Inflation data, which has been a major cause of stress over the last year, declined further. The CPI rose 0.4% month-over-month in April of 2023, matching market expectations. This brought the annual rate of inflation down to 4.9%, lower than previous readings and meeting forecasts. It also showed that the Fed’s path of tightening may be working and that a soft landing could be possible. However, the excitement was short lived as the debt ceiling debate raged on. Lawmakers in Washington haven’t come to agreement and the United States has moved closure to a default on its debt. Credit default swaps on U.S. treasuries rose to their highest point on record. Stocks also gyrated lower. Also helping create extra volatility was the continued unrest in the regional banks. This time, PacWest announced a 9.5% decline in its deposits, increasing selling pressure on the bank’s stock along with other west coast rivals like Western Alliance Bancorp. However, in an interview with Bloomberg News, JPMorgan CEO Jamie Dimon mentioned that the regional banks are “quite strong", helping to ease some of the selling pressure.

Next week, investors will get plenty of consumer data, with the month-over-month retail sales report being released on Tuesday. Retail sales sank 0.6% in March and 0.7% in February, reversing several months of gains and showing that rising rates are having an effect on consumers. However, analysts now predict that the slowing rate of inflation should help spur forward a 0.7% gain for April. The effect of the Fed’s pace of rate hikes will also be seen on the housing sector next week with the release of the building permits and housing starts report on Wednesday. The amount of permitted construction fell to a seasonally adjusted annualized rate of 1.43 million in March, slightly above estimates. Economists predict April’s number to clock in at roughly the same. Meanwhile, the number of houses that have physically started construction is also expected to dip by 1.5% for April. While overall data released will be light this week, investors will get a smattering of speeches from various Federal Reserve Governors including Chairman Powell on Friday. Powell isn’t expected to comment any further than previously indicated stances that more tightening could be on the way. However, any shocks could send stocks falling during the week.

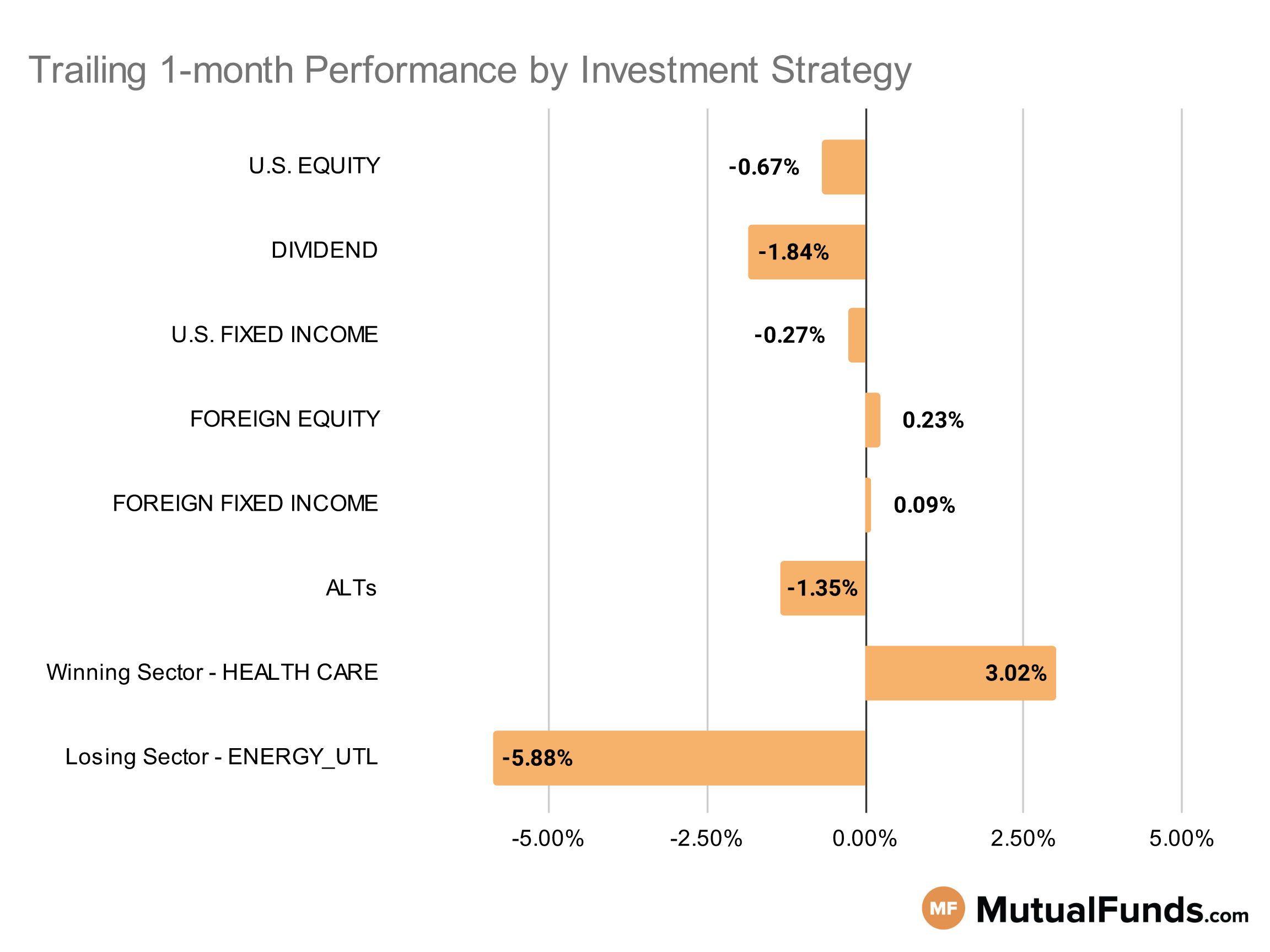

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

U.S Equity Strategies

In U.S. equities, growth strategies including those focused on large-cap equities outperformed others over the last trailing month. On the other hand, just like last week, small-cap strategies continued to struggle.

