Let’s go over some of the key tenets of the prospectus.

Overview

For the purposes of this article, we will use the prospectus for the American Funds Growth Fund of America, which can be found here. It can be found through the fund family’s website at American Funds and covers all of its share classes, including the A, B, C, F series (e.g., F1), 529 series (e.g., 529A) and R series (e.g., R1) shares.

1. Investment Objective

For instance, the Growth Fund of America’s objective is to provide its shareholders with growth of capital. However, depending on the fund, this could include preservation of capital, growth and income, or aggressive growth.

2. Fees and Expenses

For example, the A and 529-A shares’ upfront load for the Growth Fund is 5.75% with a maximum deferred sales charge of 1.00%. The prospectus fee section also breaks down the fund’s expense ratio. The Growth Fund A share, for instance, has a management fee of 0.27%, a distribution (12b-a) fee of 0.24% and other expenses of 0.13%. This would have an annual fund operating expense of 0.64%.

For more information on mutual fund share classes, click here.

Another useful section for investors is the example that American Funds provides when $10,000 is invested in each of the different share classes. Using the A share again, a shareholder would pay $637 after one year, $768 after three years, $911 after five years and $1,327 after ten years. Over the ten-year period, the most inexpensive share class for the Growth Fund is the F-3 share at $418. However, this is the institutional class and cannot be typically purchased without investing a very large amount.

Later on in the prospectus, one can find more in-depth coverage of sales charges, sales charge reductions and waivers, and how to choose the right share class.

3. Investment Strategies

For instance, the Growth Fund invests in stocks that offer “superior opportunities for growth of capital.” This section also states the fund will primarily invest in large and mid-capitalization companies, as well as up to 25% of stocks that are outside the United States. The Growth Fund also uses a system of multiple portfolio managers, which is divided into segments. This way, the manager believes that the fund will best achieve its goals using the best-performing segments.

4. Risk

For example, the Growth Fund identifies five specific risks. Market conditions are the first risk, which are due to the fund’s investment in stocks. Issuer risk is another risk where the issuer of a current holding could cause the investment value to decline due to a deterioration of rating or other negative aspects. The Growth Fund also has risks of investing in both growth and international stocks. Finally, the last stated risk is management risk where the investment could lose value if the fund’s management changes or could change methods of analysis.

To measure the risk of a mutual fund, read this article.

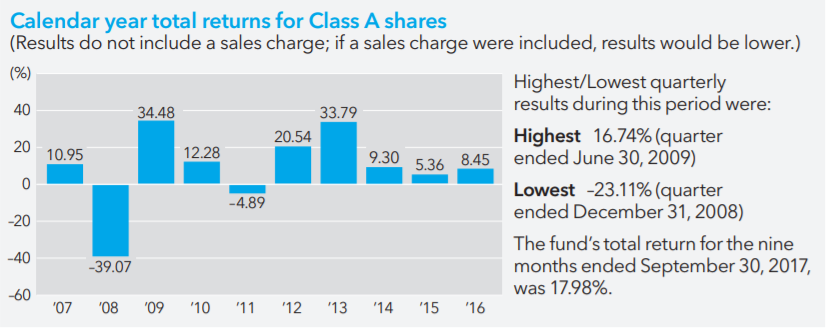

5. Past Performance

6. Manager Information

For instance, the prospectus for the Growth Fund of America covers the fund’s management section in two areas. The first is a quick summary of the investment advisor, which is called the Capital Research and Management Company. It also lists the 12 team members and provides their portfolio management experience. Later on in the prospectus, there is much more detailed information on the investment advisor and each individual team member.

Want to know what a mutual fund manager does exactly? Read this.

7. Purchase and Sale Information

For example, the minimum account size for the fund is $250 with minimum subsequent purchases of $50. This section also includes contact information if an investor wants to sell shares it owns that are held directly at American Funds.

8. Benchmark Comparisons

For American Funds, there is the ‘Additional investment results’ section that compares the A share average annual total returns against several benchmarks for comparative purposes. It shows five indices, such as the S&P 500, Lipper Large-Cap Growth Funds Index, Lipper Growth Funds Index, Lipper Large-Cap Core Funds Index and Lipper Capital Appreciation Funds Index. Like the past performance section of the prospectus, this table displays the returns in the one year, five year, ten year and lifetime time frames.

A useful resource to compare index funds against actively managed funds is the Index Fund Center.

9. Other

It covers topics like distributions, taxes, rollovers from retirement plans and financial highlights. Distributions discuss the issuance of capital gains in December, which is common with almost every mutual fund. The tax portion covers the taxation of both the short-term and long-term ramifications of capital gains distributions and transactions. The rollovers from retirement plan section cover the different circumstances when an investor is looking to roll his or her mutual fund in an employer-sponsored plan into an IRA. Finally, the financial highlights section is intended to further help investors understand the fund’s results for the past five years, displaying a variety of tables.

The Bottom Line

All investors should review mutual fund prospectuses before deciding to purchase a mutual fund to make sure that they are well-informed of the fund’s fees, risks and other very important factors and ensure that they align with their investment goals.

Sign up for our free newsletter to get the latest news on mutual funds.