First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and unavailable for investment outside registered accounts such as retirement or 529.

In this edition, we look closely at trending Large-Cap Equity Funds for investors.

Global equity markets moved sharply lower throughout 2022 thanks to rising interest rates, Russia’s invasion of Ukraine, and higher energy prices, among other headwinds. With a potential recession on the horizon, investors have sold off growth stocks and increased allocations to value stocks, helping these funds outperform over the past year.

Be sure to check out the Large-Cap Equity Funds page to learn more about the other funds in this category as well.

Trending Funds

The Beutel Goodman Large-Cap Value Fund (BIAVX) comes in first place with a 7.71% trailing 12-month return. With a 0.70% expense ratio and a 1.5% yield, the fund is also our list’s highest-yielding and lowest-cost option.

The $1.5 billion fund invests in companies trading at a discount to the present value of sustainable free cash flow. The fund managers employ a disciplined, bottom-up investment process to identify these opportunities and only make investments when there’s enough of a discount to mitigate the loss of capital in adverse circumstances.

The relatively concentrated portfolio is heavily weighted in industrials (16%), information technology (15.1%), financials (15%), and consumer discretionary (14.8%). As of December 31, 2022, the largest holdings included Omnicom Group (5%), Amdocs Ltd. (4.8%), and Amgen Inc. (4.7%), with the top holdings accounting for 42% of the total portfolio.

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com.

2. Invesco Comstock Select Fund (CGRWX)

The Invesco Comstock Select Fund (CGRWX) comes in second place with a 6.25% trailing 12-month return. With a 0.91% expense ratio and a 1.22% yield, the fund is middle-of-the-road in terms of expense and yield on today’s list.

The fund managers use a highly selective and patient approach to identify undervalued stocks over a long-term period. In particular, they take a bottom-up, unconstrained approach to selecting stocks to build a concentrated portfolio of about 30 companies, focusing on the underlying value of a business’s assets and balancing risk and reward.

The portfolio is weighted heaviest in financials (20.28%), healthcare (17.86%), and industrials (13.35%). Unlike the previous fund, its most significant holdings are more well-known companies like Exxon Mobil (5.14%), Wells Fargo (4.96%), and Merck (4.66%).

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com.

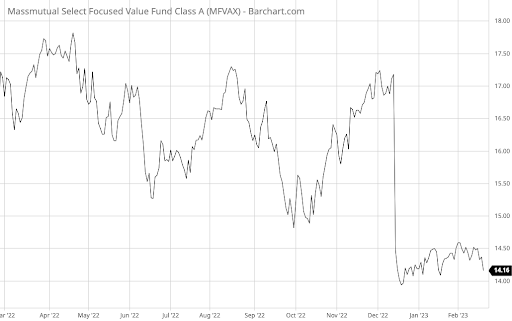

3. MassMutual Equity Opportunities Fund (MFVAX)

The MassMutual Equity Opportunities Fund (MFVAX) comes in third place with a -0.62% trailing 12-month return. With a 1.29% expense ratio and a 0.88% yield, the fund is also the lowest-yielding and most expensive on today’s list.

The fund focuses on financially sound and conservatively valued equities of all sizes, including common stock, preferred stock, convertible securities, and warrants. In addition, the fund may invest up to 30% of its assets in foreign American Depositary Receipts (ADRs), and the managers may use futures for hedging or leverage.

The portfolio of 65 securities is concentrated in healthcare (20.31%), financials (14.36%), and consumer staples (13.52%). Meanwhile, about 11% of its portfolio consists of non-U.S. equities. Some of its recent largest holdings include TJX Companies Inc. (4.39%), Chubb Ltd. (4.26%), Nike Inc. (4.01%), and Honeywell International Inc. (3.75%).

Learn more about different Portfolio Management concepts here.

Source: Barchart.com.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete Best High Dividend Model Portfolio.

All data as of February 15, 2023.