Be sure to also read about the 7 Questions to Ask When Buying a Mutual Fund.

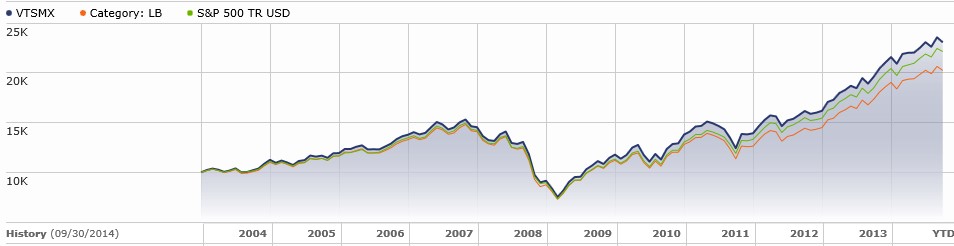

1. Vanguard Total Stock Market ( VTSMX, VTSAX, VITSX, VTI)

Strategy: The Vanguard Total Stock Market is a passive index fund that tracks the CRSP US Total Market Index. This index represents approximately 100% of investable companies in the domestic equity market and includes exposure to small-, mid- and large-cap U.S. stocks. Ultimately, the fund can be used as a core position to provide broad stock exposure. That fact has helped it amass a monstrous $400 billion-plus in assets from investors of all walks.

Performance: As a broad index fund that tracks the market, the Vanguard Total Stock Market has done a pretty good job of tracking the market. VTSMX has returned 8.67% annually over the last 10 years.

Learn more about whether Mutual Fund Benchmarks Matter.

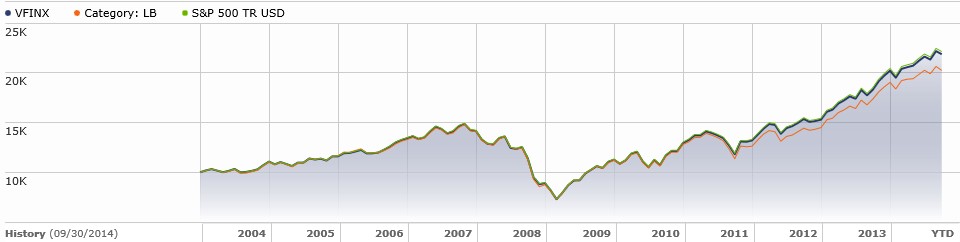

2. Vanguard 500 Index Fund (VFIAX, VFINX, VINIX, VOO)

Strategy: Like the number one selection on this list, fellow Vanguard fund—the 500 Index Fund—is a passively managed mutual fund designed to track an index. In this case, we’re talking about the venerable S&P 500. The U.S. large-cap index is widely recognized as a benchmark of stock market performance. The fund is designed to be a core position for investors wanting exposure to these large-cap stocks.

Performance: Given the mutual fund’s full-replication strategy and size, the Vanguard 500 has done an amazing job of tracking the S&P since its inception – minus its minimal expenses. The fund has managed to produce a 7.89% return over the last 10 years.

Be sure to see the Complete Guide to Mutual Fund Expenses.

3. PIMCO Total Return (PTTAX, PTTRX, PTTDX, PTTCX)

Strategy: The PIMCO Total Return is an actively managed bond fund that doesn’t just focus on the income side or coupons of the asset class. Former manager Bill Gross and the current team at PIMCO will buy or sell whatever sector of the bond market they deem is a good bet at the time. However, the fund’s primary portfolio consists of intermediate-term, investment grade bonds.

Performance: Under Bill Gross’s tenure, Total Return has been the envy of most bond funds. His ability to choose correctly has added about 1 to 2 percentage points in return above broad bond indexes. All in all, Total Return has managed to produce a 5.99% average return over the last 10 years.

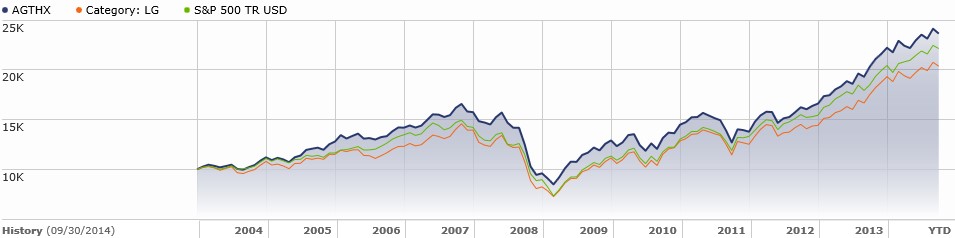

4. American Funds Growth Fund of America (AGTHX)

Strategy: The American Funds Growth Fund of America is designed to aggressively grow investors’ capital over the long haul. Its mandate allows it to invest in any U.S. stock where its managers see the best opportunities. AGTHX invests at least 65% of its assets in common stocks. However, it may also own in convertibles, preferred stocks, U.S. government securities, bonds and cash equivalents as its managers see fit.

Performance: Given its size, AGTHX has 12 different portfolio managers. Yet that large team has done a good job of guiding AGTHX to good returns. Since its inception in 1973, the fund has managed to return 13.88% annually and over the last 10 years AGTHX has returned 9.25%.

