Let’s look at Fidelity’s new funds and the broader mutual fund to active ETF conversion landscape.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Fidelity’s New Thematic ETFs

The following six mutual funds will be converted to their ETF equivalents:

- Fidelity Disruptors Fund (FGDFX)

- Fidelity Disruptive Automation Fund (FBOTX)

- Fidelity Disruptive Communications Fund (FNETX)

- Fidelity Disruptive Finance Fund (FNTEX)

- Fidelity Disruptive Medicine Fund (FMEDX)

- Fidelity Disruptive Technology Fund (FTEKX)

According to the company’s regulatory filings, the new ETFs will have a modest 0.50% expense ratio in line with the industry average and lower than the previous mutual fund’s 1% expense ratio. And all of the converted funds will be run by the same portfolio managers, meaning investors will have access to the same strategies and experience.

Following a Broader Trend

According to Bloomberg Intelligence, more than $1 trillion worth of mutual fund assets could be converted into ETFs over the coming decade, providing a massive boost to the $6.5 trillion ETF market.

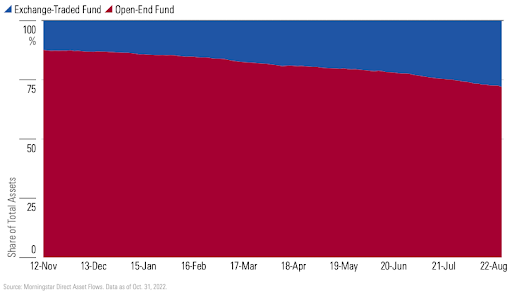

Mutual funds are steadily losing market share to ETFs. Source: Morningstar

Mutual funds have steadily lost market share to ETFs since 2012. That’s because many older investors are drawing down their mutual fund-heavy portfolios in retirement. And at the same time, younger fee-conscious investors are more prone to use robo-advisors (leveraging ETFs to build portfolios) or construct their own portfolios.

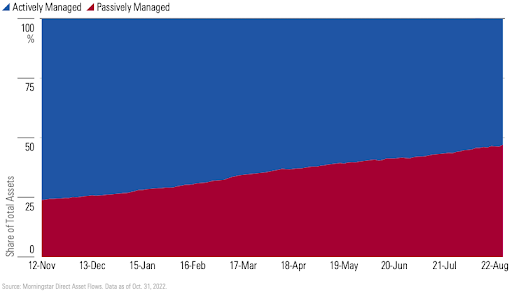

Passively-managed funds have captured market share from actively-managed funds over time. Source: Morningstar

The transition from actively-managed to passively-managed funds has also influenced mutual fund-to-ETF conversions. Since actively-managed funds typically have higher fees, they’re most vulnerable to losing the market share to lower-cost active ETFs. Therefore, it’s not surprising that most conversions have involved active strategies.

Why Undergo a Conversion?

Mutual funds must constantly rebalance to maintain asset allocations or accommodate redemptions. And the sale of securities creates a capital gain for all shareholders. As a result, you could have an unrealized loss on your mutual fund shares and still owe capital gains tax!

On the other hand, ETFs manage inflows and outflows by creating and redeeming creation units – or baskets of assets that approximate investment exposure. That means shareholders don’t typically experience capital gains on any individual security in the underlying structure.

But why would fund managers take a haircut on fees and convert their top actively-managed mutual funds to ETFs?

Mutual fund-to-ETF conversions enable asset managers to maintain their performance track record and retain existing shareholders through the conversion. In addition, ETFs are cheaper to run and easier to sell than mutual funds, potentially translating to a larger asset base.

Finally, new ETF rules permit mutual funds to launch semi-transparent ETFs and active non-transparent ETFs. As a result, asset managers concerned about disclosing their holdings in real time can protect their strategies and still compete in the ETF universe.

The Bottom Line

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.