Building a portfolio is a complex endeavor. And we’re not just talking about what asset classes to own and in what percentages. Actually, funds and security selection are equally complex. This is especially true when dealing with mutual funds.

This is why here at Mutualfunds.com, we’ve come up with the concept of “primary share class” for our screener, fund sponsor and fund category pages. By simplifying the process of selection and avoiding the alphabet soup of share classes, investors can get exactly what they are looking for.

Sign up for our free newsletter to get the latest news on mutual funds.

What Are Share Classes?

For example, American Funds Growth Fund of America is one of the largest mutual funds on the planet with nearly $190 billion in assets. However, investors can get access to the fund via a whopping 17 different share classes – Class A Shares (AGTHX), Class C Shares (GFACX), Class F-2 Shares (GFFFX), etc.

The problem is that each of the share classes own the same assets, but they come with different fees and expenses. Moreover, many share classes have different initial minimum investments. The theory is that investors are able to pick a fee/expense structure that aligns with their investment goals and timelines.

However, in reality, that theory tends to confuse investors, make security selection harder and place them in products that may not accomplish their goals.

An Introduction to Primary Share Class

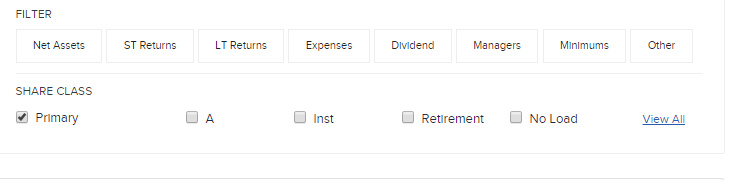

Now, when a user searches our screener for funds related to an asset class, looks at a fund company page or a category page, the various tables on the site will show just one share class for each fund. By default, this is the Primary Share Class. This way, it becomes simpler to compare different funds. Users don’t have to look at several rows of data for the same fund anymore. However, an investor can choose a different specific share class or multiple classes, if they already know what they are looking for.

To start with, we looked at the initial inception date for a fund. Thanks to the various regulation changes over the years, many share classes have different initial start dates – the share class with the earliest inception data is the primary share class for that fund. Typically, the age of a share class often determines what ticker becomes the most “popular” search for investors. Moreover, older share classes tend to be invested in more than the newer ones. As a result, we use this as our first metric when defining Primary Share Class. Using the example above, AGTHX has an inception date of 1973, while GFFFX has a start date in 2008. As a result, Class A (AGTHX) is the Primary Share Class for the American Funds Growth Fund of America.

However, there are many instances when a fund’s various share classes got their start on the same day. Sometimes, a fund sponsor will try and cover all share classes and scenarios at once. A prime example of this would be Franklin Templeton’s Franklin Mutual Beacon Fund. The fund’s Class A (TEBIX), Class C (TEMEX) and Class Z shares (BEGRX) all launched in 1962.

In this case, we use a logical order to determine a fund’s Primary Share Class. First, we look at our reader base. Funds with investor, institutional and advisor share classes are given top billing, as these are the main categories of users on our site. This makes it easier, for let’s say, an endowment fund manager, to quickly see “institutional” classes for a category or asset class.

As Class Z would be classified under “advisor/manager” category, BEGRX would be the Primary Share Class for the Franklin fund.

Next, thanks to their popularity, we use the various load-bearing share classes – A, B, C, and D. And while retirement is a major goal for many mutual fund investors, it isn’t the only reason people invest. Because of this, retirement share classes are further down the line. Same with no-load funds, because not everyone has access to them. Finally, filling out the rear are all other share classes.

Use our screener to find the funds that meet your investment criteria.

A Novel Way to Explore Mutual Funds

Let’s say you’re interested in adding some exposure to fast-growing Brazil and Latin American equities. Under the “other” filter, you can click the “Latin American Equities” category. Using the Primary Share Class metric from this link would give you the following easy-to-digest table. From here, you change the share class, dig into fund sponsors or minimum investment filters to find the right fund.

But our new primary share class ranking system makes it easy to compare it to other funds in the same category by default. You can still compare the different share classes from the same fund, which can be done by unselecting the primary share class filter.

The Bottom Line

Be sure to check our News section to keep track of the recent fund performances.