5. American Funds EuroPacific Growth (AEPGX)

Strategy: Like its sister fund at number 4 on this list, the American Funds EuroPacific Growth is designed to aggressively grow investors’ capital over the long haul. However, unlike the previously mentioned AGTHX, AEPGX does this by betting on developed market international stocks. Its mandate also allows its managers to bet on firms of all sizes—from small-caps to mega-caps—as well as convertibles, preferred stocks. At least 80% of the fund’s assets must be invested in securities of issuers domiciled in Europe or the Pacific Basin

Performance: Like AGTHX, AEPGX’s team of managers has done a good job of navigating the fund to good returns. Since its inception in 1984, AEPGX has managed to return 10.49% annually. Over the last 10 years, AEPGX has managed rack up 8.83% annual returns.

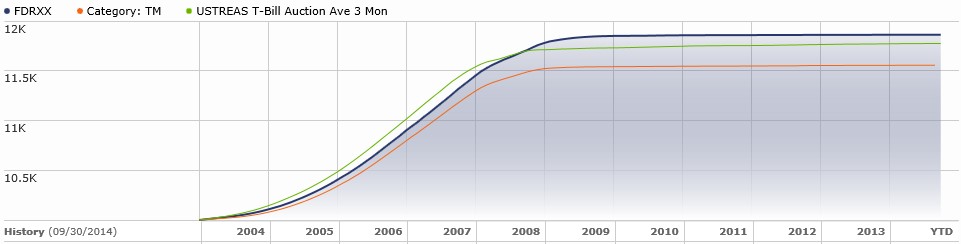

6. Fidelity Cash Reserves (FDRXX)

Strategy: Investors of all sizes need a parking place for their cash while they await good opportunities. The Fidelity Cash Reserves fund is the preferred method for doing that. The fund is a money market mutual fund and invests in very short-term bond securities of domestic and foreign issuers as well as repurchase agreements. As a money market mutual fund, FDRXX seeks to preserve the value of an investment at $1.00 per share.

Performance: Given that short-term interest rates are near zero, FDRXX’s return hasn’t exactly been amazing over the last few years. Its three-year annual return is just 0.01% and 10-year return is just 1.66%. However, insane returns aren’t necessarily the point of investing in the fund – liquidity is.

7. Fidelity Contrafund (FCNTX)

Strategy: The Fidelity Contrafund is all about being a contrarian investor. Manager William Danoff’s strategy for the fund is to seek stocks whose “value” has not been fully recognized by the market and public. He will screen for various metrics, buy and hold until they reach his price targets. Sometimes that process can take years.

Performance: Danoff has been guiding the fund since 1990, and under his leadership FCNTX has managed to beat the S&P 500 by a wide margin. Over the last 10 years, Contra has managed to produce annual returns of 10.28%.

8. Franklin Income (FKINX)

Strategy: The Franklin Income Fund is what’s called a hybrid fund, which means it will own a variety of asset classes. In this case, FKINX will own corporate, foreign and U.S. Treasury bonds, as well as stocks with relatively high dividends in an effort to create a high and stable income stream for its shareholders. Lead manager Edward Perks uses the fund’s broad mandate to select securities that present the best opportunities as market conditions change.

Performance: FKINX is one of the nation’s oldest mutual funds, having been founded in 1948. Since that time, the fund has had impressive returns of 10.61%. Over the last 10 years, that return dropped to 8.15%. The fund currently yields 4.9%.

Be sure to see the Cheapest Mutual Funds for Every Investment Objective.

9. Vanguard Wellington Fund (VWELX, VWENX)

Strategy: The Vanguard Wellington Fund is the world’s first balanced fund—owning both stocks and bonds in a set proportion – currently at 60%–70% stocks, 30%–40% bonds. The stock allocation will focus on large- and mid-cap U.S. stocks, while the bond allocation will focus on all levels of duration with regards to government and investment-grade corporate bonds. This broad focus has some market pundits believing that VWELX is the only mutual fund an investor can own.

Performance: The dual focus of stocks and bonds has helped VWELX weather some nasty storms—like the Great Depression, 1987’s Black Monday, the Dotcom Bust and the Great Recession—since its inception in 1929. All in all, VWELX has returned 8.43% over the last 10 years.

10. Dodge & Cox International Stock (DODFX)

Strategy: The Dodge & Cox International Stock mutual fund seeks the long-term growth of principal and income. It does this by betting on stocks issued by non-U.S. companies from both the developed and emerging world. The fund’s management team focuses in on countries whose economic and political systems appear more stable and are believed to provide some protection to foreign shareholders. Like all the funds in the Dodge & Cox family, stocks are selected via a committee approach, in which firms are placed up for vote for inclusion in the fund. That rigorous approach has helped DODFX on the returns front.

See also 10 Ways to Beat Inflation with Mutual Funds.

Performance: To say that DODFX has been a great fund isn’t doing it justice. Over the last 10 years it has managed to produce an annual return of 9.55%. That’s about 2% more than its benchmark index each year. The combination of stock selection and then committee votes are the key to that extra return.