An array of positive economic data releases also helped improve investor confidence. For instance, month-over-month durable goods orders popped 1.7% in May, following a revised 1.2% increase in April. This was in stark contrast to a 1% decline expected by analysts, showcasing the latest sign of resilience in the U.S. economy as lower inflation and strong supply chains helped demand for big-ticket items. Additionally, the CB Consumer Confidence figure rose to 109, beating estimates and rising to a 17-month high. Despite rising mortgage rates, new home sales also surged 12.2% month-over-month, easily crushing estimates. Separately, in two speeches at the Banco de Espana Fourth Conference, Fed chairman Jerome Powell reiterated the central bank’s stance on rate hikes and estimated that it will raise rates at least two more times. Investors took that in stride as this reinforced the market consensus regarding monetary policy.

Next week, the markets will be closed for the July 4 holiday on Tuesday. Nonetheless, there will be a lot of economic data for investors to digest. Driving the week’s volatility and potential gains will be the release of FOMC meeting minutes on Wednesday afternoon. Policy makers have indicated that they expect at least two more rate hikes before the end of the year. However, investors will be looking for clues about the timing of those hikes as they closely watch how the Fed feels about moderating inflation data and the weakening economy. Labor and employment trends will also be closely monitored next week. After unexpectedly rising by 358,000 in April 2023, the JOLTS report for May 2023 is once again predicted to come around 10 million when it is released on Thursday. While seeing a slight increase, the unemployment rate in June is estimated to come in at 3.7% on Friday, still at lows not seen since well before the COVID-19 pandemic. Lower inflationary rates and the continued growth of onshoring is predicted to help boost June ISM Manufacturing PMI to 48, above last month’s level of 47 and just below expansion levels. The ISM’s measure of the services economy is also expected to jump to 53.

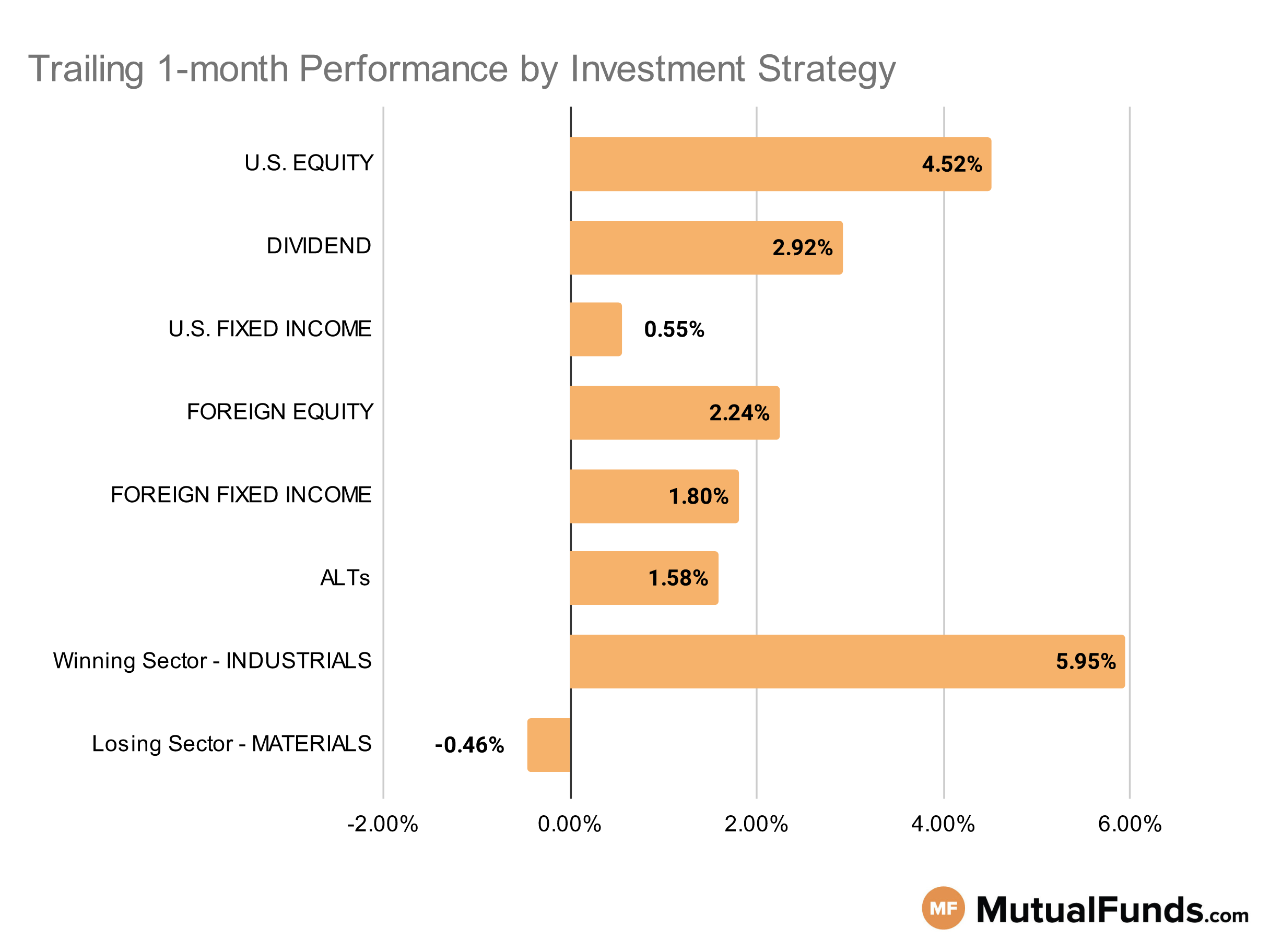

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

U.S Equity Strategies

In U.S. equities, growth strategies continued to outperform value-focused strategies.

