Stocks remained volatile this week as the shortened trading week was driven by a mix of economic data and market-moving events.

Former President Trump’s Truth Media had an initial public offering (IPO) via a special purpose acquisition company (SPAC), surging more than 16% on its opening day. This gave credence to the idea that risk assets were back. Also surging this week was Krispy Kreme after it announced a key new partnership with McDonald’s. In February, month-over-month durable goods orders clocked in 1.4%, beating estimates of a 0.7% gain. The number was bullish, yet not so bullish that investors were positive on the Federal Reserve’s prospects to begin cutting interest rates soon. Personal spending and income data also pointed to a strong consumer economy. Meanwhile, the latest quarter-over-quarter GDP growth report painted a picture of a still-growing economy, albeit one that is slowing. Investors cheered the idea that the central bank may finally have inflation under wraps and will begin cutting rates sooner than later. Overall, stocks had a magnificent first quarter.

After the Easter Break, the first trading week of April will be light on economic data. Starting things off will be the latest Job Openings and Labor Turnover Survey (JOLTS) Report. The number of available jobs continues to be high, showing a bullish labor market trend. Analysts expect the trend to continue as seasonal hiring begins. Also being reported will be the official unemployment rate and non-farm payroll figures. The unemployment rate slightly increased to 3.9% last month, while the economy added 275,000 jobs. Analysts expect the unemployment rate to remain at a similar level in March. Factory orders are expected to rebound in February, growing by 1% after declining 3.6% in January. Also set for an expected rebound will be the Manufacturing PMI. While still showing contraction, the survey is estimated to increase to 48.3 in March, up from 47.8 reported in February. Service economy data will also be released, with the Services PMI expected to stay bullish at around 52.

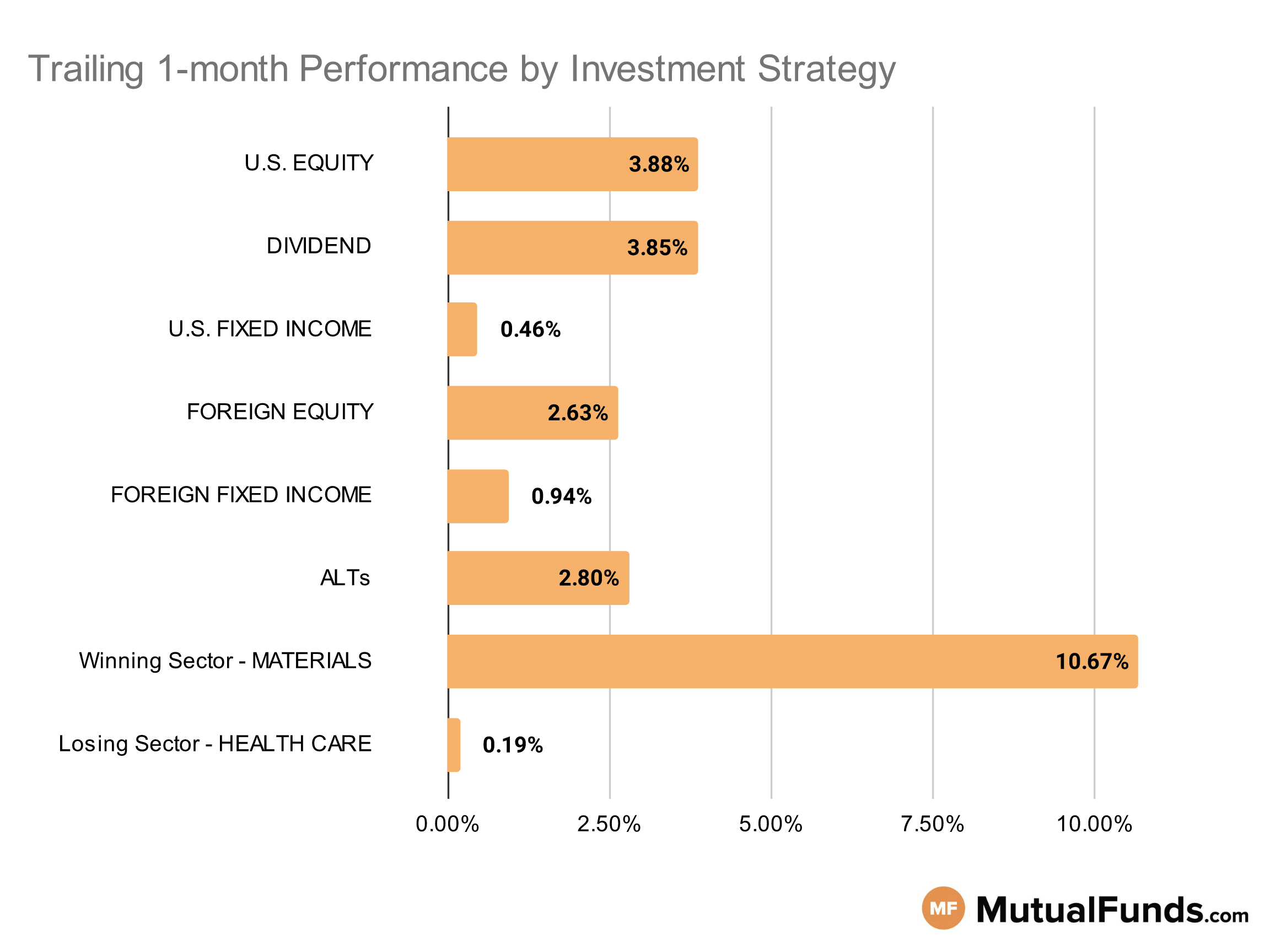

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets maintained their positive momentum for the rolling month.

