Despite the New Year’s holiday on Monday, the shortened trading week was still busy and started 2024 on a downtrend as investors took profits after 2023’s rally.

Investors had hoped the Fed would provide a more concrete timeline for rate cuts in its latest FOMC meeting minutes. However, the central bank continued to tow the line, suggesting three cuts in 2024 and reiterating that while growth is slowing, the economy was still on a good footing. With no news of near-term rate cuts, investors sold stocks. Additionally, healthy labor market data via a strong JOLTS Report and non-farm payroll figures contributed to the market selloff. Meanwhile, declines in both the services and manufacturing PMI reports painted a gray economic picture. With those economic worries, investors sold high-growth names and booked profits starting early in the new year.

For the first full trading week of the new year, investors are expected to dive into inflation and labor market data. Inflation data will be released on Thursday, with the latest CPI Report expected to dip to just 3.0% year-over-year in December, down from 3.1% in November. Investors will be keen to see the data considering the Fed’s recent pauses and potential to cut rates in the new year. However, producer inflation is expected to see a slight increase on Friday, with the PPI for December likely to rise marginally by 0.1%. Elsewhere, on Thursday investors will also be focused on the labor market with the weekly jobless claims data for the week ending January 6. Recent figures have pointed to a still-bullish labor market and are expected to stay near recent levels for new claims. With the year just starting, other data will be light.

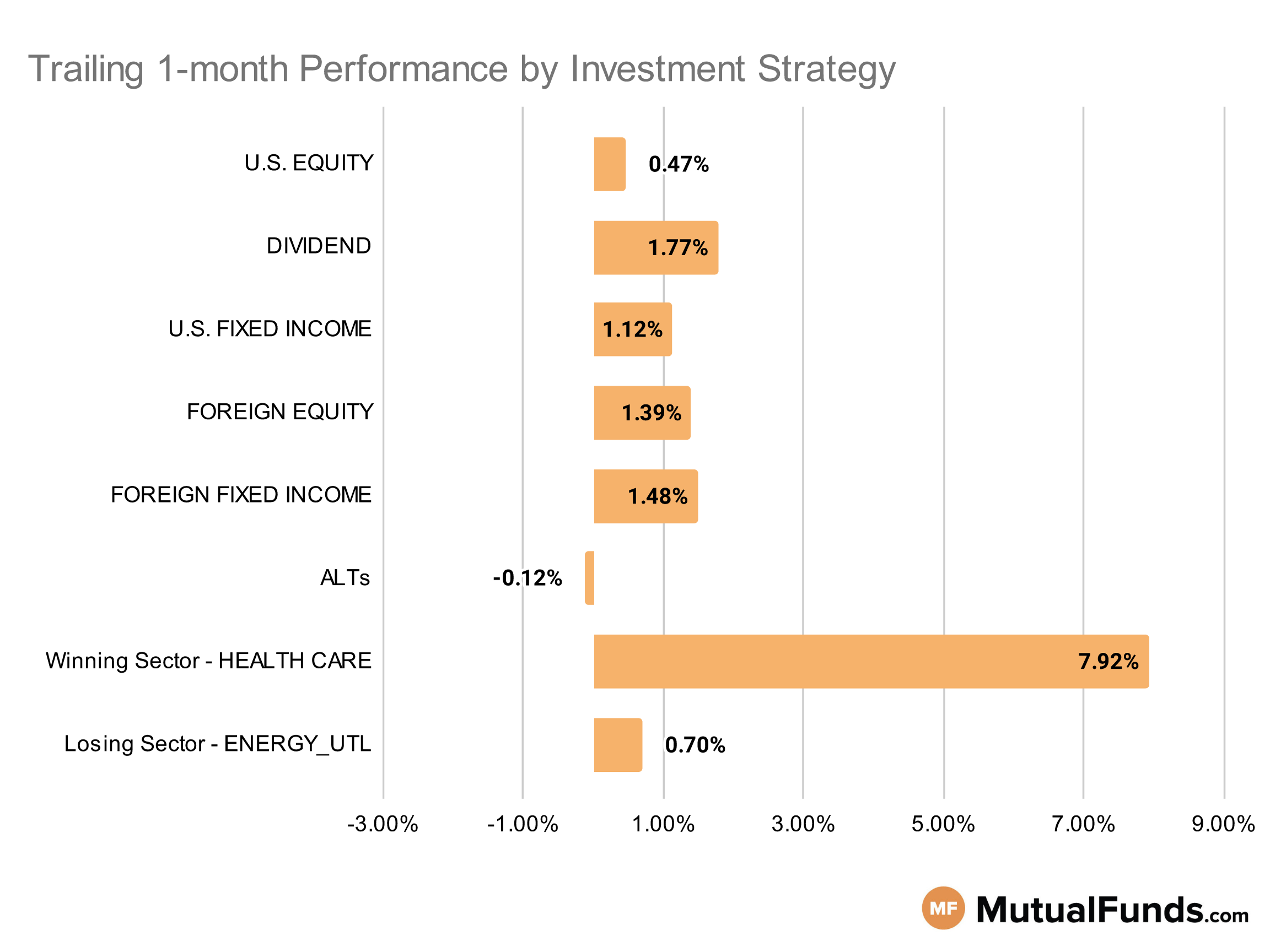

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets continued their upward trajectory for the rolling month.

