- The carnage in equity mutual funds continued these past two weeks, with the flow picture deteriorating considerably. For the last two weeks, outflows from equity funds amounted to $14.3 billion compared to under $6 billion in the prior two weeks.

- Domestic mutual funds were the most hit with more than $8 billion in outflows in the last week alone. On the contrary, funds focused on the rest of the world experienced inflows of $1.7 billion.

- Bond mutual funds continued to be favored by investors, with estimated inflows of $6.5 billion in the past two weeks, up from $2.5 billion in the prior fortnight. Taxable bonds were the main beneficiary of the inflows, while municipal bonds saw an infusion of more than $300 million in the past two weeks.

- The European Central Bank signaled plans to end its Quantitative Easing program by the end of the year and keep interest rates at current record -low levels at least through the summer of 2019.

- The Bank of England kept interest rates steady at 0.75%, but a rosy picture of the economic output may require an intervention soon. The central bank warned of potential negative effects from a no-deal Brexit, although policymakers in the European Union made clear a deal was likely.

- The U.S. labor market has continued to tighten, with the economy adding 201,000 jobs for the month of August. Hourly wages shot up 0.4% month-over-month and 2.9% compared to the same month last year.

- We provide this report on a fortnightly basis. To stay up to date with mutual fund market events, come back to our news page here.

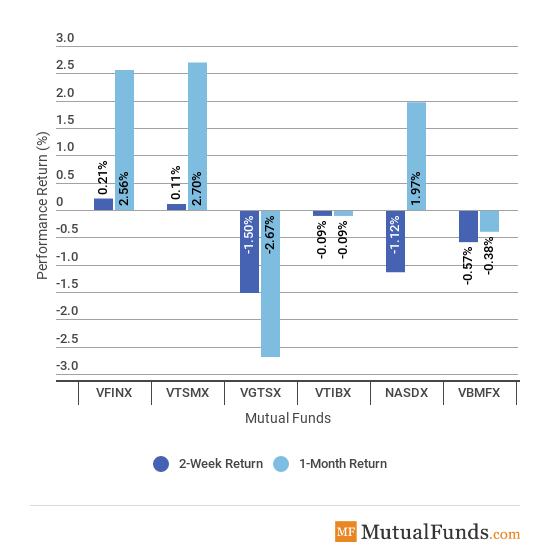

Broad Indices

- Only the blue-chip U.S. equity funds saw positive performance for the two weeks ended September 14, as a batch of upbeat economic data amid a deteriorating picture in emerging markets boosted the appeal of U.S. stocks.

- While the S&P 500 (VFINX) was the best performer with a rise of 0.21%, Global equities ex-U.S. (VGTSX) dropped 1.5%.

- For the rolling month, the performance picture was more mixed. Vanguard Total Stock Market Index Fund Investor Shares (VTSMX), a broad index containing 4,000 companies listed in the U.S., advanced 2.70%.

- VGTSX, meanwhile, lost 2.67% over the same period.

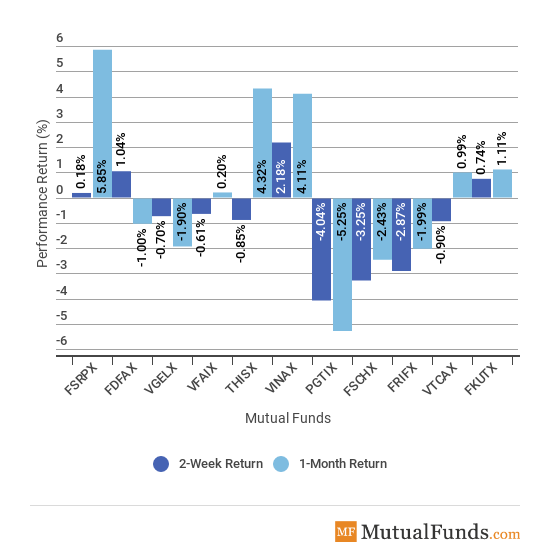

Major Sectors

- The industrials sector (VINAX) was by far the best performer in the past two weeks, with a gain of 2.18%, as stocks are recovering from oversold territory following a spate of tariffs imposed by the U.S. on several trading partners.

