Where to Find Them

Be sure to also read the Complete Guide to Mutual Fund Expenses

What They Contain and How to Read Them

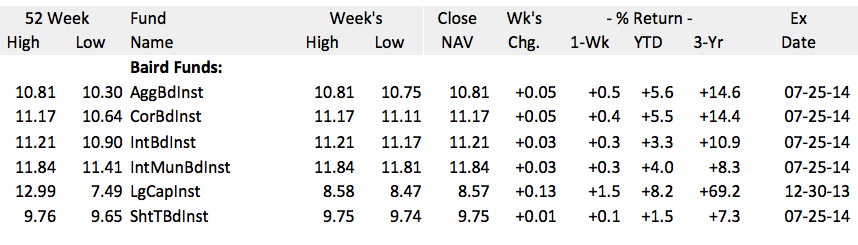

52 Week High and Low – These numbers show the highest and lowest prices that the fund closed at on any trading day during the past year. This time period is updated on a daily basis to trail that day’s closing price.

Fund Name – This is typically abbreviated, because most fund names are rather long. For example, “IntMunBdInst” stands for International Municipal Bond Fund, Institutional Shares. There is usually a key or ledger that explains what many of the abbreviations mean, such as N for no-load, Inst for institutional and so on.

Week’s High and Low – The high and low closing prices for the past 5 trading days.

Close NAV – The closing Net Asset Value price of the fund the previous day. Open-ended mutual funds have forward pricing, because their prices cannot be determined until the close of the trading day, when the closing prices of all of the securities that the fund holds can be mathematically aggregated to determine the fund share price.

Wk’s Change – How much the fund price rose or fell over the past 5 trading days in dollars and cents.

-% Return – This shows how much the fund price rose or fell in terms of percentage for one week, Year-to-Date and over the past three years. +0.5 means that it rose by one half of one percent.

Ex Date – This is the calendar day on which the fund will begin trading at a lower price due to the adjustment from its dividend that will be paid.

Tips and Tricks

Of course, you can also find mutual fund data directly on the website of any fund company, although it is not always published exactly in standard table form. You will also find a great deal more information about the fund on the site than is published in any table, such as the fund company’s history, its portfolio managers and much more detailed information on each of its funds.

A large percentage of fund companies provide downloadable fact sheets that contain a complete range of a fund’s performance history going back to its inception, Morningstar commentary on the fund’s performance and a set of technical indicators that mathematically quantify the fund’s performance. Standard deviation measures the fund’s volatility while alpha measures the portfolio manager’s performance against the fund’s underlying benchmark. Beta compares the level of volatility of the fund versus the market at large. With that being said, this type of information is seldom found in mutual fund tables.