Stocks trended lower this week as stubbornly high inflation continued to impact expectations of interest rate cuts.

The Consumer Price Index (CPI) increased 0.4% month-over-month in March, the same as in February, and above market expectations for a 0.3% rise. This rattled investors, with the FedWatch tool now showing the timing of rate cuts will most likely be delayed. The Federal Reserve echoed a similar idea via the latest Federal Open Market Committee (FOMC) meeting minutes, highlighting that several governors are now worried that inflation has remained too high for an extended period. Several central bank governors expressed the view that rate cuts may not be possible until the end of the year, keeping stocks volatile throughout the week.

After last week’s surprise inflation numbers, investors will see relatively light economic data heading into next week. Arguably the most important release will be month-over-month retail sales, which are expected to increase 0.4% in March, following a 0.6% rise in February. Housing data will also be on deck, with bullish expectations for both building permits and housing starts numbers after they surged higher last month despite elevated mortgage rates. Amidst a strong labor market, investors will also keep an eye on the latest weekly jobless claims numbers. The overall bullish momentum could continue to throw the Federal Reserve for a loop, delaying rate cuts. In turn, expectations of higher-for-longer interest rates could put pressure on the markets in the weeks ahead.

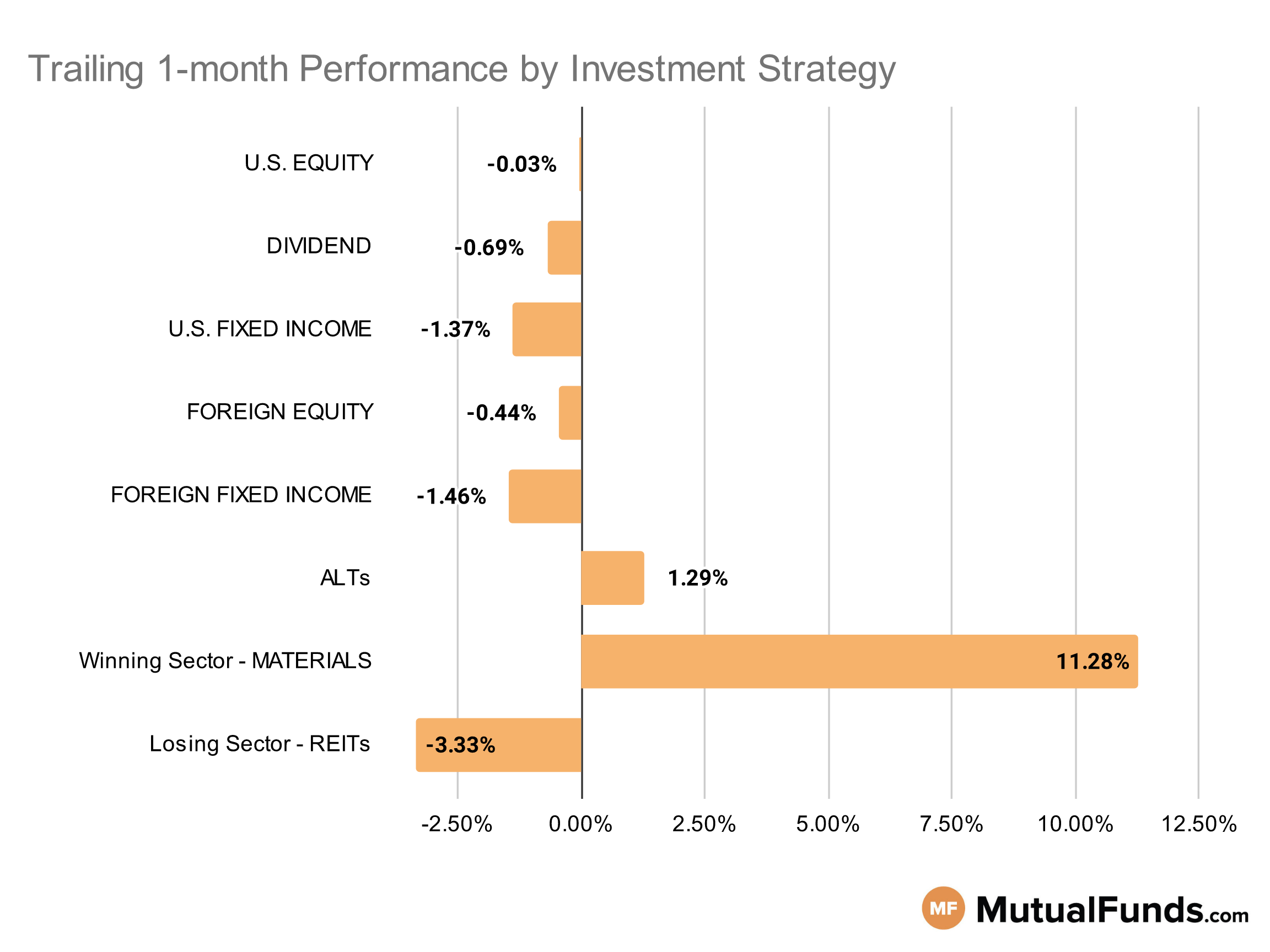

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, some of the major U.S. stock indices marginally declined for the rolling month.

