Stocks continued their surge this week—shortened due to Thanksgiving– as a potentially accommodative stance from the Federal Reserve helped lift growth stocks.

The latest FOMC meeting minutes showed that while policymakers would consider more rate hikes, the lag in data could limit the timing of those hikes. To that end, Chairman Jerome Powell showed that the Fed’s previous dot plot forecasting one more hike this year may not be accurate anymore. With that, investors locked in income in Treasuries and started buying stocks. Growth in artificial intelligence demand helped boost tech stocks as well. Adding fuel to the fire was the poor economic data. Durable goods orders slipped by 5.4% In October, erasing September’s 4% gain. The latest Michigan Consumer Sentiment Report slid to 61.3 in November, down from 63.8 in October, marking the fourth consecutive month of declines. However, a robust labor market, as evidenced by lower-than-predicted initial jobless claims, could signal that the Fed may achieve a soft landing after all.

Heading into the critical holiday spending season, investors will be treated to some pivotal data that could make or break the buying binge. First up is the CB Consumer Confidence report on Tuesday. Consumers still remain bullish given the robust labor market. However, high-interest rates and dwindling savings balances have caused the number to slip in recent readings. Analysts expect a slight dip to 102.1 for November. On Thursday, we’ll get to see the latest personal spending and income data, with the metrics expected to increase by 0.4% and 0.3%, respectively. Investors will also get inflation readings on Thursday, including the Fed’s preferred metric, the Core PCE Price Index, which increased by 0.3% in September. For October, analysts expect another 0.3% increase, which could signal that more rate hikes are on the table. That could derail a potential jump in consumer spending during the holiday season.

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

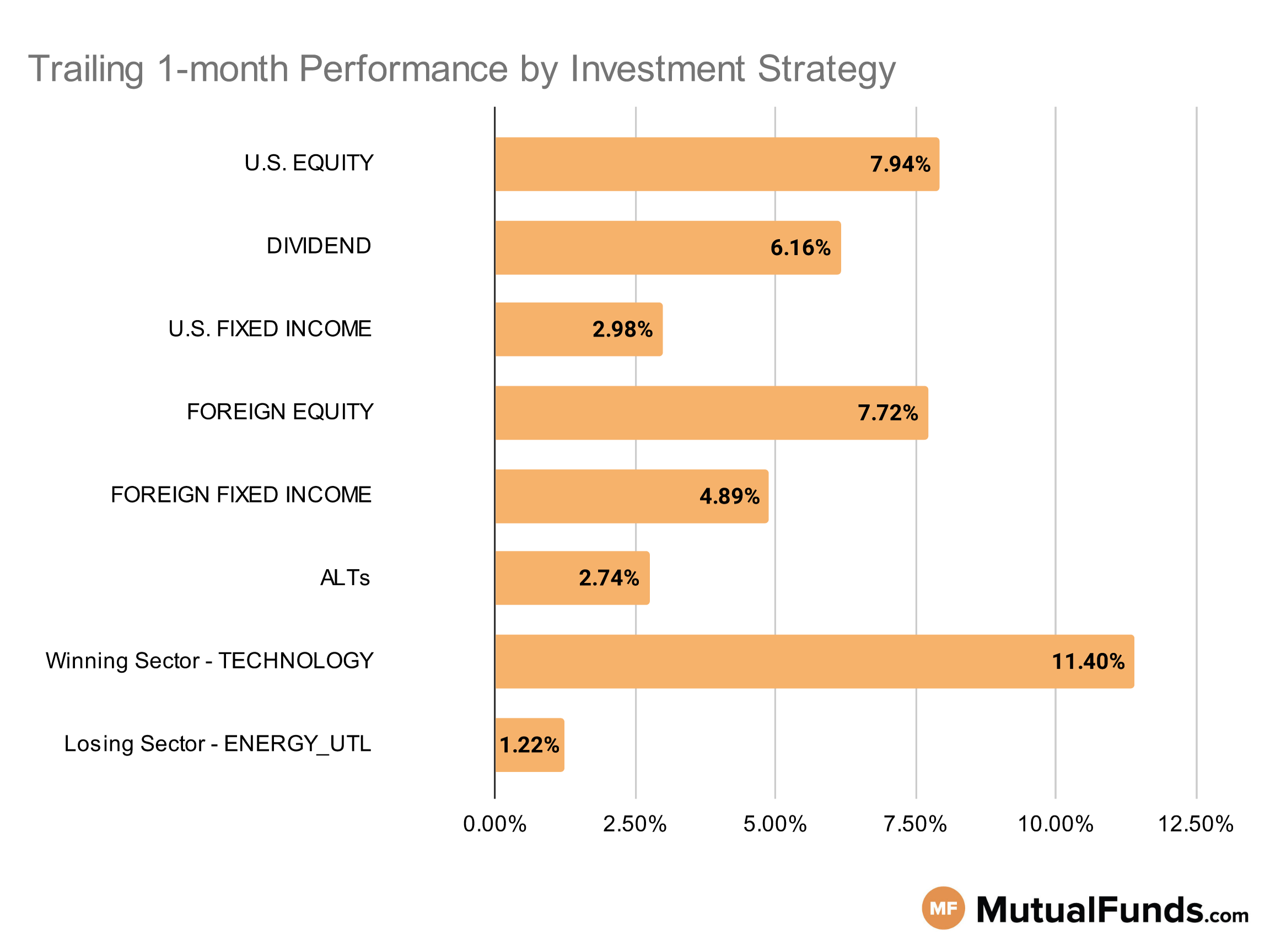

Overall, the U.S. stock markets continued their upward trajectory for the rolling month.

