October lived up to its spooky reputation as being the worst month of the year for stocks.

The broader markets ended the month lower before rallying at the end of the week. Strong economic data, including a better-than-expected JOLTS report and consumer confidence figures caused investors to second-guess what the Fed would do later in the week. However, the Federal Reserve kept rates at 5.5% for the second consecutive time. This pleased markets and created a nice post-meeting rally. Additionally, Chairman Powell and other Fed governors reiterated their stance that more hikes could be needed and that the FOMC had not discussed cutting rates. Meanwhile, deteriorating economic data may force the Fed’s hand. The unemployment rate increased to 3.9%, while the ISM Services PMI dropped from 53.6 in September to 51.8 in October, just above contraction levels. The continued earnings season has been mixed as well, with several firms reporting strong current profits but mixed guidance in light of the tough economy.

With the Veterans Day holiday being celebrated on Friday of next week, economic data will be light in the coming days. Most of the limited data releases will focus on the health of the consumer and job markets. On Thursday, we’ll see the release of the weekly jobless claims for the week ending November 4. Last week, the figure came in slightly above estimates and represented the highest number of claims in nearly two months. However, jobless claims have been generally trending lower and analysts predict the robust labor market will keep the figure lower. This is expected to boost consumer sentiment via the University of Michigan report. The preliminary number for November is predicted to marginally rise to 64 (vs. October’s final reading of 63.8) when reported on Friday, indicating a cautious, yet still willing to spend consumer cohort. Other data on the week will include the balance of trade, with the U.S. trade gap having narrowed to $58.3 billion in August 2023 – the lowest in nearly three years. On Tuesday, analysts predict September’s number to come in at around $59.5 billion.

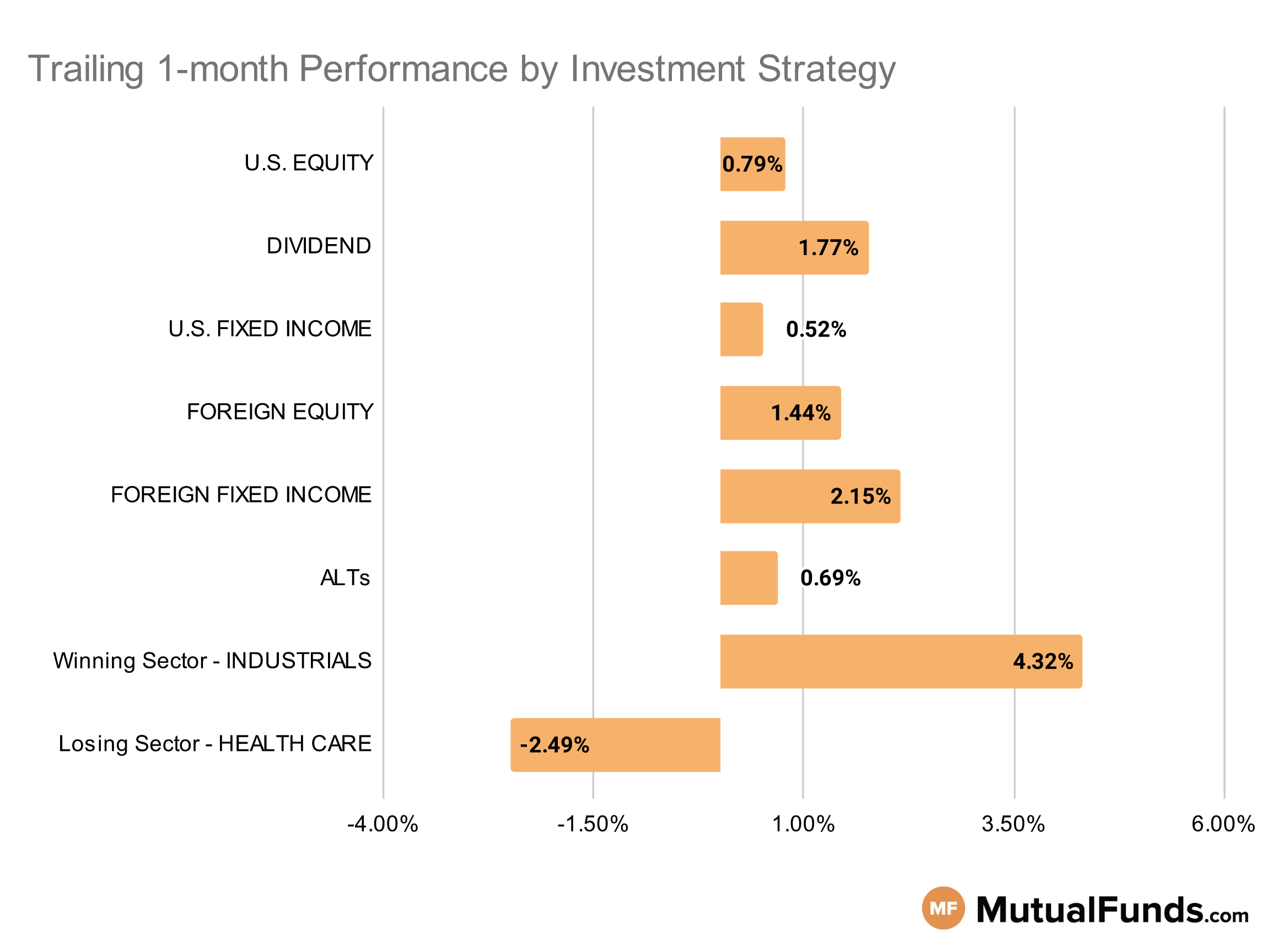

Investment Strategy Scorecard

Overall, the U.S. stock markets were slightly up for the rolling month.

