One of Warren Buffett’s most famous quotes is, “Price is what you pay, value is what you get.” Perhaps nothing sums up the style of value investing better than that adage. With this style, investors dig deeper beyond price and momentum, and look at fundamentals relative to a stock’s price. And in that, it’s a bit more nuanced.

That makes the value style of investing an ideal candidate for active management.

Thanks to the nature of value investing, portfolios may get their biggest boost from using active management in the style. With the new surge of active ETFs on the marketplace, the benefits of value investing can finally be unleashed.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Value Investing Differs

The best way to think of value investors is that it’s a bit like Sherlock Holmes. The investment strategy involves picking stocks that appear to be trading for less than their overall values. In essence, the market is underestimating what they are really worth. To that end, value investors dig deep into a firm’s fundamentals. Sales growth, cash flows, debt levels, dividend yields, book values, and other metrics are compared to broad market or sector benchmarks. A value investor will make the determination on whether or not a stock is perceived as a “value,” and then buy accordingly.

This differs from other styles of investing.

For example, growth investing simply looks at a firm’s sales/revenue growth rates and determines if it’s moving faster than its peers. The stock could be overpriced on a valuation basis or not; it doesn’t really matter. The same could be said for momentum investing, in which investors only focus on the forward momentum of stocks. The stock could be unprofitable, full of debt, and trading for a sky-high valuation; however, the only thing that matters is the share price movement.

Because of its nature, value investing has a more human touch. It takes a certain skill set to look at a stock, dig into its corporate reports, and understand what it all means. There are some broader value stock indices that are very popular, like the Russell 3000 Value Index or the S&P 500 Value Index. However, these broader indices tend to focus on stocks on a price-to-book basis and don’t offer a complete picture. In fact, some stocks may qualify for both the value and growth version of an index when looking at just one metric.

Active Is Better

Given that value investing is an art form versus just simply following trends, active managers can play a pivotal role in adding additional returns to the strategy. Because they look at more than one factor, value managers can avoid so-called value traps or those stocks with poor fundamentals with a low price, focus more on total return potential – dividends and market discovery, and avoid cyclical/business cycle pressures.

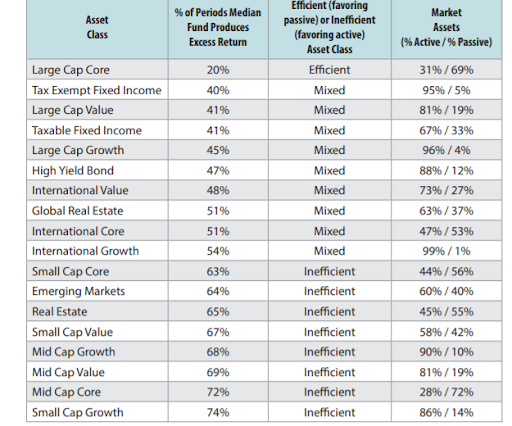

The proof may be in the pudding – there’s evidence to suggest that active managers in value styles can add additional long-term returns to a portfolio. The key comes down to the ability of active funds to have a much higher so-called active share, which is the difference between what a fund actually holds (aka manager skills) versus an index against which the fund can be benchmarked. You can see that active management in value styles is better, based on the inefficiency of these markets, from the results in this chart by investment manager Baird. Humans can and do generate better returns in many cases.

Source: Baird

Active ETFs Help

Going forward, active ETFs could help value managers unlock even more “value” for investors. And there’s two big reasons why.

For starters, the lower costs of ETFs help on the returns front. With lower fee hurdles, ETFs are helping close the gap between active management and passive investing. Given that active value investing can already outperform in many instances, this is a boon to managers using the fund type. By going with an ETF, active value managers can generate real returns for their investors.

Secondly, active managers using an ETF structure do not need to worry about investor redemptions. One of the issues with value investing, especially deep value styles, is that it can take a long time for the market to realize a stock’s mispricing. Mutual funds must sell shares to cover investor redemptions. This can lock in losses or enable a value manager to underperform while they wait for their stocks to realize their potential. With ETFs and their creation/redemption mechanism and second market transactions, value managers are able to buy and hold stocks to their completion. This should help them to perform better over the long haul.

Use the Dividend Screener to find high-quality dividend stocks.

Making an Active Value Play

Given that active ETFs can play a big role in value investing, investors looking at adding a dose of value stocks may want to skip the broader index funds like the iShares S&P 500 Value ETF (IVE), and instead focus on one of the newer active value ETFs to hit the market. And there are plenty to choose from.

The key is due diligence, and to find ETFs with so-called high active shares. Those ETFs in which managers focus on different portfolios, rather than what’s in an index, tend to succeed in the style.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.