Actively managed ETFs have become increasingly popular over the past few years, but some investors are still hesitant to increase allocations to them. The 2022 Trackinsight Global ETF Survey provides insight into why investors are flocking to active ETFs, where they’re coming from, and what’s holding them back from allocating more.

Let’s take a look at some of the key takeaways from the survey and what’s in store for the future of active ETFs.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

More Ubiquitous in Portfolios

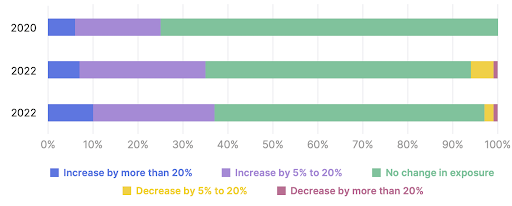

Active ETFs have become more common in investor portfolios over the past few years. In 2020, 70% of investors had no exposure to active ETFs, but by 2022, more than half of all portfolios held at least one active ETF. But while they’ve become more widely known, they still represent less than 20% of holdings for two-thirds of investors.

Investors expect to increase their allocations to active ETFs more than ever. Source: Trackinsights

The increase in active ETF allocations primarily comes from existing ETF investors seeking excess returns (41%), mutual fund converts hoping to lower costs (38%), and direct investors seeking to increase diversification and lower costs (30%). Surprisingly, few investors were drawn to active ETFs due to their improved transparency over mutual funds.

These trends could continue as a growing number of mutual funds launch ETF versions of their strategies or convert existing funds. At the same time, the Federal Reserve’s plans to raise interest rates could make active fixed income ETFs popular among direct investors looking for greater diversification with a market-cap-weighted approach.

New Funds Eliminate Obstacles

About 60% of the roughly 500 ETFs launched last year are actively managed, according to Morningstar Direct, attracting more than $80 billion in capital inflows. While that’s just a fraction of the broader $7 trillion ETF industry, active ETF launches continue to outpace passive ETFs, making it a priority for issuers.

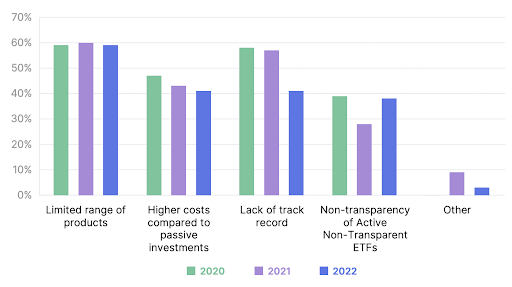

The biggest challenge remains a limited range of products despite a record number of new active ETF launches. Source: Trackinsights

Despite the tremendous growth in active ETFs, Trackinsights found that nearly 60% of investors want more choices before increasing their allocations to active strategies. In addition, higher costs relative to passive investments and the lack of an established track record were two other big reasons for holding investors back from active funds.

Fortunately, these issues will likely resolve over time as more active ETFs launch. Newly launched funds will provide investors with more options and put downward pressure on expense ratios over time. In meantime, existing active ETFs will extend their track records, providing reassurance to investors looking for established fund options.

The Bottom Line

Active ETFs have become increasingly prominent in investment portfolios over the past few years, particularly in fixed income, international markets, and other areas where active strategies provide alpha. And, of course, thematic ETFs, such as the ARK Innovation ETF (ARKK) remains popular despite the sector’s recent weakness.

As new active ETFs launch, investors could see more options over the coming year, putting downward pressure on expense ratios. Many of these new funds target unique corners of the market, such as ESG, quant strategies, international value, fixed income/dividend, and unique themes (e.g., tech). As a result, investors may want to keep an eye on the market.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.