Strategies focused on technology, growth, and long duration bonds posted some of the best performances for the rolling month. Meanwhile, oil and other commodity-focused strategies struggled.

U.S Equity Strategies

Growth strategies continue to outperform their value counterparts over the trailing month.

Winning

- Touchstone Sands Capital Select Growth Fund (TSNCX) , up 15.39%

- Spyglass Growth Fund (SPYGX), up 13.45%

- Invesco Dynamic Large Cap Growth ETF (PWB), up 12.24%

- iShares Morningstar Growth ETF (ILCG), up 10.24%

- Schwab U.S. Large-Cap Value ETF™ (SCHV) , up 6.48%

- Pacer Trendpilot™ US Large Cap ETF (PTLC), up 6.32%

- Neuberger Berman Large Cap Value Fund (NPNRX) , up 3.11%

- Parnassus Core Equity Fund (PRBLX), up 2.6%

Dividend Strategies

Several small can mid-cap focussed dividend strategies continue to post strong performance for the rolling month.

Winning

- Invesco S&P Ultra Dividend Revenue ETF (RDIV) , up 11.22%

- Delaware Ivy Mid Cap Income Opportunities Fund (IVOYX), up 10.52%

- Ivy Mid Cap Income Opportunities Fund (IVOSX) , up 10.5%

- ProShares Russell 2000 Dividend Growers ETF (SMDV), up 8.51%

- WisdomTree U.S. High Dividend Fund (DHS) , up 3.41%

- Principal Global Diversified Income Fund (PGBAX), up 2.91%

- iShares Core High Dividend ETF (HDV) , up 2.74%

- First Eagle Global Income Builder Fund (FEBIX), up 2.59%

U.S. Fixed Income Strategies

In US fixed income, long duration strategies continued to outperform others.

Winning

- PIMCO StocksPLUS® Long Duration Fund (PSLDX) , up 15.96%

- PIMCO Extended Duration Fund (PEDPX), up 12.67%

- SPDR® Portfolio Long Term Corporate Bond ETF (SPLB) , up 8.38%

- iShares 10+ Year Investment Grade Corporate Bond ETF (IGLB), up 8.15%

Losing

- T. Rowe Price Dynamic Global Bond Fund (TRDZX) , down -1.65%

- iShares Floating Rate Bond ETF (FLOT), down -2.54%

- AlphaCentric Income Opportunities Fund (IOFCX) , down -2.82%

- ProShares Short 20+ Year Treasury (TBF), down -7.12%

Foreign Equity Strategies

Mexican equity, international growth, and Swedish equity strategies posted some of the strongest performances among foreign equities.

Winning

- iShares MSCI Mexico ETF (EWW) , up 16.74%

- Franklin International Growth Fund (FNGZX), up 14.47%

- Grandeur Peak International Stalwarts Fund (GISOX) , up 14.4%

- iShares MSCI Sweden ETF (EWD), up 13.49%

- DFA International Value Portfolio (DFIVX), up 4.53%

- Janus Henderson Overseas Fund (JAOSX), up 4.06%

- iShares India 50 ETF (INDY) , up 2.49%

Foreign Fixed Income Strategies

Emerging market bond strategies continue to post positive performance for the rolling month.

Winning

- John Hancock Funds Emerging Markets Debt Fund (JEMIX) , up 6.04%

- Ashmore Emerging Markets Total Return Fund (EMKIX), up 5.93%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) , up 5.64%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), up 5.61%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), up 4.7%

- DFA World ex U.S. Government Fixed Income Portfolio (DWFIX), up 3.61%

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , up 3.6%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), up 2.19%

Alternatives

Among alternatives, hedged Eurozone, hedged Japan, and contrarian strategies posted strong performances.

Winning

- iShares Currency Hedged MSCI Eurozone ETF (HEZU) , up 8.89%

- Columbia Contrarian Core Fund (SMGIX), up 8.65%

- iShares Currency Hedged MSCI Japan ETF (HEWJ) , up 8.34%

- Janus Henderson Contrarian Fund (JCNCX), up 8%

Losing

- iShares GSCI Commodity Dynamic Roll Strategy ETF (COMT), down -4.66%

- AlphaSimplex Managed Futures Strategy Fund (AMFAX), down -5.13%

- iShares S&P GSCI Commodity-Indexed Trust (GSG) , down -5.2%

- PIMCO TRENDS Managed Futures Strategy Fund (PQTIX), down -5.57%

Sectors

Among the sectors, technology continued to outperform others, while oil strategies struggled.

Winning

- American Beacon ARK Transformational Innovation Fund (ADNYX) , up 22.29%

- ARK Next Generation Internet ETF (ARKW), up 21.47%

- ProShares Ultra Financials (UYG) , up 20.61%

- Putnam Global Technology Fund (PGTYX), up 13.48%

Losing

- Vanguard Energy Index Fund (VENAX) , down -4.73%

- Fidelity® Select Energy Portfolio (FSENX), down -5.04%

- Invesco DB Oil Fund (DBO) , down -9.1%

- United States Oil Fund, LP (USO), down -9.23%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.