High inflation, rising interest rates, and the possibility of a recession have put pressure on tech stocks over the past year. The risk of a recession has investors seeking safe havens while rising interest rates reduce the present value of future profits. And in the tech world, those profits often lie far in the future, exacerbating the impact.

Value stocks have become a safe haven during the bear market. For instance, the Vanguard Value Index Fund ETF (VTV) is down only 5.54% since the beginning of the year, compared to an 18.24% decline for the Vanguard Total Stock Market Index Fund (VTI) and a blistering 25.34% drop for the Vanguard IT Index Fund ETF (VTG).

Let’s take a look at how these trends have played out in actively-managed ETFs over the past year.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Big Losses in Tech

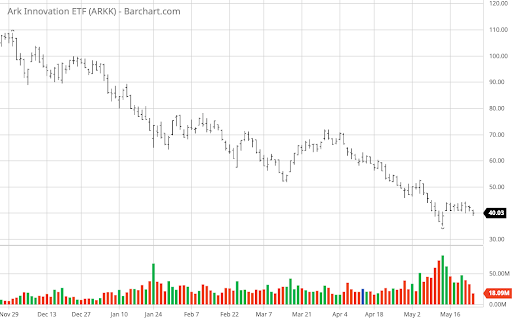

Cathie Woods’ ARK Innovation ETF (ARKK) is perhaps the best-known actively-managed technology fund. Since the beginning of the year, the fund has lost more than half of its value, falling 56.55% year to date. In fact, its terrible performance even led to the creation of the Tuttle Capital Short Innovation ETF (SARK) in November 2021.

The ARK Innovation ETF has seen a steep decline so far this year. Source: Barchart

Surprisingly, despite the significant drop, the ARK Innovation ETF attracted about $1.4 billion in net inflows since the beginning of the year. Cathie Woods’ transparency when it comes to her long-term convictions has kept investors on board while her regular research reports help reassure shareholders that the long-term thesis remains intact.

In addition to ARK funds, many actively-managed crypto ETFs posted significant losses since January. For instance, the Amplify Transformational Data Sharing ETF (BLOK) fell more than 45% since the beginning of the year while many smaller funds posted even more significant losses in the cryptocurrency and blockchain space.

Value Investors Shine

Value stocks have been a large beneficiary of the flight to safety. In many cases, these companies have strong balance sheets to survive a recession along with a reasonable valuation that provides a margin of safety in the event of a market sell-off. At the same time, they typically have profitable businesses, mitigating the impact of rising interest rates.

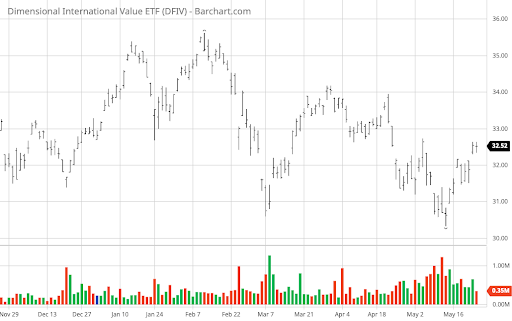

The Dimensional International Value ETF has had a much better performance. Source: Barchart.com

For instance, the Dimensional International Value ETF (DFIV) offers investors exposure to international markets (insulated from domestic worries) with a focus on value-driven opportunities. Since the beginning of the year, the fund has fallen about 2%, outperforming the S&P 500 index by more than 15% over the timeframe.

The Aventis U.S. Small Cap Value ETF (AVUV) is another example of an actively-managed value-focused fund. While the fund has fallen about 10% so far this year, that’s still about 8% less than the S&P 500 index. The fund managers’ focus on low valuations and high profitability ratios mean their holdings could be better positioned to weather a recession.

The Bottom Line

High inflation, rising interest rates, and the growing risk of a recession have taken a toll on the tech industry. While ARK and other funds have seen significant declines, many investors have taken refuge in international and small-cap value-focused funds, which have significantly outperformed tech stocks and the S&P 500 index.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.