Rebalancing a portfolio is the term for adjusting a portfolio back to its original allocation. For example, a portfolio with 60% equity funds and 40% bond funds is a fairly balanced allocation. If the equity markets have a very good year, the original 60% portion might have grown to 70% equity, thus increasing the risk of the portfolio. A way to reset the portfolio back to its 60% equity portion is to sell off the 10% of profits in equity and purchase bond funds. This would restore the bond fund portion back to its original 40% of the portfolio.

It is extremely important to rebalance or adjust a portfolio at least once a year. When it comes to long-term investing, the asset allocation an investor chooses reflects both their risk tolerance ands performance over the long haul. Rebalancing will ensure that both of these objectives are achieved.

However, there are several other reasons why a mutual fund investor might want to rebalance their portfolio other than realigning back to their original allocation. Let us go over them in detail.

Click here to learn about the core-satellite approach to fund portfolio construction.

Why Should You Rebalance?

1. Underperformance

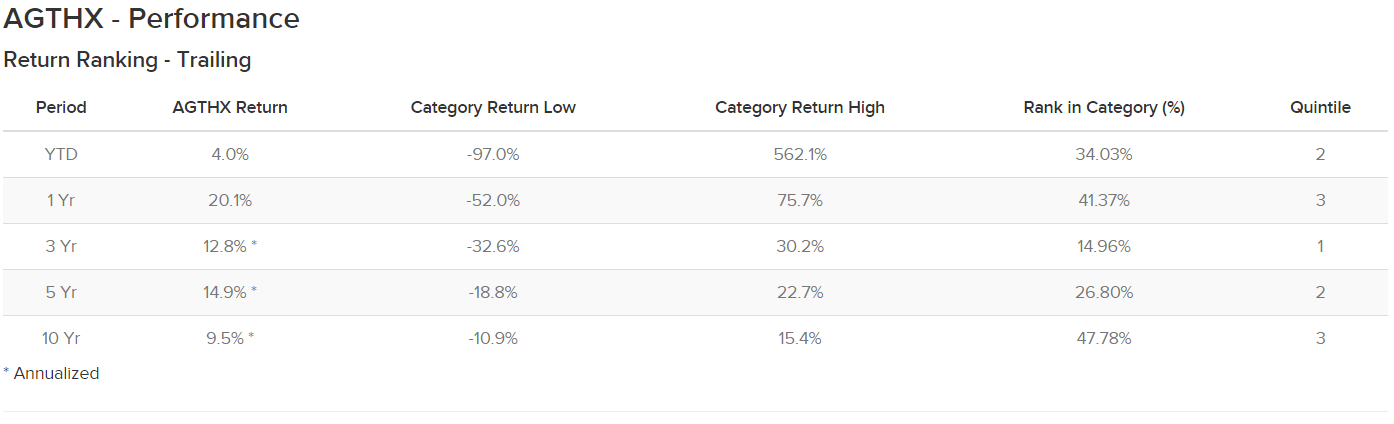

One reason that investors typically use mutual funds is to gain access to a professional money manager, with the hopes of outperforming the benchmark. A great way to compare how well a mutual fund is performing is to compare it to its peer group. Looking at the chart below, the American Funds Growth Fund of America A (AGTHX) is in the Large Cap Growth category and it is currently ranked in the first quintile for the trailing three-year period, with an average return of 12.8%. However, for the year-to-date and five-year average returns, the fund is in the second quintile. For a one-year and ten-year average, the fund is in the third quintile. Overall, the fund is an average fund and performs more often in the second and third quintiles in relation to its peer group.

Measuring a fund’s performance is an important part of investing and determining whether or not it is time to make a change to a better fund. When comparing the ten-year data for the Growth Fund of America, the fund had a respectable 9.5% average return. However, this only ranked the fund in the third quintile. The category high for Large Cap Growth Equities is 15.4% over the same time, which outperformed AGTHX by nearly 6% every year on average. Keeping a fund that is consistently underperforming its peers would undoubtedly warrant a change.

Another time to adjust or rebalance a fund out of a portfolio is when the mutual fund changes its purpose or policy and no longer aligns with its original purpose. One example of this is when Vanguard changed its REIT Index Fund to the Vanguard Real Estate Index Fund (VGSNX). The fund also changed its investment objective to accommodate a wider array of real estate-based stocks and changed its benchmark to something closer to its new allocation.

Changing the fund’s objective or policy is very common with mutual fund managers who are given a lot of freedom to drift their style. For example, a fund manager might currently be categorized in Large Cap Growth but, from time to time, their underlying holdings might drift them to Large Cap Core or even Large Cap Value. When this happens and a portfolio already has a Large Cap Core or Value mutual fund, there is a potential for overlap. During these circumstances, it is important for investors to truly examine the underlying holdings of the fund to ensure that the manager is maintaining its category. When the category changes, this should trigger a fund change back to the original intended category.

3. Change in Fund Expenses

Investors should constantly be aware of the expense ratios within their mutual funds. Higher expense ratios are justified when a mutual fund outperforms both its peers and corresponding index on a risk and return basis. Otherwise, it might make sense to move the fund into a low-cost index fund. The Vanguard Growth Index Admiral fund (VIGAX) is under the same Large Cap Growth category as the Growth Fund of America. On a 10year average basis, the fund performed better with a 10.8% return, putting it in the second quintile. From an expense ratio, VIGAX charges 0.05%, which is significantly lower than the AGTHX expense ratio of 0.64%. When comparing the two, VIGAX has a better 10year return and is 0.59% less expensive than AGTHX.

On occasion, mutual funds have raised the expense ratio when its operating costs have increased. This would be another opportunity for an investor to adjust their portfolio. This would be a time to re-examine the performance of the fund in relation to less expensive peers.

4. Change in Investment Objective or Risk Tolerance Level

The final reason why an investor should rebalance or adjust their mutual fund portfolio is when their own investment objective or risk tolerance changes.

A younger investor seeking long-term growth and an older investor seeking preservation of capital would have completely different investment objectives. The younger investor would be focused on maximizing returns, since the time horizon is longer and would most likely have a higher tolerance for risk. An older investor, who is in or near retirement, would have a much lower risk tolerance and be focused on preserving their principal, since they have a shorter time horizon. As an investor goes through different life stages, they should re-examine their portfolio’s investment objective and risk to ensure that it aligns with their current situation.

Check here to know why you would need mutual funds in your portfolio.

The Bottom Line

Sign up for our free newsletter to get the latest news on mutual funds.