This week, stocks remained volatile as investors digested the release of several key economic data, with the spotlight on inflation numbers.

The Consumer Price Index (CPI) increased 0.4% month-over-month in February, the highest increase in five months and matching market forecasts. A bullish retail sales report, which increased by 0.6% in February and was ahead of estimates, and a strong consumer sentiment report helped drive equities higher. The data continues to show that consumers remain a bright spot in the economy. Initial jobless claims for the week ending March 9 also clocked in lower than expected. However, selling pressure in semiconductor stocks like NVIDIA and AMD and a looming Federal Reserve decision on interest rates helped keep a lid on the gains heading into the weekend.

Next week, the focus will be on the Federal Reserve’s latest interest rate decision, due on Wednesday. While the central bank has expressed that interest rates have most likely peaked for this hiking cycle, questions still linger about the timing of the first cut. With inflation starting to tick higher, analysts now predict that the Fed will keep benchmark rates at 5.50% till summer at the earliest. On Tuesday, we’ll also see February’s building permit data, which has been surprisingly robust despite higher interest rates and is expected to marginally decline to a seasonally adjusted annual rate of 1.48 million. Similarly, housing starts in February are also expected to increase to an annualized level of 1.43 million, after a slight seasonally adjusted pullback seen in January. Weekly jobless claims for the week ending March 16 are also expected to be bullish, showing a resilient labor market.

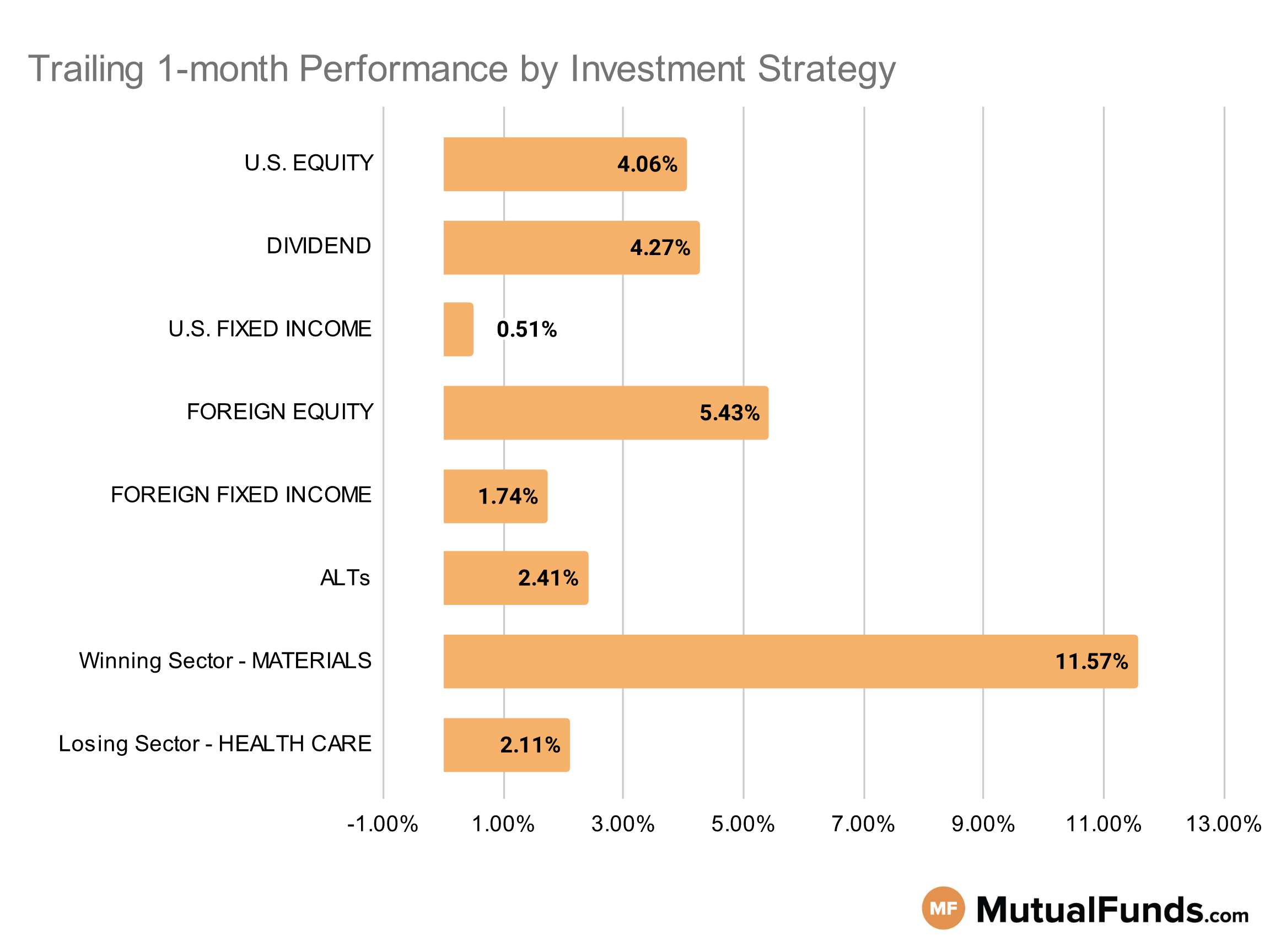

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets continue to be in the positive territory for the rolling month.

