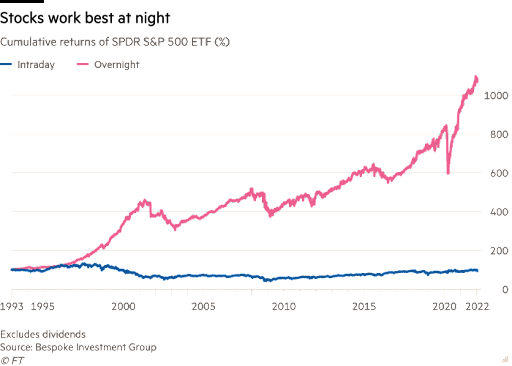

Let’s look at the night effect and how investors can capitalize on it using a new active transparent ETF.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

What Is the Night Effect?

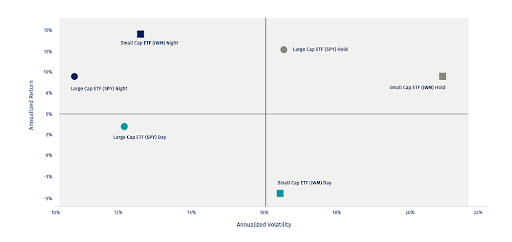

In the chart below, NightShares shows that, in addition to superior returns, nighttime strategies tend to have significantly lower volatility, translating to higher risk-adjusted returns.

There are a few reasons why the strategy might produce market-beating returns. One of the most popular theories is that day traders ‘fading’ stocks at the open cause higher prices earlier in the day. Meanwhile, many day traders don’t want overnight positions and sell at the end of the day. As a result, prices could be higher at the open and lower at the close.

Another theory is that quantitative hedge funds using algorithmic strategies bid up their positions when the market is closed. Since there’s lower liquidity, they can increase after-hours prices more easily. When the market opens, they can gradually liquidate their positions without impacting the market as much, given the higher starting point.

Investing in the Night Effect

More recently, NightShares launched the NightShares 500 1x/1.5x ETF (NSPL), which maintains exposure to the daytime return of the S&P 500 (1x) while offering 1.5x exposure to nighttime returns. As a result, investors can add a differentiated source of U.S. large-cap equity returns and potentially minimize volatility to boost risk-adjusted performance.

The newly launched ETF has a modest 0.67% expense ratio, which is on par with many actively-managed ETFs. In addition to maintaining a modest expense ratio, the fund mitigates transaction costs by using equity index futures/swaps and other strategies to gain efficient exposure to the overnight portion of the market.

Other Hedge Fund Strategies

| Ticker | Name | Type | AUM | Expense Ratio |

| RYLD | Global X Russell 2000 Covered Call ETF | Passive | $1.32 billion | 0.60% |

| RPAR | RPAR Risk Parity ETF | Active | $1.07 billion | 0.51% |

| DBMF | iMGP DBi Managed futures Strategy ETF | Active | $1.06 billion | 0.85% |

| TDSC | Cabana Target Drawdown 10 ETF | Active | $574 million | 0.69% |

| MNA | IQ Merger Arbitrage ETF | Passive | $556 Million | 0.77% |

Data as of October 25, 2022

The Bottom Line

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.