- On balance, total long-term inflows have had an impressive start to the year. Barring the first week of 2019, flows have been consistently positive. Indeed, the favorable trend continued for the two weeks ended February 20, with more than $7 billion in inflows registered.

- As it happens, bonds were in high demand, recording total inflows of more than $14 billion. The equity asset class suffered slightly, with outflows of $5.5 billion.

- China and the U.S. are reportedly close to reaching a deal on trade if the former agrees to impose stricter protections of intellectual property rights and buy a significant amount of U.S. products. At the same time, China made clear that any deal would have to include the immediate removal of levies on $200 billion worth of Chinese imports.

- U.S. President Donald Trump walked out of a summit with North Korean President Kim Jong-un, after the latter requested the full removal of sanctions against the nuclear country.

- Brexit is most likely to be delayed for at least a short period of time, although a last-minute agreement between Prime Minister Theresa May and Parliament is also likely.

- U.S. Federal Reserve Chair Jerome Powell reiterated his stance that the central bank will be patient in making further rate hikes in prepared testimony for the Senate Banking Committee. He noted that he received conflicting signals of late from the U.S. economy. That was not enough to deter President Trump from launching another salvo at the Fed president, saying Powell likes high interest rates.

- A rise in business spending has boosted the U.S. GDP in the last quarter of the year, although growth fell from an annualized 3.4% to 2.6%. Yet, the figure was well above analyst estimates of 2.2%.

We provide this report on a fortnightly basis. To stay up to date with mutual fund market events, come back to our news page here.

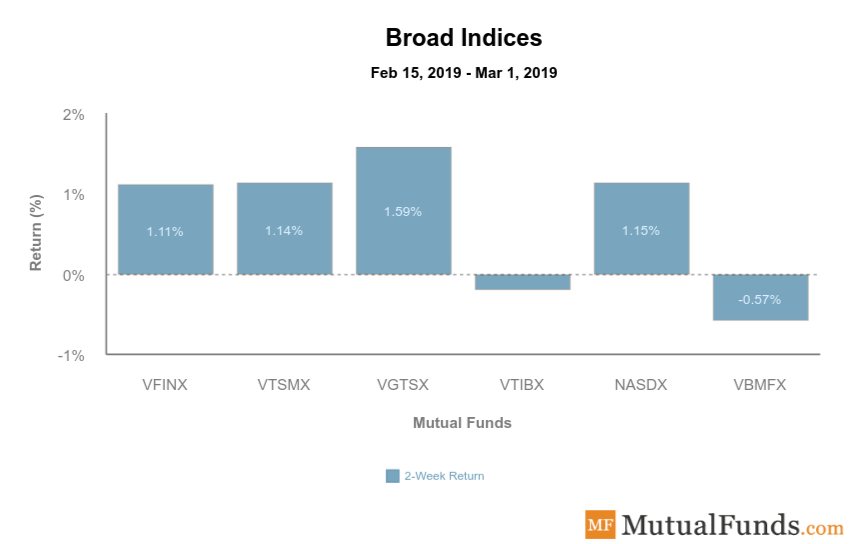

Broad Indices

- Vanguard’s total international stock fund (VGTSX), which provides exposure to global non-U.S. blue chip companies such as Nestle, Novartis and HSBC, is the best performer for the past two weeks with a gain of 1.59%.

- Vanguard’s total bond fund (VBMFX) is the worst performer, down 0.57%, largely due to falling U.S. Treasury yields and inflation. Ten-year Treasury notes now yield around 2.7% compared with 3.2% at their peak in November 2018.

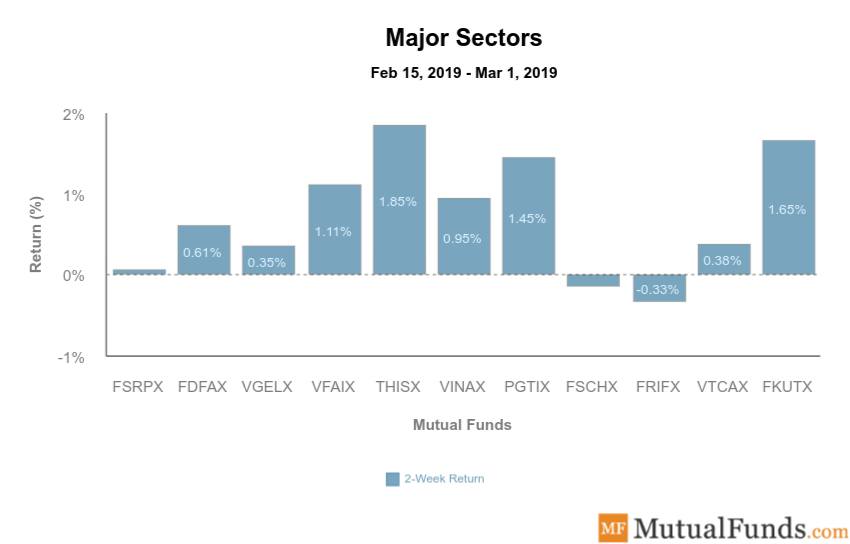

Major Sectors

- Sectors were mixed.

- Amid low volatility, T.Rowe’s healthcare fund (THISX) is the best performer with a rise of 1.85%.

- Fidelity’s real estate income fund (FRIFX) is the worst performer with a fall of 0.33%.

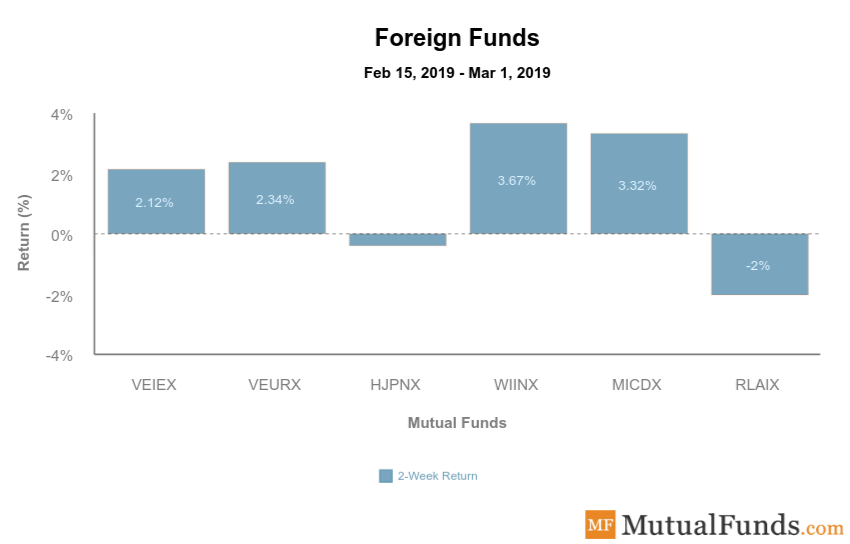

Foreign Funds

- Foreign funds were mixed.

- Indian equities fund (WIINX) is the best performer from the pack, registering an advance of 3.67%, as a military escalation between Pakistan and India appears to be drawing to a close for the time being.

- At the other end of the spectrum is Latin America equities (RLAIX), which declined 2%.

Major Asset Classes

- Long-term bond fund (PEDIX) has been severely hit over the past two weeks, declining nearly 4%.

- Meanwhile, BlackRock’s small-cap sector fund (CSGEX) is again the best performer for the week, with an advance of nearly 2%. Small caps have benefited from falling yields as many of these companies are highly leveraged and may see their bottom lines suffer should interest rates increase.

The Bottom Line

Be sure to sign up for your free newsletter here to receive the most relevant updates.