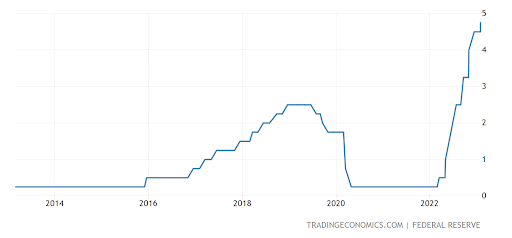

In this article, we’ll look at how low interest rates boosted passive funds over the past 15 years and why active funds could experience a renaissance in today’s rising rate environment.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

How Low Rates Boosted Passive Funds

A handful of large growth stocks disproportionately drove most passive fund returns over the past decade. For instance, Alphabet, Amazon, Apple, Facebook, and Microsoft returned more than 55% in 2020, while the remaining S&P 500 index returned just over 10%. And, at the core, most of these returns came from cheap money.

Low interest rates helped large firms use acquisitions as a substitute for organic growth in the tech industry. For example, Salesforce.com bought Slack for $28 billion and borrowed $10 billion to complete the deal. And Amazon.com has historically doubled down on growth over profits, relying on Wall Street to reward multiples over profitability.

Higher interest rates could make it more difficult for these companies to grow through acquisitions – at least with leverage. At the same time, higher interest rates could push the U.S. into a recession and hurt tech earnings. After all, many tech companies derive their revenue from advertising and consumer spending behaviors.

Why Higher Rates Could Help Active Funds

At the same time, the S&P 500 index dispersion rose to 33% in January 2023, which is just outside the 95th percentile of historical observations, according to S&P Global. The resulting 17% spread in returns between the best- and worst-performing sectors offers active managers more opportunities to outperform their passively managed counterparts.

And finally, a growing number of mutual fund to active ETF conversions could provide investors with more stable and affordable options for active exposure. Many of these funds bring a strong track record and a reputable brand name, making it easier for more risk-averse investors to move their passive fund assets into actively-managed funds to improve returns.

The Bottom Line

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.