April is quickly becoming a month investors would rather forget, with stocks once again falling for much of the week.

Conflict in the Middle East escalated after Israel launched a missile strike on Iran in retaliation for weekend attacks on the nation, sending already elevated oil prices higher and the stock market lower. This has led to fears that rising energy prices will spike inflation, therefore keeping benchmark interest rates higher for longer. A very bullish retail sales figure, which clocked in at a 0.7% gain versus expectations of a 0.4% increase, also didn’t help. Several Federal Reserve governor speeches, including one by Chairman Jerome Powell, also reiterated the central bank’s stance on keeping interest rates on pause for now. A strong labor market, indicated by a bullish weekly jobless claims report, added to the selling pressure on the markets.

Aside from any continued rise in tensions in the Middle East, next week could be a volatile one. Part of that uncertainty will be tied to the release of the Fed’s favorite inflation metric, the Core Personal Consumption Expenditure (PCE) Price Index. Analysts now expect Core PCE to register a 0.3% increase in March, following 0.3% and 0.5% increases in February and January. This, along with bullish reports of personal spending and income, is likely to keep interest rates elevated. However, what could save the day and increase the chance of a rate cut will be the durable goods report and the gross domestic product (GDP) report. Month-over-month durable goods are expected to rise marginally, showing signs of weakness in an otherwise uptrend observed in recent months and highlighting woes in the economy. Meanwhile, the GDP growth rate for the first quarter of the year is expected to decline to nearly 2.1%, down from the 3.4% growth reported last quarter. Both of these measures could help the Federal Reserve make a rate cut decision sooner than later.

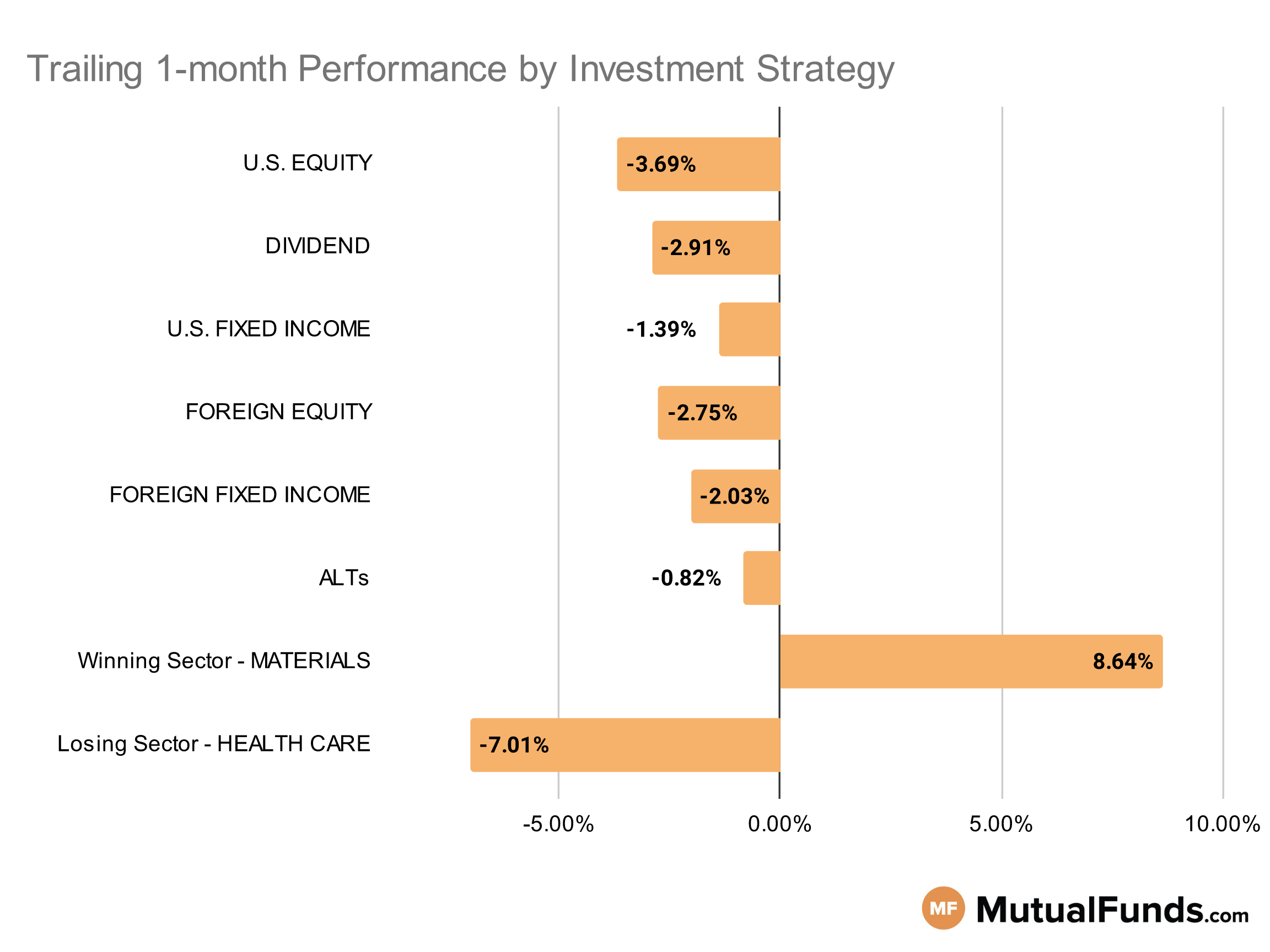

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, major U.S. stock indices went down for the rolling month.