- The technology sector (PGTIX) is the worst performer for the past two weeks amid fears a trade war between China and the U.S. will intensify. Big index exponents, such as Apple, which relies on China for its supply chain, could take a hit if the trade war escalates after President Donald Trump imposed another batch of levies on Chinese imports. PGTIX is also the worst performer for the rolling month, down 5.25%.

- The consumer discretionary sector (FSRPX) rose the most for the rolling month, just shy of 6%.

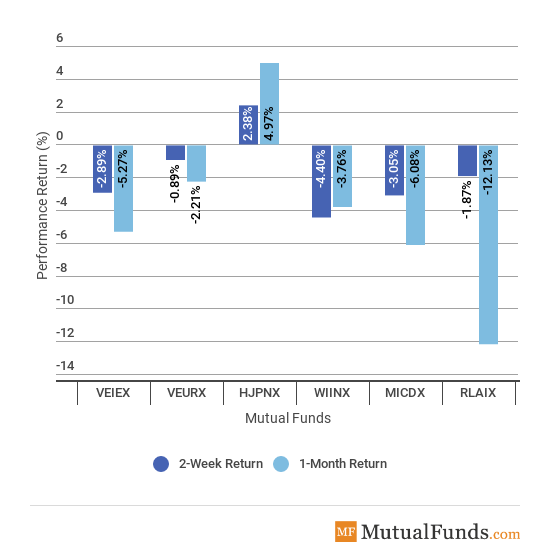

Foreign Funds

- India (WIINX) is surprisingly the worst performer for the past two weeks, in part because of a Goldman Sachs report calling time on the stock market’s rally. WIINX declined 4.4% in the past fortnight.

- Amid rising worries about a trade war between China and the U.S. and the emerging markets carnage, Japan (HJPNX) provides safety to investors. HJPNX rose 2.38% in the past two weeks, the only riser from the pack. Unsurprisingly, the Japanese stock market is also the best monthly performer, up nearly 5%.

- Latin America (RLAIX) tumbled a staggering 12.1% for the rolling month, due to an ongoing currency crisis in Argentina, political uncertainty in Brazil and a humanitarian debacle in Venezuela.

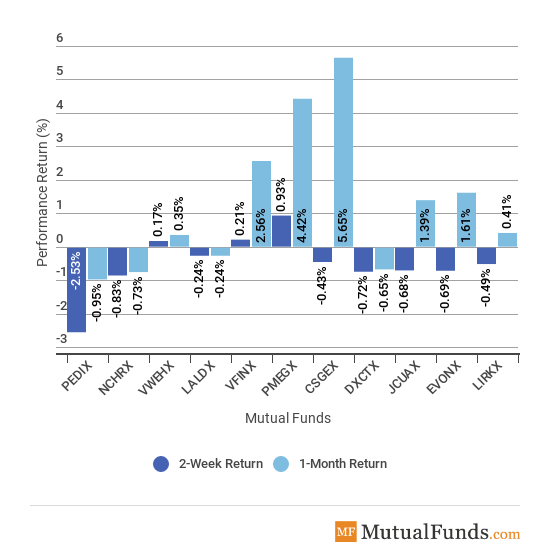

Major Asset Classes

- T.Rowe’s mid-cap equity growth fund (PMEGX) is the best-performing asset class for the past two weeks, rising a little bit below 1%.

- Meanwhile, PIMCO’s long-term bonds index (PEDIX) is down 2.53% for the past two weeks and 0.95% for the rolling month.

- For the rolling month, BlackRock’s small-cap index (CSGEX) remains the best performer, up 5.65%.

Bottom Line

Be sure to signup for your free newsletter here to receive the most relevant updates.