Active ETFs have become a popular vehicle for thematic investments and mutual fund conversions, but Engine No. 1’s success demonstrates its potential to influence corporations with even a small stake. And BlackRock, Vanguard, and State Street control about 25% of the U.S. equity market and vote proxies on behalf of millions of investors.

Let’s look at the voting record of the largest ESG funds and then look at how smaller active ETFs are leveraging proxies for good.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Growing Assets, Questionable Record

Global sustainable fund assets reached $2.74 trillion in 2021, with U.S. ESG fund assets reaching $357 billion. While that’s just a fraction of the $21.3 trillion U.S. mutual fund industry, sustainable fund assets grew at a 13% annual clip, outpacing the wider industry. These metrics suggest that sustainable funds could have a growing influence over time.

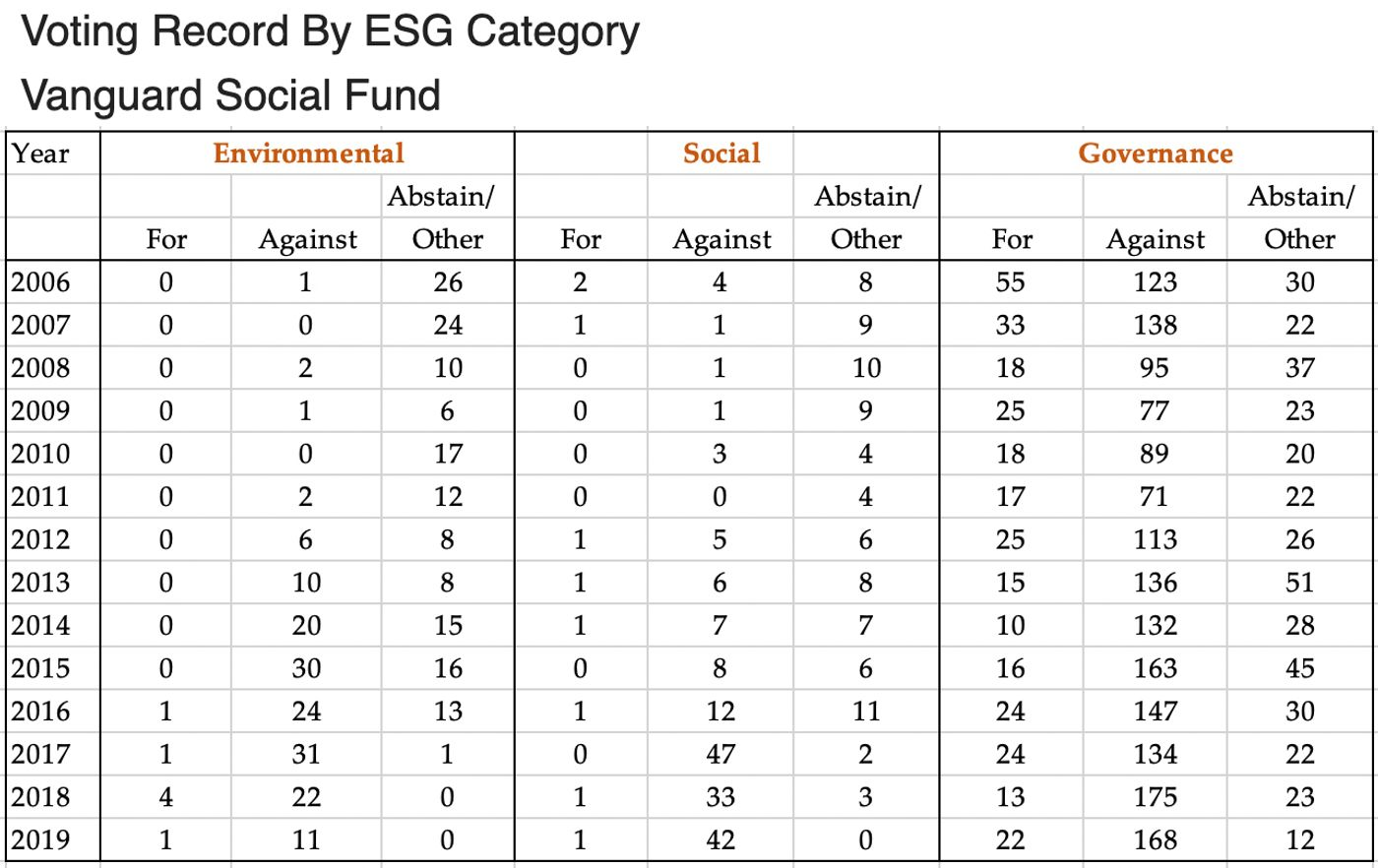

The Vanguard Social Index Fund voting records. Source: MarketWatch

Despite the ESG moniker, MIT researchers found the proxy voting records of these funds often contradict their stated objectives. For example, the Vanguard Social Index Fund (VFTNX) voted against almost all environmental resolutions over the past 14 years (see above). The BlackRock DSI ETF (DSI) has a similarly poor track record.

These votes can have a significant impact on passing ESG measures. For example, according to ShareAction, only 30 of 146 ESG resolutions passed last year, and 18 more would have passed if one of the big three ETF issuers voted in favor. Worse, the six largest asset managers voted more conservatively than their proxy advisors recommended.

Small Funds With an Outsized Influence

The good news is some active ETFs are leveraging their voting power to support ESG causes—and even pick pro-ESG battles. Perhaps most famously, Engine No. 1’s Transform 500 ETF (VOTE) successfully installed three Exxon Mobil board members following a tense proxy fight to push the energy giant into diversifying into renewable energy.

More recently, Engine No. 1 launched the Transform Climate ETF (NETZ) to pursue a similar strategy, enacting ESG principles via proxy votes and working with companies with ties to the production of greenhouse gas. For example, one of the fund’s largest holdings will be General Motors, which Engine No. 1 began collaborating with last year.

In addition to launching new funds, Engine No. 1 maintains a proxy voting dashboard that shows how it votes on each proposal at every company in its portfolio. The unparalleled transparency could become a model for other ESG-related ETFs as investors demand greater insights into how they vote their proxies to effect positive change.

Don’t forget to explore our Dividend Guide where you can access all the relevant content and tools available on Dividend.com based on your unique requirements.

The Bottom Line

Investor interest in ESG is growing rapidly, but actual change will rely on the support of the world’s largest asset managers. Unfortunately, despite their ESG moniker, many of the largest ESG funds vote against ESG measures. ShareAction and other non-profits are raising awareness of these issues to align funds with their investors’ goals.

In the meantime, Engine No. 1 demonstrated even smaller ETFs could make a big difference by leveraging the power of proxies. ESG-focused investors should keep an eye out for similar ETFs over the coming year focused on actively pushing for change through proxies rather than passively holding ESG-friendly stocks.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.