Strategies focused on blockchain, gold, defense, and foreign equity (especially from Japan and Brazil) outperformed others for the rolling month. Meanwhile, cannabis and small-cap growth-focused strategies continued to struggle.

U.S Equity Strategies

Large-cap growth strategies reversed course and outperformed especially their small-cap counterparts.

Winning

- T. Rowe Price Large-Cap Growth Fund (TRLGX) , up 4.24%

- Invesco Dynamic Large Cap Growth ETF (PWB), up 4.2%

- Columbia Large Cap Growth Fund (GEGTX) , up 4.12%

- iShares Morningstar Growth ETF (ILCG), up 2.87%

Losing

- First Trust US Equity Opportunities ETF (FPX) , down -1.58%

- iShares Russell 2000 Growth ETF (IWO), down -2.68%

- Brown Capital Management Small Company Fund (BCSIX) , down -7.35%

- Gabelli Small Cap Growth Fund (GABSX), down -8.98%

Dividend Strategies

Several dividend strategies reversed course and came up as winners over the rolling month, with some international and global strategies benefitting more than others.

Winning

- SPDR® S&P International Dividend ETF (DWX) , up 3.78%

- ClearBridge Dividend Strategy Fund (SOPYX), up 3.57%

- Federated Hermes Strategic Value Dividend Fund (SVAIX) , up 3.22%

- First Trust Dow Jones Global Select Dividend Index Fund (FGD), up 2.94%

- Schwab U.S. Dividend Equity ETF™ (SCHD) , up 0.36%

- ProShares S&P 500 Dividend Aristocrats ETF (NOBL), up 0.28%

- First Eagle Global Income Builder Fund (FEBIX) , up 0.17%

Losing

- HCM Dividend Sector Plus Fund (HCMNX), down -0.67%

U.S. Fixed Income Strategies

In US fixed income, certain long-duration bond strategies emerged as winners while high-yield muni strategy struggled.

Winning

- PIMCO StocksPLUS® Long Duration Fund (PSLDX) , up 4.12%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), up 3.57%

- PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (LTPZ) , up 3.39%

- Xtrackers Low Beta High Yield Bond ETF (HYDW), up 2.56%

Losing

- Miller Convertible Bond Fund (MCIFX) , down -1.41%

- ProShares Short 20+ Year Treasury (TBF), down -2.37%

- AlphaCentric Income Opportunities Fund (IOFCX) , down -5.6%

- VanEck Vectors High Yield Muni ETF (HYD), down -33.33%

Foreign Equity Strategies

Brazilian equity strategies emerged as winners among foreign equity strategies. Chinese equity strategies struggled.

Winning

- iShares MSCI Brazil ETF (EWZ) , up 8.24%

- iShares Latin America 40 ETF (ILF), up 7.73%

- PGIM Jennison International Opportunities Fund (PWJQX) , up 5.23%

- BNY Mellon International Stock Fund (DISYX), up 4.51%

Losing

- Artisan International Small-Mid Fund (APHJX) , down -2.74%

- Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR), down -2.82%

- KraneShares Bosera MSCI China A ETF (KBA) , down -3.45%

- Lord Abbett Developing Growth Fund (LADVX), down -4.9%

Foreign Fixed Income Strategies

Emerging market bond strategies emerged as winners over the rolling month, reversing course from the last few weeks.

Winning

- Ashmore Emerging Markets Total Return Fund (EMKIX) , up 5.15%

- Fidelity Advisor® New Markets Income Fund (FNMIX), up 4.43%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC) , up 3.26%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 2.92%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX) , up 1.63%

- John Hancock Funds Emerging Markets Debt Fund (JEMIX), up 1.01%

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , up 0.4%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), up 0.14%

Alternatives

Among alternatives, Japanese hedged equity and gold strategies outperformed others while managed futures-based strategies lost ground, reversing a trend seen over the last few weeks.

Winning

- iShares Currency Hedged MSCI Japan ETF (HEWJ) , up 5.69%

- WisdomTree Japan Hedged Equity Fund (DXJ), up 5.04%

- Fidelity® Select Gold Portfolio (FSAGX) , up 4.98%

- Fidelity® SAI U.S. Low Volatility Index Fund (FSUVX), up 4.15%

Losing

- VanEck Vectors Agribusiness ETF (MOO) , down -2.39%

- American Beacon AHL Managed Futures Strategy Fund (AHLYX), down -3.75%

- PIMCO TRENDS Managed Futures Strategy Fund (PQTIX) , down -4.12%

- ETFMG Alternative Harvest ETF (MJ), down -13.78%

Sectors

Among the sectors, blockchain and gold strategies outperformed, while cannabis and clean energy strategies continued to struggle.

Winning

- Amplify Transformational Data Sharing ETF (BLOK) , up 13.91%

- iShares MSCI Global Gold Miners ETF (RING), up 10.16%

- Fidelity® Select Defense & Aerospace Portfolio (FSDAX) , up 9.45%

- Fidelity® Select Utilities Portfolio (FSUTX), up 8.53%

Losing

- Fidelity® Select Semiconductors Portfolio (FSELX) , down -4.48%

- Fidelity® Select Medical Technology and Devices Portfolio (FSMEX), down -5.91%

- First Trust NASDAQ® Clean Edge® Green Energy Index Fund (QCLN) , down -11.99%

- AdvisorShares Pure US Cannabis ETF (MSOS), down -23.97%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.