Cannabis and precious metal strategies, especially silver and gold, continued to post solid performances for the rolling month. Meanwhile, long duration bonds and some healthcare strategies struggled.

U.S Equity Strategies

Among U.S. equities, several value strategies continued to outperform their growth counterparts over the rolling month.

Winning

- Invesco Small Cap Value Fund (VSMIX), up 4.18%

- Columbia Select Large Cap Value Fund (CSVZX), up 2.74%

- iShares Core S&P U.S. Growth ETF (IUSG), up 1.19%

- Schwab U.S. Large-Cap Growth ETF™ (SCHG), up 1.09%

Losing

- SPDR® S&P 600 Small Cap Value ETF (SLYV), down -2.11%

- iShares Russell 2000 Growth ETF (IWO), down -2.12%

- Independent Franchise Part Equity Fund (IFPUX), down -3.89%

- Virtus KAR Small-Cap Growth Fund (PXSGX), down -4.16%

Dividend Strategies

Several dividend growth-focused strategies continued to post positive performances over the rolling month.

Winning

- Fidelity Advisor® Dividend Growth Fund (FDGTX), up 2.41%

- Fidelity® Dividend Growth Fund (FDGFX), up 2.32%

- Invesco BuyBack Achievers ETF (PKW), up 0.74%

- First Trust Rising Dividend Achievers ETF (RDVY), up 0.44%

Losing

- ProShares Russell 2000 Dividend Growers ETF (SMDV), down -2.41%

- Matthews Asia Dividend Fund (MIPIX), down -2.69%

- SPDR® S&P International Dividend ETF (DWX), down -3.43%

- Vanguard Dividend Growth Fund (VDIGX), down -4.05%

U.S. Fixed Income Strategies

In US fixed income, investment-grade, and global bond strategies continued to post positive results, while several longer duration bond strategies continued to be in the red.

Winning

- ProShares Short 20+ Year Treasury (TBF), up 5.26%

- ProShares Investment Grade—Interest Rate Hedged (IGHG), up 1.05%

- T. Rowe Price Dynamic Global Bond Fund (TRDZX), up 0.91%

- DFA Five Year Global Fixed Income Portfolio (DFGBX), up 0.5%

Losing

- PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (LTPZ), down -4.94%

- iShares 20+ Year Treasury Bond ETF (TLT), down -5.34%

- PIMCO Extended Duration Fund (PEDPX), down -7.17%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), down -7.83%

Foreign Equity Strategies

Among foreign equities, Mexican and some emerging market strategies posted solid performances, while Swiss and Swedish strategies struggled.

Winning

- iShares MSCI Mexico ETF (EWW), up 4.79%

- Fidelity Advisor® Focused Emerging Markets Fund (FAMKX), up 3.17%

- T. Rowe Price Emerging Markets Discovery Stock Fund (PAIJX), up 2.86%

- EMQQ The Emerging Markets Internet & Ecommerce ETF (EMQQ), up 1.85%

Losing

- BNY Mellon International Stock Fund (DISYX), down -4.09%

- iShares MSCI Sweden ETF (EWD), down -4.33%

- Morgan Stanley Institutional Fund, Inc. Global Franchise Portfolio (MSGFX), down -4.63%

- iShares MSCI Switzerland ETF (EWL), down -4.95%

Foreign Fixed Income Strategies

Handul of emerging market debt strategies posted positive results over the rolling month.

Winning

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), up 1.42%

- Fidelity Advisor® New Markets Income Fund (FNMIX), up 0.24%

Losing

- VanEck Emerging Markets High Yield Bond ETF (HYEM), down -0.74%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), down -0.84%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), down -3.1%

- T. Rowe Price International Bond Fund (PAIBX), down -3.11%

- iShares International Treasury Bond ETF (IGOV), down -3.13%

- Templeton Global Bond Fund (TGBAX), down -4.43%

Alternatives

Among alternatives, cannabis, and gold strategies posted strong results over the rolling month, while mortgage strategies struggled.

Winning

- ETFMG Alternative Harvest ETF (MJ), up 28.94%

- Fidelity® Select Gold Portfolio (FSAGX), up 13.42%

- Invesco DB Agriculture Fund (DBA), up 9.57%

- BlackRock Commodity Strategies Portfolio (BCSAX), up 7.42%

Losing

- Fidelity Advisor® Mortgage Securities Fund (FIKUX), down -2.67%

- Columbia Mortgage Opportunities Fund (CLMAX), down -3.35%

- Invesco Preferred ETF (PGX), down -3.5%

- SPDR® DoubleLine Total Return Tactical ETF (TOTL), down -3.83%

Sectors

Among the sectors, cannabis and precious metal strategies continued to post strong results, while some healthcare strategies continued to struggle.

Winning

- AdvisorShares Pure US Cannabis ETF (MSOS), up 29.78%

- Global X Silver Miners ETF (SIL), up 24.96%

- Franklin Gold and Precious Metals Fund (FGPMX), up 15.48%

- Invesco Gold & Special Minerals Fund (OPGSX), up 14.1%

Losing

- TIAA-CREF Real Estate Securities Fund (TRRSX), down -5.94%

- Vanguard Health Care Fund (VGHAX), down -6.17%

- ARK Genomic Revolution ETF (ARKG), down -7.57%

- Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (SRVR), down -8.72%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.