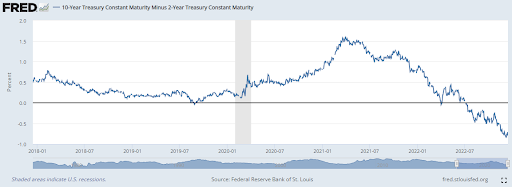

The inverted yield curve is one of the most powerful indicators, having accurately predicted recessions dating back to the 70s. And by mid December, the yield curve inversion between the 10-year and 2-year Treasury notes reached -0.74%. These readings show that long-term interest rates are decreasing relative to short-term rates.

Source: Federal Reserve Bank of St. Louis

In addition to bond yields, Dana Peterson, the Conference Board’s chief economist, recently told CNBC that 98% of surveyed CEOs expect a recession in the next 12 to 18 months. These sentiments may be self-reinforcing since executives often cut back on expenditures in anticipation of a downturn, exacerbating any economic decline.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Hedging With Active ETFs

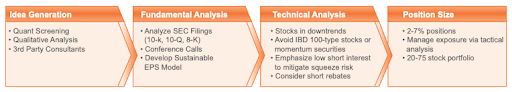

Fortunately, actively-managed ETFs offer an alternative that lets investors remain in the market while taking some risk off the table. For example, the AdvisorShares Ranger Equity Bear ETF (HDGE) takes a fundamental and systemic approach to short-selling stocks. Rather than getting out of the market, the fund lets you “remove” the riskiest stocks and sectors.

Unlike a broad short ETF, the fund managers combine fundamental and technical analysis to build a 20 to 75 stock portfolio with 2% to 7% allocations for each holding. While the fund has a 4.29% expense ratio, these costs could be justified given the managers’ active, hands-on approach that involves more due diligence than passive funds.

For example, fund managers typically look for declining revenue, unsustainable margin expansion, and signs of accounting issues. Then, they’ll look at technical factors like short interest to mitigate the risk of a short squeeze while capitalizing on opportunities to earn short rebates to boost returns from dividends and other sources.

Currently, the fund’s top holdings include:

Source: Barchart.com

So far this year, the fund is trading 13% higher while the S&P 500 Index is about 17% lower, reflecting a 30% outperformance.

The Bottom Line

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.