Stocks hit new record highs last week as strong economic data helped markets overcome worries about the Federal Reserve’s interest rate decision next week.

The technology sector’s so-called ‘Magnificent Seven’ surged as investors made bullish bets on the state of the U.S. economy, showing confidence in its ability to avoid a recession. The IPO of BrightSpring did have a rocky start in its first day of trading, however. In terms of economic data, durable goods orders were flat for December, below the market expectation for a slight gain. However, U.S. GDP grew by an annual pace of 3.3% in the fourth quarter, outpacing market estimates of 2.4%. While slower than the third quarter growth rate, the latest GDP number showed that the U.S. economy is humming right along. Personal spending and income data was also bullish, showing that consumers still have plenty of firepower to drive the economy.

Next week, investors are expected to keep an eye on the Federal Reserve’s interest rate decision.The central bank has continued to hold rates at a steady 5.5% for several meetings. However, it has indicated 0.75% worth of total potential cuts by the end of this year. The question is whether key economic data, including inflation, has fallen enough to warrant a rate cut today. The CME FedWatch tool currently implies that the Fed will continue to hold rates steady for now. Economic data next week may influence the direction of interest rates going forward, though. On Tuesday, the JOLTS Report is predicted to slightly decline to 8.69 million jobs for December (vs. 8.79 million jobs reported in November), still reflecting a bullish labor market. Later on Thursday, the ISM Manufacturing PMI for January is expected to marginally increase to 47.6, continuing its rise and showing an expansionary phase of manufacturing activity in the U.S. Finally on Friday, non-farm payrolls data for January is expected to show that the U.S. economy added nearly 175,000 jobs, less than the 216,000 jobs added in December. The U.S. unemployment rate for January is expected to remain unchanged from last month and hover around 3.7%.

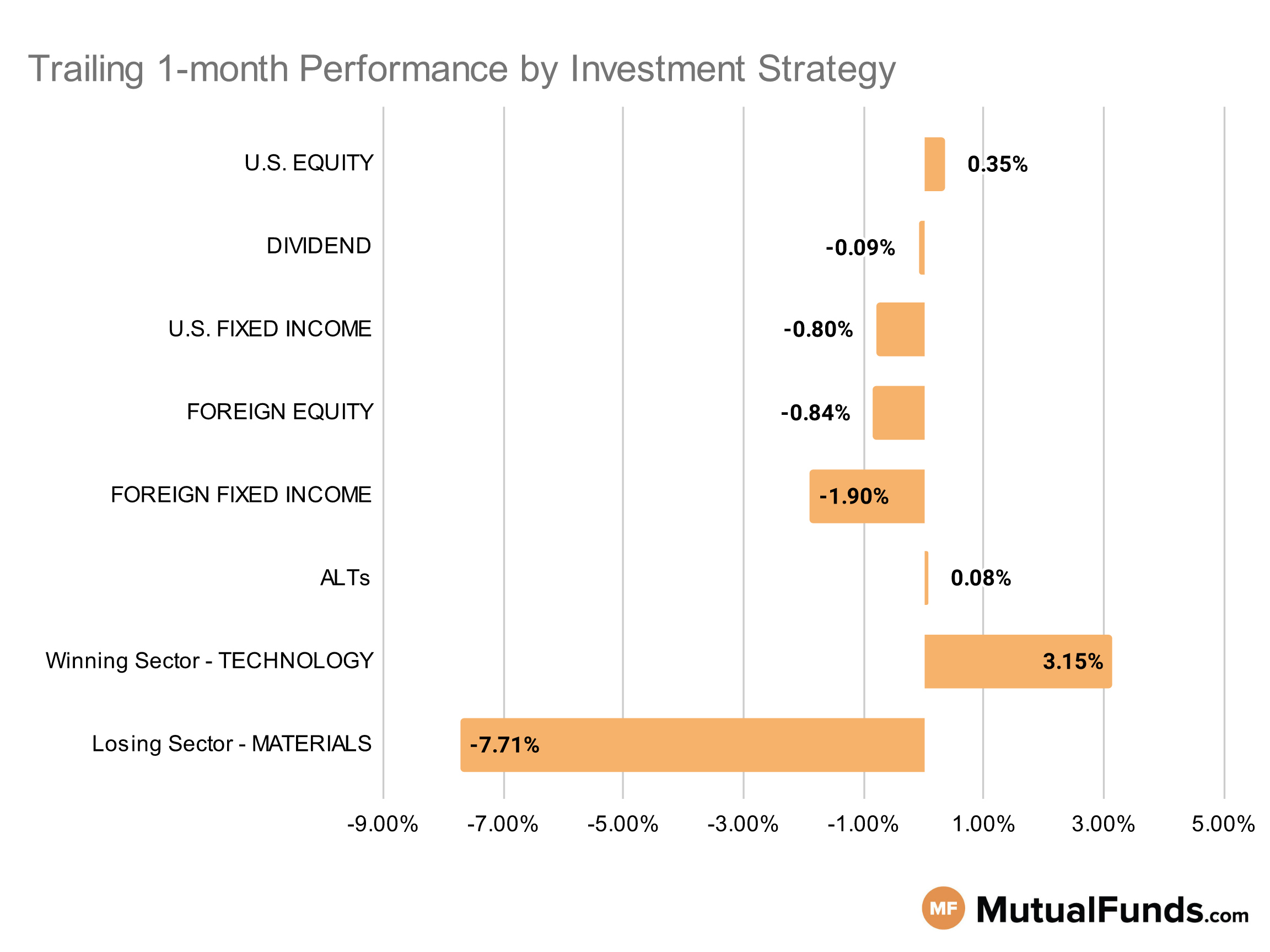

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets were marginally up for the rolling month.

