (33.43%), information technology (13.82%), and consumer discretionary (10.03%). Some of its largest holdings include Infosys Inc. (7.72%), ICICI Bank Ltd. (7.46%), and Reliance Industries (6.83%).

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com.

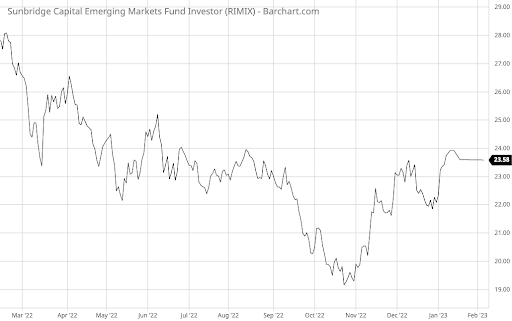

3. Sunbridge Capital Emerging Markets Fund (RIMIX)

The Sunbridge Capital Emerging Markets Fund (RIMIX) comes in third place with a -13.69% trailing 12-month return. With a 1.53% expense ratio and a 2.4% yield, the fund is the most expensive option on today’s list.

The fund invests at least 80% of its net assets in emerging market equities. The managers use a research-driven approach with a high-touch, boots-on-the-ground, bottom-up investment process. While the fund may hold derivatives or invest in IPOs and secondaries, it does not hedge against currency risk, providing dollar diversification.

Currently, the fund holds a portfolio of 67 companies with a minimum $1 billion market cap. The portfolio holds equities from a range of countries, including China (30%), India (13%), Taiwan (13%), South Korea (10%), and Indonesia (10%). Meanwhile, the largest sector allocations are to consumer cyclical (36%), technology (20%), and financial services (18%).

Learn more about different Portfolio Management concepts here.

Source: Barchart.com.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete Best High Dividend Model Portfolio.

All data as of February 2, 2023.