Material startegies, especially palladium, reversed course and emerged as one of the top performers for the rolling month. Meanwhile, cannabis and some growth strategies struggled.

U.S Equity Strategies

Among U.S. equities, mid-cap growth strategies emerged as winners for the rolling month.

Winning

- iShares S&P Mid-Cap 400 Growth ETF (IJK), up 8.41%

- SPDR® S&P 400 Mid Cap Growth ETF (MDYG), up 8.39%

- ClearBridge All Cap Value Fund (SFVCX), up 8.35%

- Vanguard S&P Mid-Cap 400 Growth Index Fund (VMFGX), up 8.33%

- Vanguard S&P Mid-Cap 400 Value Index Fund (IVOV), up 0.51%

Losing

- iShares Micro-Cap ETF (IWC), down -2.32%

- VALIC Company I Stock Index Fund (VSTIX), down -2.84%

- Brown Capital Management Small Company Fund (BCSIX), down -3.12%

Dividend Strategies

Several dividend growth focused strategies continued to post positive performances over the rolling month.

Winning

- First Trust Rising Dividend Achievers ETF (RDVY), up 7.05%

- Fidelity® Dividend Growth Fund (FDGFX), up 6.62%

- Fidelity Advisor® Dividend Growth Fund (FDGTX), up 6.51%

- JPMorgan Diversified Return U.S. Equity ETF (JPUS), up 5.48%

- Invesco High Yield Equity Dividend Achievers™ ETF (PEY), up 1.54%

- ProShares Russell 2000 Dividend Growers ETF (SMDV), up 1.48%

- Principal Global Diversified Income Fund (PGBAX), up 0.76%

Losing

- VALIC Company I Dividend Value Fund (VCIGX), down -2.27%

U.S. Fixed Income Strategies

In US fixed income, longer duration and high yield municipal bond strategies posted positive results.

Winning

- Nuveen High Yield Municipal Bond Fund (NHCCX), up 2.11%

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), up 2.11%

- SPDR® Nuveen S&P High Yield Municipal Bond ETF (HYMB), up 1.55%

- Invesco CEF Income Composite ETF (PCEF), up 1.41%

Losing

- SPDR® Bloomberg Barclays High Yield Bond ETF (JNK), down -0.19%

- ProShares Short 20+ Year Treasury (TBF), down -0.34%

- Old Westbury Fixed Income Fund (OWFIX), down -0.5%

- VALIC Company I Core Bond Fund (VCBDX), down -2.76%

Foreign Equity Strategies

Among foreign equities, European equity strategies posted solid growth numbers, with Sweden and Italy leading the pack.

Winning

- iShares MSCI Sweden ETF (EWD), up 10.98%

- iShares MSCI Italy ETF (EWI), up 10.59%

- JPMorgan Europe Dynamic Fund (JFESX), up 9.13%

- Janus Henderson Overseas Fund (JAOSX), up 8.67%

- PGIM Jennison Emerging Markets Equity Opportunities Fund (PDEZX), up 1.58%

- Grandeur Peak International Opportunities Fund (GPIIX), up 1.49%

- WisdomTree India Earnings Fund (EPI), up 0.54%

- iShares MSCI Brazil ETF (EWZ), up 0.4%

Foreign Fixed Income Strategies

Emerging market debt strategies continue to lead the pack, among foreign fixed income strategies/

Winning

- Vanguard Emerging Markets Bond Fund (VEMBX), up 2.46%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 2.43%

- TCW Emerging Markets Income Fund (TGEIX), up 2.39%

- iShares International Treasury Bond ETF (IGOV), up 2.31%

- VanEck Emerging Markets High Yield Bond ETF (HYEM), up 1.23%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), up 1.02%

- DFA World ex U.S. Government Fixed Income Portfolio (DWFIX), up 0.96%

- Janus Henderson Developed World Bond Fund (HFARX), up 0.79%

Alternatives

Among alternatives, gold and natural resource strategies posted strong results over the rolling month, while cannabis strategies continued to struggle.

Winning

- Fidelity® Select Gold Portfolio (FSAGX), up 14.48%

- SPDR® S&P Global Natural Resources ETF (GNR), up 7.04%

- BlackRock Commodity Strategies Portfolio (BCSAX), up 6.49%

- FlexShares Morningstar Global Upstream Natural Resources Index Fund (GUNR), up 6.2%

- SPDR® DoubleLine Total Return Tactical ETF (TOTL), up 0.3%

Losing

- PIMCO TRENDS Managed Futures Strategy Fund (PQTIX), down -0.55%

- Victory Market Neutral Income Fund (CBHAX), down -1.07%

- ETFMG Alternative Harvest ETF (MJ), down -8.53%

Sectors

Among the sectors material strategies posted strong results, while strategies focused on cannabis and technology were in red.

Winning

- Aberdeen Standard Physical Palladium Shares ETF (PALL), up 23.26%

- Global X Copper Miners ETF (COPX), up 18.86%

- Franklin Gold and Precious Metals Fund (FGPMX), up 16.52%

- Sprott Gold Equity Fund (SGDLX), up 16.15%

Losing

- VALIC Company I Nasdaq-100 Index Fund (VCNIX), down -1.8%

- VALIC Company I Blue Chip Growth Fund (VCBCX), down -7.12%

- Invesco WilderHill Clean Energy ETF (PBW), down -9.92%

- AdvisorShares Pure US Cannabis ETF (MSOS), down -10.02%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.