While some mutual funds carry a “one-size fits all” or no-load moniker, many others offer a variety of share classes that represent the same ownership of the fund. However, each comes with its own mix of one-time expenses, tickers and operating costs. Choosing the wrong share class for your portfolio could have some negative effects on fund performance over both the short and long term.

Nonetheless, with a bit of basic background knowledge, selecting the right share class for your portfolio can be an easy exercise and lead to the right returns for you and your investment goals. This basic knowledge is critical for anyone looking to use mutual funds as a way to expand their portfolio’s potential.

Read on to find out how to decode the various share classes of mutual funds.

Share Classes: The Basics

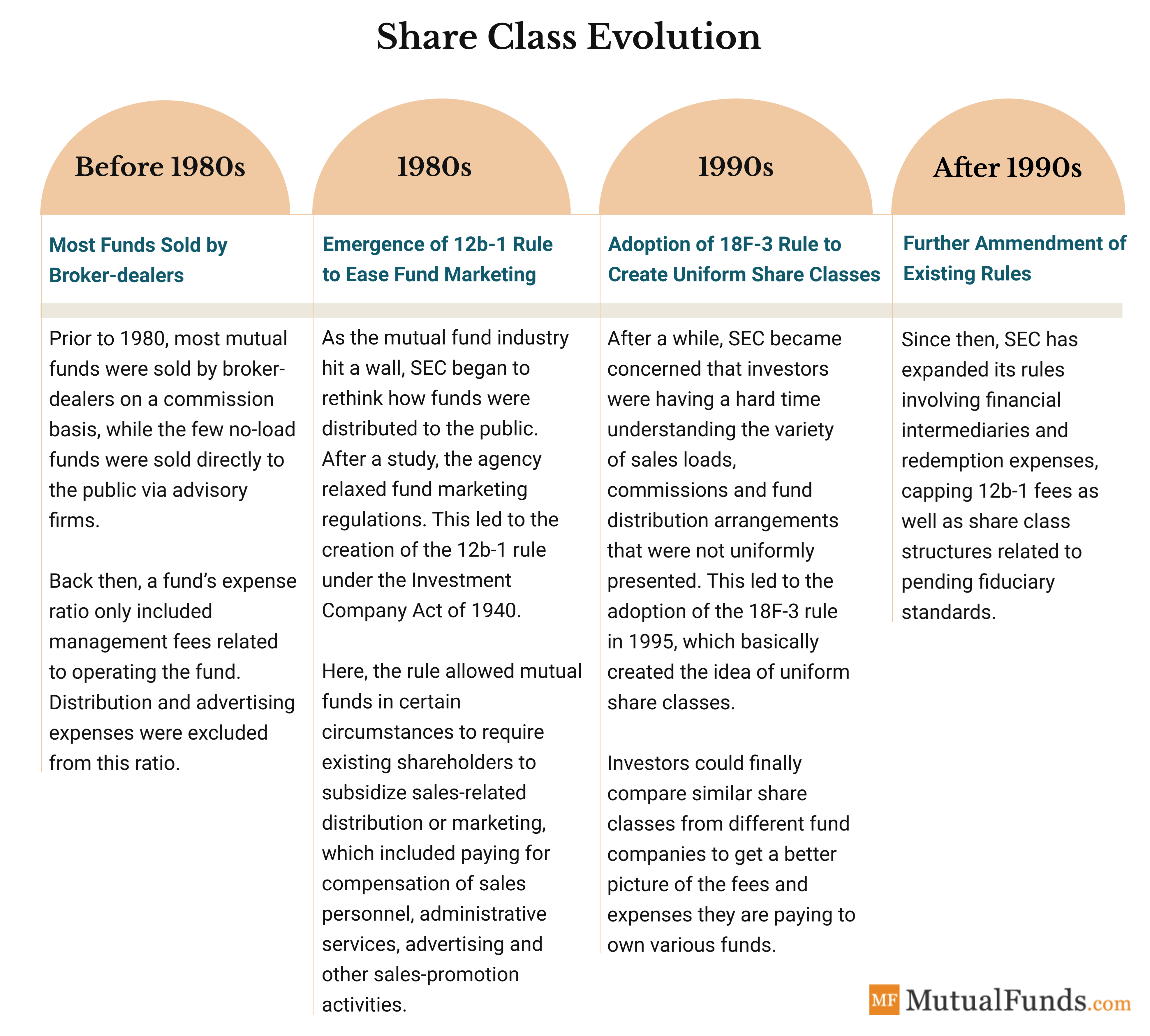

The reason for the difference and multitude of share classes stems from a variety of regulatory actions by the Security and Exchange Commission (SEC), with rules 12b-1 and 18f-3 being some of the most important.

The main reason behind creating a multitude of share classes stems from the fact that fund companies needed different ways to make their funds appealing to different groups of investors. As a result, multiple share classes of the same fund emerged and they were primarily differentiated based on the investor group targeted, fees charged and minimum investment requirement.

The Share Class Alphabet Soup

For starters, the first thing is to determine what kind of account you’re investing in – taxable, tax-deferred or tax free. Second is to determine the timeline for those assets, whether it will be long or short. If the investment is for retirement, general spending or a child’s education via a 529 plan, certain share classes work better than others in different situations. The decision comes down down to a few factors and metrics associated with each share class.

One of the biggest is the so-called sales-load. Some share classes will charge an upfront fee, as high as 5.75%. This may not be good for an investor looking to dollar-cost average small monthly purchases each month as a fee will need to be paid each time. At the same time, some funds will charge a back-end load when shares are finally sold. This may be best suited for investors looking for short-term holding periods. Additionally, some share classes remove 12b-1 fees altogether.

Secondly, initial investment amounts matter when selecting a share class. Some share classes require as little as $0 to purchase, while others require investors to pony up $1 million or more. Moreover, many mutual fund firms will offer so-called break points for investors willing to invest deeper over a period of time. This can help reduce front-end or back-loads on some mutual fund share classes.

With this information in tow, investors can choose the right share class for their investment. And while there are numerous classes, the most popular are A, B, C and I.

- Class A

Historically, these shares were sold by financial advisors that worked directly with investors. In order to compensate the advisor for the sale, Class A shares come with what’s called a front-end load. This is still true today – even if the shares are sold directly by a mutual fund company. Typically, this fee is between 2.5% and 5.75% and is taken off when the shares are first purchased. Secondly, because of the front-load, Class A shares generally have lower 12b-1 fees than other classes. This makes them a good option for longer-term investments.

- Class B

Like Class A shares, Class B shares charge a sales load. However, this time it’s on the back-end – when shares are sold. To compensate and encourage shareholders to stick with the fund, this sales load drops the longer you hold Class B shares. And after a certain period, that fee can drop to zero – typically six to eight years – and will convert into Class A shares. Typically, initial expense ratios are more expensive for Class B shares as are 12b-1 fees. However, longer holding periods will drop these expenses.

- Class C

Class C shares are also known as level-load funds. With that, Class C shares do not charge a front- or back-end sales load. However, they do lever an extra charge, typically 1% every year of fund ownership. Without the front-end load, your entire contribution earns a return. Nonetheless, that extra 1% on top of regular expenses make them an expensive choice for longer holding periods. As a result, they make sense for shorter time lines.

- Class I

If you have a lot of money to invest – normally, $500,000 or more – then Institutional or I Class shares could be a good bet. They offer lower expense ratios than A, B and C classes, and typically do not come with 12b-1 fees. Class I shares represent some of the lowest cost mutual fund shares around.