Growth focused strategies, especially biotechnology, continue to post some of the strongest performances over the rolling month. Meanwhile, tactical/concentrated and commodity strategies continued to struggle.

U.S Equity Strategies

Several small-cap growth strategies continue to outperform their larger counterparts over the trailing month.

Winning

- Wasatch Ultra Growth Fund (WAMCX) , up 7.38%

- Meridian Small Cap Growth Fund (MSGGX), up 6.92%

- iShares Micro-Cap ETF (IWC) , up 6.59%

- iShares S&P Small-Cap 600 Value ETF (IJS), up 5.89%

- iShares Core S&P U.S. Growth ETF (IUSG) , up 0.49%

- First Trust US Equity Opportunities ETF (FPX), up 0.2%

Losing

- Mercer US Large Cap Equity Fund (MLCGX) , down -33.86%

- Lazard US Equity Concentrated Portfolio (LEVOX), down -42.47%

Dividend Strategies

Several dividend strategies, including buyback and large cap, continue to post strong performances over the rolling month.

Winning

- Invesco S&P Ultra Dividend Revenue ETF (RDIV) , up 6.08%

- Invesco BuyBack Achievers ETF (PKW), up 5.57%

- VALIC Company I Dividend Value Fund (VCIGX) , up 4.06%

- Pioneer Equity Income Fund (PEQIX), up 3.99%

- SPDR® S&P International Dividend ETF (DWX) , up 2.34%

- FlexShares Quality Dividend Index Fund (QDF), up 1.99%

Losing

- Sterling Capital Equity Income Fund (BEGIX) , down -4.44%

- Cullen High Dividend Equity Fund (CHDEX), down -4.79%

U.S. Fixed Income Strategies

In US fixed income, long-duration bond-focused strategies continued to post solid performances over the rolling month.

Winning

- Delaware Tax Free USA Fund (DTFIX) , up 3.78%

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), up 3.67%

- iShares 10-20 Year Treasury Bond ETF (TLH) , up 2.91%

- SPDR® Portfolio Long Term Treasury ETF (SPTL), up 2.88%

Losing

- iShares Core International Aggregate Bond ETF (IAGG) , down -2.14%

- Mercer Opportunistic Fixed Income Fund (MOFIX), down -3.92%

- Calamos Market Neutral Income (CVSIX) , down -3.95%

- ProShares Short 20+ Year Treasury (TBF), down -4.26%

Foreign Equity Strategies

Among foreign equities, Saudi Arabian and Australian strategies outperformed Chinese and Taiwanese counterparts for the rolling month.

Winning

- iShares MSCI Saudi Arabia ETF (KSA) , up 7.94%

- iShares MSCI Australia ETF (EWA), up 6.62%

- Brown Capital Management International Small Company Fund (BCSVX) , up 6.52%

- Grandeur Peak International Opportunities Fund (GPIIX), up 5.18%

Losing

- Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) , down -4.24%

- iShares MSCI Taiwan ETF (EWT), down -8.05%

- Invesco Oppenheimer International Growth Fund (OIGIX) , down -8.4%

- MFS International Intrinsic Value Fund (MGIAX), down -8.51%

Foreign Fixed Income Strategies

International treasury strategies continued to post some of the best performances in the foreign fixed income space.

Winning

- iShares International Treasury Bond ETF (IGOV) , up 2.66%

- PIMCO International Bond Fund Unhedged (PFUNX), up 2.54%

- T. Rowe Price International Bond Fund (PAIBX) , up 2.3%

- VanEck Emerging Markets High Yield Bond ETF (HYEM), up 2.03%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC) , up 1.09%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 0.8%

Losing

- Invesco International Bond Fund (OIBIX) , down -0.45%

- DFA World ex U.S. Government Fixed Income Portfolio (DWFIX), down -0.59%

Alternatives

Among alternatives, preferred stock and low volatility strategies posted strong results over the rolling month, while managed futures and commodities continued to struggle.

Winning

- Virtus InfraCap U.S. Preferred Stock ETF (PFFA) , up 4.1%

- VictoryShares US 500 Volatility Wtd ETF (CFA), up 3.43%

- Columbia Convertible Securities Fund (COVRX) , up 2.96%

- AB All Market Real Return Portfolio (AMTYX), up 2.74%

Losing

- Invesco DB Agriculture Fund (DBA) , down -5.86%

- Invesco DB Commodity Index Tracking Fund (DBC), down -6.02%

- BlackRock Tactical Opportunities Fund (PCBAX) , down -6.92%

- AQR Managed Futures Strategy Fund (AQMIX), down -8.84%

Sectors

Among the sectors healthcare strategies, especially those focused on biotechnology, continue to post strong results, while strategies focused on concentrated bets and oil remained in red.

Winning

- Fidelity Advisor® Biotechnology Fund (FBTAX) , up 16.67%

- Franklin Biotechnology Discovery Fund (FTDZX), up 14.5%

- SPDR® S&P Biotech ETF (XBI) , up 13.52%

- iShares Nasdaq Biotechnology ETF (IBB), up 11.08%

Losing

- Global X Uranium ETF (URA) , down -5.42%

- Invesco DB Oil Fund (DBO), down -5.52%

- MassMutual Blue Chip Growth Fund (MBCZX) , down -17.41%

- MassMutual Select Blue Chip Growth Fund (MBGFX), down -20.17%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.