Let’s look at the effect on ETF fund flows and how to choose the best fixed income strategies to navigate this year’s market.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

An Uneven Impact on Bond ETFs

Of course, these inflows weren’t evenly distributed among bond funds. Less than $10 billion went into actively managed bond funds, according to

Bloomberg Intelligence. PIMCO and Allianz-branded funds were some of the biggest losers, with PIMCO’s Enhanced Short Maturity Active ETF (MINT) seeing a record $4.4 billion capital outflow.

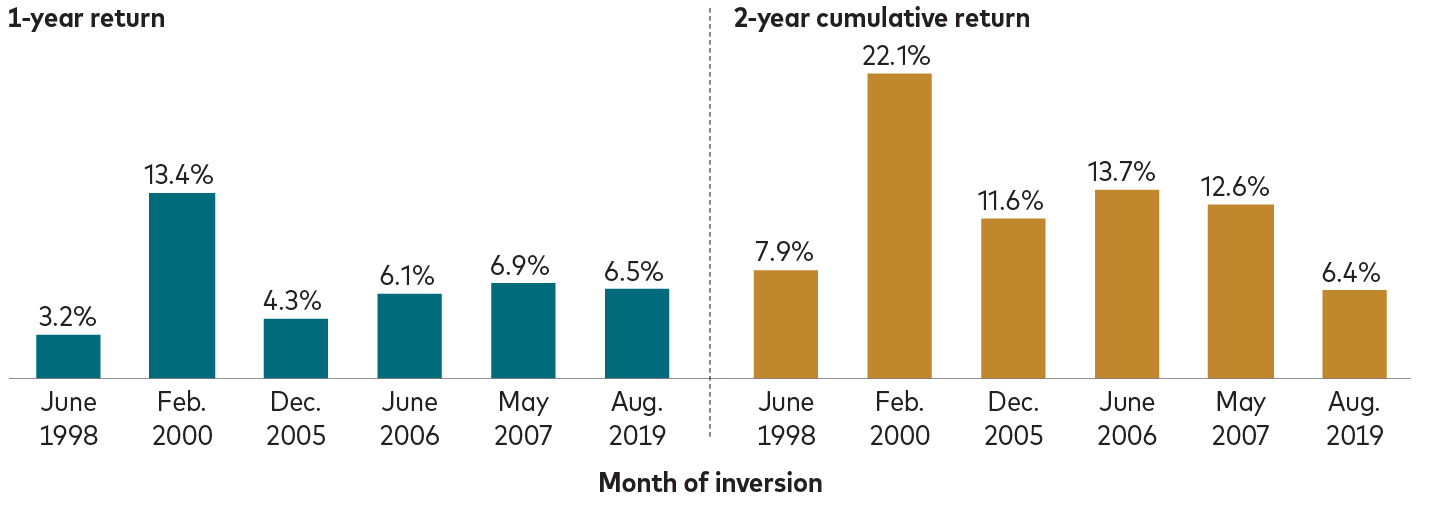

Source: Vanguard

The good news is that bonds could see a recovery in 2023. Historically, one-year and two-year returns on the U.S Aggregate Bond Index after 2-year and 10-year Treasury yields invert are very strong (see above). And bond yields are not sharply higher than dividend yields, meaning investors may have fewer options to generate enough income to outpace inflation.

Asset Managers Differ in Response

Others are doubling down on their active fixed-income fund offerings. For instance, Invesco recently launched four new fixed-income ETFs, saying that fixed income still represented the fastest-growing active strategy in 2022. These new funds fill in some holes in their offerings, providing investors with options to capitalize on things like CLOs and HY bonds.

Invesco’s new fund offerings include:

| Name | Ticker | Expense Ratio |

| Invesco AAA CLO Floating Rate Note ETF | ICLO | 0.26% |

| Invesco High Yield Select ETF | HIYS | 0.48% |

| Invesco Municipal Strategic Income ETF | IMSI | 0.50% |

| Invesco Short Duration Bond ETF | ISDB | 0.35% |

Choosing Active vs. Passive Bond ETFs

Investors may consider using active fixed income funds when investing in riskier bonds. For instance, Invesco’s newly launched High Yield Select ETF (HIYS) uses fundamental analysis to invest in below investment grade securities strategically. Meanwhile, passive funds may be better for government bonds or less risky fixed income assets.

In addition, investors should always review an active bond fund’s performance relative to a benchmark index. It’s essential to look at both yields and risk factors, such as volatility, to determine if the bond fund is suitable for your portfolio and worth the extra cost versus a comparable passive fund.

The Bottom Line

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.