Growth focused strategies, especially cannabis and semiconductors, along with Japanese equity posted some of the strongest performances over the rolling month. Meanwhile, palladium, gold and long duration bond strategies struggled.

U.S Equity Strategies

Large-cap growth strategies continue to post positive results after a long time, while small-cap strategies struggled over the rolling month,

Winning

- Lord Abbett Growth Leaders Fund (LGLIX), up 7.04%

- Alger Focus Equity Fund (ALZFX), up 6.47%

- Invesco Dynamic Large Cap Growth ETF (PWB), up 5.51%

- iShares Core S&P U.S. Growth ETF (IUSG), up 4.27%

Losing

- iShares Russell 2000 Value ETF (IWN), down -4.2%

- Invesco S&P SmallCap 600 Revenue ETF (RWJ), down -4.29%

- Westwood SmallCap Fund (WWSYX), down -5.1%

- Morgan Stanley Institutional Fund, Inc. Growth Portfolio (MSEGX), down -5.19%

Dividend Strategies

Several quality-focused dividend strategies continued to post positive performances over the rolling month, while small-cap and high-yield strategies struggled.

Winning

- O’Shares U.S. Quality Dividend ETF (OUSA), up 2.86%

- BNY Mellon Equity Income Fund (DQIRX), up 2.81%

- HCM Dividend Sector Plus Fund (HCMNX), up 2.35%

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW), up 2.35%

Losing

- Fidelity® Equity Dividend Income Fund (FEQTX), down -2.83%

- Fidelity® Strategic Dividend & Income® Fund (FSDIX), down -3.59%

- Invesco High Yield Equity Dividend Achievers™ ETF (PEY), down -4.13%

- ProShares Russell 2000 Dividend Growers ETF (SMDV), down -4.41%

U.S. Fixed Income Strategies

In US fixed income, long-duration bond-focused strategies dipped while some high-yield and hedged long-duration strategies posted positive returns for the rolling month.

Winning

- ProShares Short 20+ Year Treasury (TBF), up 6.28%

- iShares Interest Rate Hedged Long-Term Corporate Bond ETF (IGBH), up 2.12%

- Thompson Bond Fund (THOPX), up 1.73%

- American Beacon SiM High Yld Opps Fund (SHOYX), up 1.12%

Losing

- SPDR® Portfolio Long Term Treasury ETF (SPTL), down -4.57%

- iShares 20+ Year Treasury Bond ETF (TLT), down -5.21%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), down -7.82%

- PIMCO Extended Duration Fund (PEDPX), down -7.99%

Foreign Equity Strategies

Among foreign equities, Japanese strategies outperformed South Korean and Swedish counterparts for the rolling month.

Winning

- Fidelity® SAI Japan Stock Index Fund (FSJPX), up 4.99%

- Matthews Japan Fund (MJFOX), up 4.91%

- iShares MSCI Japan ETF (EWJ), up 4.48%

- JPMorgan BetaBuilders Japan ETF (BBJP), up 4.38%

Losing

- Baillie Gifford Emerging Markets Equities Fund (BGELX), down -4.59%

- MFS International Diversification Fund (MDIZX), down -4.98%

- iShares MSCI Sweden ETF (EWD), down -6.04%

- iShares MSCI South Korea ETF (EWY), down -7.58%

Foreign Fixed Income Strategies

Emerging market debt strategies were the only ones to post slightly positive performances in the foreign fixed-income space.

Winning

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), up 0.53%

- VanEck Emerging Markets High Yield Bond ETF (HYEM), up 0.32%

Losing

- Invesco International Bond Fund (OIBIX), down -0.9%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND), down -1.66%

- T. Rowe Price International Bond Fund (PAIBX), down -2.9%

- PIMCO International Bond Fund Unhedged (PFUNX), down -2.96%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), down -3.33%

- iShares International Treasury Bond ETF (IGOV), down -3.94%

Alternatives

Among alternatives, hedged Japanese equity and tactical strategies posted strong results over the rolling month, while gold and natural resource-focused strategies struggled.

Winning

- ETFMG Alternative Harvest ETF (MJ), up 13.97%

- WisdomTree Japan Hedged Equity Fund (DXJ), up 8.5%

- Fidelity® Contrafund® Fund (FCNKX), up 5.47%

- BlackRock Tactical Opportunities Fund (PCBAX), up 3.74%

Losing

- SPDR® S&P Global Natural Resources ETF (GNR), down -6.56%

- FlexShares Morningstar Global Upstream Natural Resources Index Fund (GUNR), down -6.63%

- Swan Defined Risk Fund (SDRIX), down -10.61%

- Fidelity® Select Gold Portfolio (FSAGX), down -11%

Sectors

Among the sectors cannabis and semiconductor strategies posted strong results, while strategies focused on palladium and precious metals were in red.

Winning

- AdvisorShares Pure US Cannabis ETF (MSOS), up 38.1%

- VanEck Vectors Semiconductor ETF (SMH), up 11.02%

- Fidelity® Select Semiconductors Portfolio (FSELX), up 9.71%

- Fidelity Advisor® Semiconductors Fund (FIKGX), up 9.37%

Losing

- Invesco Gold & Special Minerals Fund (OPGSX), down -10.81%

- American Beacon ARK Transformational Innovation Fund (ADNYX), down -12.47%

- Invesco WilderHill Clean Energy ETF (PBW), down -19.19%

- Aberdeen Standard Physical Palladium Shares ETF (PALL), down -19.6%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.