Winning

- Virtus AllianzGI Focused Growth Fund (PGWAX) , up 5.97%

- T. Rowe Price Institutional Large Cap Core Growth Fund (TPLGX), up 4.7%

- Schwab U.S. Large-Cap Growth ETF™ (SCHG) , up 3.62%

- iShares Morningstar Growth ETF (ILCG), up 2.7%

Losing

- SPDR® S&P 600 Small Cap Value ETF (SLYV) , down -5.23%

- iShares S&P Small-Cap 600 Value ETF (IJS), down -5.3%

- Voya Russell Small Cap Index Portfolio (IRSIX) , down -8.32%

- Voya Russell Mid Cap Index Portfolio (IRMCX), down -13.75%

Dividend Strategies

When it comes to income, international dividend strategies won while high dividend strategies lost over the trailing one month period.

Winning

- Amana Mutual Funds Trust Income Fund (AMANX) , up 2.01%

- SPDR® S&P International Dividend ETF (DWX), up 1.26%

- Lord Abbett Dividend Growth Fund (LAMYX) , up 0.74%

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW), up 0.13%

Losing

- DWS CROCI Equity Dividend Fd (KDHSX) , down -4.23%

- Federated Hermes Strategic Value Dividend Fund (SVAIX), down -4.88%

- WisdomTree U.S. High Dividend Fund (DHS) , down -6.56%

- Invesco S&P Ultra Dividend Revenue ETF (RDIV), down -9.61%

U.S. Fixed Income Strategies

In US fixed income, strategies focused on shorting longer duration US treasuries along with some structured credit strategies benefited over the last trailing one month, while long-only strategies focused on longer duration US treasuries continue to lose.

Winning

- ProShares Short 20+ Year Treasury (TBF) , up 1.86%

- GMO Opportunistic Income Fund (GMOLX), up 1.32%

- City National Rochdale Fixed Income Opportunities Fund (RIMOX) , up 0.95%

- iShares Core International Aggregate Bond ETF (IAGG), up 0.88%

Losing

- PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (LTPZ) , down -2.28%

- Invesco CEF Income Composite ETF (PCEF), down -2.53%

- Vanguard Extended Duration Treasury Index Fund (VEDIX) , down -2.81%

- PIMCO Extended Duration Fund (PEDPX), down -3.07%

Foreign Equity Strategies

Among foreign equity strategies, small cap and Mexican equities came out as the top performing strategies, while Asian equity strategies including those focused on China continued to lose.

Winning

- Oakmark International Fund (OANEX) , up 5.94%

- Oakmark International Small Cap Fund (OAZEX), up 5.94%

- iShares MSCI Mexico ETF (EWW) , up 4.61%

- iShares MSCI Switzerland ETF (EWL), up 4.4%

Losing

- Matthews Pacific Tiger Fund (MAPTX) , down -4.59%

- iShares Asia 50 ETF (AIA), down -5.02%

- Fidelity® China Region Fund (FHKCX) , down -5.27%

- WisdomTree China ex-State-Owned Enterprises Fund (CXSE), down -5.45%

Foreign Fixed Income Strategies

Among foreign debt, while emerging market local currency based debt strategies continued their winning streak from last week, some high yielding strategies from emerging markets lost.

Winning

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC) , up 1.16%

- PIMCO Emerging Markets Local Currency and Bond Fund (PELPX), up 1.05%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX) , up 0.65%

- SEI Institutional Investments Trust Emerging Markets Debt Fund (SEDAX), up 0.6%

Losing

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) , up 0.02%

- John Hancock Funds Emerging Markets Debt Fund (JEMIX), down -0.55%

- Ashmore Emerging Markets Total Return Fund (EMKIX) , down -0.62%

- VanEck Emerging Markets High Yield Bond ETF (HYEM), down -1.85%

Alternatives

Among alternative strategies, Japanese equity strategies continued to win. On the contrary, broader commodity based strategies were on the losing end.

Winning

- iShares Currency Hedged MSCI Japan ETF (HEWJ) , up 4.63%

- WisdomTree Japan Hedged Equity Fund (DXJ), up 3.77%

- AQR Managed Futures Strategy Fund (AQMIX) , up 2.64%

- Fidelity® Contrafund® Fund (FCNKX), up 2.31%

Losing

- ALPS/CoreCommodity Management CompleteCommoditiesSM Strategy Fund (JCRAX) , down -6.11%

- PIMCO CommoditiesPLUS® Strategy Fund (PCLAX), down -6.8%

- iShares S&P GSCI Commodity-Indexed Trust (GSG) , down -7.98%

- Invesco S&P SmallCap Low Volatility ETF (XSLV), down -8.17%

Sectors

Among the various sectors, just like last week, biotech strategies continued to win over the last trailing month. However, regional banking startegies continue to suffer.

Winning

- Eventide Healthcare & Life Sciences Fund (ETAHX) , up 13.41%

- SPDR® S&P Biotech ETF (XBI), up 11.88%

- Fidelity Advisor® Biotechnology Fund (FBTAX) , up 9.46%

- Aberdeen Standard Physical Platinum Shares ETF (PPLT), up 9.13%

Losing

Methodology

Here is a summary of different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.