Winning

- Morgan Stanley Institutional Fund, Inc. Growth Portfolio (MSEGX) , up 10.62%

- Wasatch Small Cap Value Fund (WMCVX), up 8.38%

- First Trust US Equity Opportunities ETF (FPX) , up 7.36%

- Dimensional U.S. Targeted Value ETF (DFAT), up 5.97%

Losing

- iShares Core S&P U.S. Growth ETF (IUSG) , up 3.71%

- Schwab U.S. Large-Cap Value ETF™ (SCHV), up 3.67%

- Columbia Global Equity Value Fund (CEVYX) , up 0.63%

- American Funds Washington Mutual Investors Fund (RWMGX), up 0.36%

Dividend Strategies

When it comes to dividend income, sector and mid-cap company focused strategies came up on top while international dividend strategies continued to struggle.

Winning

- HCM Dividend Sector Plus Fund (HCMNX) , up 6.19%

- Principal Small-MidCap Dividend Income Fund (PMDIX), up 5.89%

- Invesco BuyBack Achievers ETF (PKW) , up 5.86%

- WisdomTree U.S. SmallCap Dividend Fund (DES), up 5.27%

Losing

- Franklin Income Fund (FCISX) , up 0.87%

- Principal Global Diversified Income Fund (PGBAX), up 0.77%

- SPDR® S&P International Dividend ETF (DWX) , down -0.41%

- First Trust Dow Jones Global Select Dividend Index Fund (FGD), down -1.3%

U.S. Fixed Income Strategies

In US fixed income, strategies focused on long duration and covertible strategies emerged as winners, while inflation-linked debt strategies suffered losses.

Winning

- PIMCO StocksPLUS® Long Duration Fund (PSLDX) , up 5.03%

- iShares Convertible Bond ETF (ICVT), up 4.49%

- PIMCO Extended Duration Fund (PEDPX) , up 3.09%

- Invesco CEF Income Composite ETF (PCEF), up 2.5%

Losing

- Schwab Intermediate-Term U.S. Treasury ETF™ (SCHR) , down -0.56%

- TIAA-CREF Inflation-Linked Bond Fund (TIKRX), down -1.31%

- MFS Inflation-Adjusted Bond Fund (MIAAX) , down -1.6%

- ProShares Short 20+ Year Treasury (TBF), down -2.44%

Foreign Equity Strategies

Among foreign equity strategies, Latin American and emerging market strategies continue to perform well, while European and some Asian market strategies lost ground.

Winning

- iShares MSCI Brazil ETF (EWZ) , up 8.96%

- iShares Latin America 40 ETF (ILF), up 7.66%

- Artisan Developing World Fund (APHYX) , up 5.14%

- Lazard Emerging Markets Equity Portfolio (LZEMX), up 4.97%

Losing

- Matthews Asia Growth Fund (MPACX) , down -0.34%

- Franklin International Growth Fund (FNGZX), down -0.37%

- iShares MSCI Singapore ETF (EWS) , down -2.7%

- Xtrackers MSCI Europe Hedged Equity ETF (DBEU), down -3.43%

Foreign Fixed Income Strategies

Among foreign debt, while emerging market and high yield debt strategies posted gains, developed market bond strategies struggled.

Winning

- American Funds Emerging Markets Bond Fund (EBNFX) , up 3.7%

- Eaton Vance Emerging Markets Local Income Fund (EEIIX), up 3.41%

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , up 2.24%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 1.76%

Losing

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND) , up 0.9%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), up 0.45%

- Stone Harbor Emerging Markets Debt Fund (SHMDX) , down -0.14%

- Janus Henderson Developed World Bond Fund (HFARX), down -0.78%

Alternatives

Among alternatives, Japanese hedged equity strategies continue to outperform. On the other end, cannabis and gold focussed strategies lost ground.

Winning

- WisdomTree Japan Hedged Equity Fund (DXJ) , up 8.2%

- iShares Currency Hedged MSCI Japan ETF (HEWJ), up 7.72%

- Janus Henderson Contrarian Fund (JCNCX) , up 5%

- Columbia Contrarian Core Fund (SMGIX), up 4.36%

Losing

- PIMCO TRENDS Managed Futures Strategy Fund (PQTIX) , down -1.34%

- Xtrackers MSCI EAFE Hedged Equity ETF (DBEF), down -2.37%

- Fidelity® Select Gold Portfolio (FSAGX) , down -4.03%

- ETFMG Alternative Harvest ETF (MJ), down -4.21%

Sectors

Among the sectors, home construction strategies emerged as the key winner over the last trailing month. However, platinum strategies continued to struggle.

Winning

- iShares U.S. Home Construction ETF (ITB) , up 14.16%

- Amplify Online Retail ETF (IBUY), up 13.8%

- American Beacon ARK Transformational Innovation Fund (ADNYX) , up 10.78%

- Vanguard Industrials Index Fund (VINAX), up 7.99%

Losing

- First Eagle Gold Fund (FEGIX) , down -3.27%

- Sprott Gold Equity Fund (SGDLX), down -5.29%

- Aberdeen Standard Physical Palladium Shares ETF (PALL) , down -10.25%

- Aberdeen Standard Physical Platinum Shares ETF (PPLT), down -10.43%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietory system to scan through thousands of relevant mutual funds and ETFs. To ensure quality and adequate track record, the system places a minimum threshold on net assets of $100 million. Fund performance data is calculated for the trailing one month, based on change in NAV.

Here is a summary of different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.