Precious metal strategies, especially silver and gold, continued to post solid performances for the rolling month. Meanwhile, some growth strategies, especially those focused on healthcare struggled.

U.S Equity Strategies

Among U.S. equities, small and mid-cap growth strategies continued to post solid performance over the rolling month.

Winning

- Invesco Small Cap Value Fund (VSMIX), up 9.54%

- ClearBridge All Cap Value Fund (SFVCX), up 8.44%

- SPDR® S&P 400 Mid Cap Growth ETF (MDYG), up 7.15%

- iShares S&P Mid-Cap 400 Growth ETF (IJK), up 7.08%

- Fidelity® Nasdaq Composite Index® ETF (ONEQ), up 2.4%

- Invesco Dynamic Large Cap Growth ETF (PWB), up 2.25%

Losing

- Brown Capital Management Small Company Fund (BCSIX), down -2.23%

- VALIC Company I Stock Index Fund (VSTIX), down -3.3%

Dividend Strategies

Several dividend growth-focused strategies continued to post positive performances over the rolling month.

Winning

- First Trust Rising Dividend Achievers ETF (RDVY), up 6.62%

- Fidelity® Dividend Growth Fund (FDGFX), up 6.36%

- Fidelity Advisor® Dividend Growth Fund (FDGTX), up 6.32%

- WisdomTree U.S. MidCap Dividend Fund (DON), up 6.13%

- O’Shares U.S. Quality Dividend ETF (OUSA), up 1.84%

- SPDR® S&P International Dividend ETF (DWX), up 1.73%

Losing

- Vanguard Dividend Growth Fund (VDIGX), down -0.13%

- VALIC Company I Dividend Value Fund (VCIGX), down -2.22%

U.S. Fixed Income Strategies

In US fixed income, convertible and longer-duration bond strategies continued to outperform others.

Winning

- iShares Convertible Bond ETF (ICVT), up 3.22%

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), up 2.28%

- Federated Hermes Municipal and Stock Advantage Fund (FMUAX), up 1.92%

- Invesco CEF Income Composite ETF (PCEF), up 1.73%

Losing

- SPDR® Nuveen Bloomberg Barclays Short Term Municipal Bond ETF (SHM), down -0.44%

- City National Rochdale Fixed Income Opportunities Fund (RIMOX), down -0.86%

- ProShares Short 20+ Year Treasury (TBF), down -1.49%

- VALIC Company I Core Bond Fund (VCBDX), down -2.34%

Foreign Equity Strategies

Among foreign equities, European equity strategies posted solid performance, with Indian and Brazilian equities struggling on the other end.

Winning

- JPMorgan Europe Dynamic Fund (JFESX), up 6.84%

- iShares MSCI Italy ETF (EWI), up 6.48%

- Horizon Kinetics Inflation Beneficiaries ETF (INFL), up 6.18%

- John Hancock Disciplined Value International Fund (JDISX), up 6.02%

Losing

- Grandeur Peak International Opportunities Fund (GPIIX), down -1.45%

- Virtus Vontobel Emerging Markets Opportunities Fund (VREMX), down -1.73%

- iShares MSCI Brazil ETF (EWZ), down -2.34%

- WisdomTree India Earnings Fund (EPI), down -2.44%

Foreign Fixed Income Strategies

Emerging market debt strategies continue to lead the pack, among foreign fixed income strategies/

Winning

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 2.48%

- Vanguard Emerging Markets Bond Fund (VEMBX), up 1.92%

- TCW Emerging Markets Income Fund (TGEIX), up 1.87%

- VanEck Emerging Markets High Yield Bond ETF (HYEM), up 1.01%

Losing

- Templeton Global Bond Fund (TGBAX), down -0.27%

- Eaton Vance Emerging Markets Local Income Fund (EEIIX), down -0.29%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND), down -0.58%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), down -0.97%

Alternatives

Among alternatives, gold and commodity strategies posted strong results over the rolling month, while market-neutral strategies struggled..

Winning

- ETFMG Alternative Harvest ETF (MJ), up 24.28%

- Fidelity® Select Gold Portfolio (FSAGX), up 16.77%

- Invesco DB Agriculture Fund (DBA), up 10.23%

- BlackRock Commodity Strategies Portfolio (BCSAX), up 6.69%

- IQ Merger Arbitrage ETF (MNA), up 0.45%

Losing

- iShares MSCI Emerging Markets Min Vol Factor ETF (EEMV), down -0.25%

- Loomis Sayles Strategic Alpha Fund (LASNX), down -0.53%

- Victory Market Neutral Income Fund (CBHAX), down -0.6%

Sectors

Among the sectors precious metal strategies continued to post strong results, while some healthcare sector strategies suffered.

Winning

- ETFMG Prime Junior Silver Miners ETF (SILJ), up 20.52%

- iShares MSCI Global Gold Miners ETF (RING), up 19.44%

- Franklin Gold and Precious Metals Fund (FGPMX), up 18.4%

- Sprott Gold Equity Fund (SGDLX), up 17.92%

Losing

- SPDR® S&P Biotech ETF (XBI), down -2.5%

- Vanguard Health Care Fund (VGHAX), down -2.82%

- Invesco DWA Healthcare Momentum ETF (PTH), down -2.84%

- VALIC Company I Blue Chip Growth Fund (VCBCX), down -8.15%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.