There’s an old adage on Wall Street that goes “it’s not what you earn, it’s what you keep.”

And while that saying was primarily focused on taxes and Uncle Sam, it can be applied to investment costs. After all, investment fees come directly out of your bottom line. Investors have gravitated to this fact over the years. This is one of the reasons why passive and index funds have become so popular. Asset managers have spent the better part of the decade battling it out and driving fees lower to rock bottom rates.

And it looks like that “fee war” is now making its way into actively managed funds.

Thanks to new research by Morningstar, fees on active funds continue to plunge. Driven by a surge in new active exchange-traded funds (ETFs), investors are paying less to take advantage of the benefits of active management. In the end, lower fees are better for everyone, and actually let active management overcome one of its biggest hurdles.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Billions Saved

$6.2 billion – that’s a lot of coin. And that’s the amount in fees that Morningstar estimates investors saved last year as expense ratios continued to drop. In 2020, the asset-weighted average expense ratio across all mutual funds and exchange-traded funds – minus money market funds and so-called funds-of-funds – clocked in at 0.41%, which comes out to be just $41 per $10,000 invested. That’s down from 0.44%, or $44 per $10,000 invested in 2019.

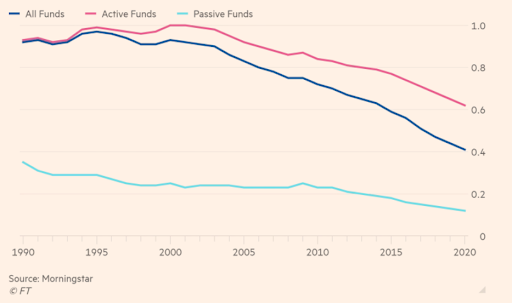

Pulling back further, falling expense ratios have been a major source of additional investor return and cost savings according to the investment researcher. Average expense ratios stood at 0.93% for all mutual funds and ETFs back in the year 2000. That’s a huge savings for investors.

Leading the way has been the revolution in passive ETFs and index funds. The reality is that all S&P 500 index funds are the same, especially those that use a full replication strategy. As a result, there’s no real difference between, say, Vanguard, BlackRock or Joe Schmo. You can still expect the same cost of ownership. Because of this, the major investment managers have spent the latter part of the decade decreasing their fees to attract investors to their funds.

And it’s worked. Billions have flowed into index funds, and the asset-weighted fee across all passive funds has declined by 66% since 1990. Currently, the average expense ratio of these funds stands at 0.12%.

Use the Dividend Screener to find high-quality dividend stocks. Stocks with the highest ratings are Dividend.com’s current recommendations to investors.

Active Gets Into the Game

But there’s an interesting side piece to the Morningstar research report. The number of passive funds decreasing their expense ratios is now at a five-year low and the vast bulk of funds have stopped decreasing their costs.

It turns out that active funds are getting into the fee war and driving lower expenses. More than 37% of all active funds reported lower expenses last year versus 2019. You can see from this chart from the Financial Times using Morningstar’s data just how quickly active fees have started to drop and how passive fees have flatlined.

Source: FT.com

All in all, the asset-weighted fees paid by investors in active funds clocked in at just 0.62% last year. That’s a 33% decline since the 1990s. The difference between 2019 and 2020 was a nearly 5% drop in fees alone.

The winner, and perhaps the main driver of this fee decline, has been ETFs. Without the additional sales loads, 12b-1 fees and other costs, active ETFs are winning the war for lower expense ratios and investor preferences. Morningstar data shows that active ETFs have taken in the lion’s share of new money from investors looking at active strategies.

Better still is that Morningstar estimates that the fee war in active ETFs will continue to benefit investors. With their higher starting point to begin with, fees of active ETFs have a lot further to fall than that of their passive counterparts. Analysts now predict that this will be the battle for large asset managers to attract new investor money to their funds.

Investors Win

In the end, lower fees are better for investors. And even better for active funds.

One of the biggest criticisms is that active management’s higher fees often cause it to underperform low-cost passive investments. For example, if you invest $100,000 in an active fund and earn 6% per year for the next 25 years, you’d end up with about $430,000. However, if you tack on a 2% per-year expense ratio to that, after 25 years, you would only have about $260,000. Whether or not that 6% return is better than a low-cost passive fund tracking the S&P 500 is really irrelevant given the active fund’s high fees. It’s return could be better by a wide margin and the fee will still cause it to underperform.

But by reducing the fee on the active fund, it has a chance to outperform and provide real returns for investors.

And that’s the direction we’re heading. Thanks to their structure, ETFs are bringing down costs for active management to a level where they can compete with passive funds and use their benefits to actually outperform. Morningstar’s report highlights just how far fees have fallen and how much further investors can win in the new burgeoning fee war.

Our Best Dividend Stocks List has 20 of the highest-rated stocks by our proprietary Dividend.com Rating system. Go Premium to find out the entire list.