Precious metal startegies, especially silver and gold, continued to post solid performances for the rolling month. Meanwhile, some tech and biotech strategies struggled.

U.S Equity Strategies

Among U.S. equities, small cap growth strategies struggled the most.

Winning

- Longleaf Partners Small-Cap Fund (LLSCX), up 0.7%

Losing

- Tweedy, Browne Global Value Fund (TBGVX), down -0.14%

- Dimensional U.S. Targeted Value ETF (DFAT), down -2.97%

- Dimensional US Core Equity Market ETF (DFAU), down -3.09%

- iShares Micro-Cap ETF (IWC), down -6.05%

- First Trust US Equity Opportunities ETF (FPX), down -6.08%

- Wasatch Ultra Growth Fund (WAMCX), down -7.66%

- Virtus KAR Small-Cap Growth Fund (PXSGX), down -7.95%

Dividend Strategies

Majority of the dividend strategies were in the red for the rolling month.

Losing

- Thornburg Investment Income Builder Fund (TIBAX), down -0.49%

- Principal Global Diversified Income Fund (PGBAX), down -1.51%

- iShares Core High Dividend ETF (HDV), down -1.63%

- Invesco High Yield Equity Dividend Achievers™ ETF (PEY), down -1.71%

- Schwab U.S. Dividend Equity ETF™ (SCHD), down -4.12%

- SPDR® S&P International Dividend ETF (DWX), down -4.46%

- Matthews Asia Dividend Fund (MIPIX), down -4.66%

- Vanguard Dividend Growth Fund (VDIGX), down -5.03%

U.S. Fixed Income Strategies

In US fixed income, global bond strategies posted marginal gains while long duration debt strategies struggled.

Winning

- ProShares Short 20+ Year Treasury (TBF), up 4.09%

- T. Rowe Price Dynamic Global Bond Fund (TRDZX), up 0.64%

- iShares Floating Rate Bond ETF (FLOT), up 0.59%

- DFA Two Year Global Fixed Income Portfolio (DFGFX), up 0.41%

Losing

- SPDR® Portfolio Long Term Treasury ETF (SPTL), down -4.12%

- iShares 20+ Year Treasury Bond ETF (TLT), down -4.4%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), down -6.71%

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), down -7.13%

Foreign Equity Strategies

Among foreign equities, Indian equity strategies posted solid performances, while Brazilian and Japanese stragies struggled.

Winning

- WisdomTree India Earnings Fund (EPI), up 3.64%

- iShares MSCI India ETF (INDA), up 1.85%

- Delaware Emerging Markets Fund (DEMRX), up 1.74%

- Fidelity Advisor® Focused Emerging Markets Fund (FAMKX), up 1.12%

Losing

- iShares MSCI Japan ETF (EWJ), down -5.68%

- iShares MSCI Brazil ETF (EWZ), down -6.14%

- JOHCM International Select Fund (JOHIX), down -6.59%

- PGIM Jennison International Opportunities Fund (PWJQX), down -6.64%

Foreign Fixed Income Strategies

Handul of emerging market debt strategies posted marginal gains, while majority of the foreign debt strategies struggled.

Winning

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), up 0.13%

Losing

- Fidelity Advisor® New Markets Income Fund (FNMIX), down -0.32%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), down -1.69%

- VanEck Emerging Markets High Yield Bond ETF (HYEM), down -1.79%

- iShares International Treasury Bond ETF (IGOV), down -3.03%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND), down -3.4%

- Invesco International Bond Fund (OIBIX), down -3.7%

- Templeton Global Bond Fund (TGBAX), down -4.79%

Alternatives

Among alternatives, agriculture strategies posted strong results over the rolling month, while preferred stock strategies struggled.

Winning

- Invesco DB Agriculture Fund (DBA), up 10.11%

- ETFMG Alternative Harvest ETF (MJ), up 5.85%

- Parametric Commodity Strategy Fund (EAPCX), up 4.86%

- American Beacon AHL Managed Futures Strategy Fund (AHLYX), up 4.8%

Losing

- Mercer Global Low Volatility Equity Fund (MGLVX), down -3.51%

- Fidelity® SAI U.S. Low Volatility Index Fund (FSUVX), down -3.64%

- SPDR® ICE Preferred Securities ETF (PSK), down -5.48%

- VanEck Preferred Securities ex Financials ETF (PFXF), down -5.7%

Sectors

Among the sectors precious metal strategies continued to post strong results, while some tech strategies were in the red.

Winning

- Global X Silver Miners ETF (SIL), up 23.21%

- VanEck Vectors Junior Gold Miners ETF (GDXJ), up 17.25%

- Franklin Gold and Precious Metals Fund (FGPMX), up 15.44%

- First Eagle Gold Fund (FEGIX), up 14.3%

Losing

- Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (SRVR), down -9.39%

- SPDR® S&P Biotech ETF (XBI), down -11.05%

- American Beacon ARK Transformational Innovation Fund (ADNYX), down -11.31%

- Fidelity® Select IT Services Portfolio (FBSOX), down -12.91%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.