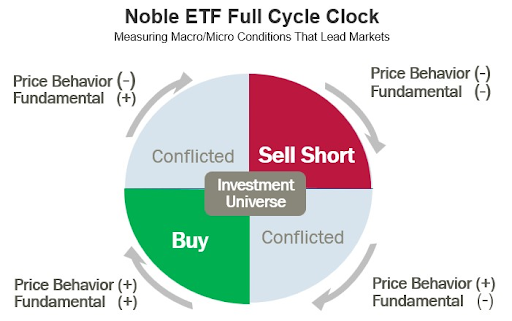

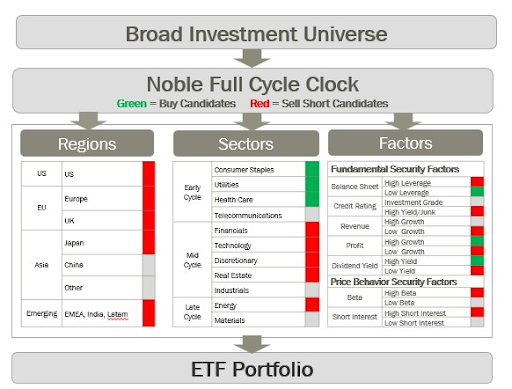

The Noble Absolute Return ETF (NOPE) is one of the few funds offering an actively-managed, long-short, absolute return strategy that captures investment opportunities over global market cycles and across regions, sectors, and factors. Using hedge fund-like strategies, the fund offers institutional-level access to everyday investors.

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

A Unique Long-Short Strategy

The fund holds primarily mid- to large-cap equities but may use liquid options to fine-tune positions and hedge risk. With its flexible long-short approach, the managers project a 150% maximum long exposure and a -100% maximum short exposure. The fund may also offer a yield in some market conditions (e.g., it currently has a 3% 30-day SEC yield).

Currently, the fund’s top non-cash holdings include:

- ProShares UltraShort QQQ

- ProShares Short Bitcoin

- Tesla Put Options

- Exxon Mobil Corp.

- Devon Energy Corp.

In terms of expenses, the fund charges a 0.98% management fee and anticipates paying about 0.84% in dividends on short sales, yielding a total expense ratio of 1.82%. While that’s higher than many other active ETFs, it’s significantly less than the 2-and-20 management fee structure comparable hedge funds charge their shareholders.

Alternatives to Consider

For example, the First Trust Long/Short Equity ETF (FTLS) takes a similar long-short approach using commodity futures.

Other activel ETFs to consider include:

| Name | Ticker | AUM | Expense Ratio |

| Franklin Systemic Style Premia ETF | FLSP | $98.1 million | 0.65% |

| Leatherback Long/Short Alternative Yield ETF | LBAY | $56.6 million | 1.43% |

| LHA Market State Alpha Seeker ETF | MSVX | $44.6 million | 1.42% |

| Discipline Fund ETF | DSCF | $31.3 million | 0.39% |

| Convergence Long/Short Equity ETF | CLSE | $23.5 million | 1.56% |

Data as of November 2, 2022

The Bottom Line

Drawing on this experience, the Noble Absolute Return ETF offers investors a unique hedge fund-like opportunity under an ETF umbrella. With its flexible long-short strategy, the absolute return fund aims to achieve positive returns during any market conditions, making it a compelling choice in today’s market environment.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.