For emerging markets, the process might be a bit more difficult. However, the rewards might be greater.

The truth is that ESG investing could lead to better returns as well as less risk in emerging and developing market stocks. With investment managers now turning their ESG attention toward the developing world, investors may finally be able to invest with confidence in high-risk stocks.

Be sure to check out our ESG Channel to learn more.

Putting the ESG in Emerging Markets

For stocks in China, Poland or Peru, this simple screening may not be enough.

By definition, emerging markets are, well, emerging, and that means they are just beginning their economic journeys. That’s generally the reason for owning them in the first place: they offer plenty of untapped potential. But with that untapped potential comes a host of problems. However, ESG can tackle these problems.

For example, environmental concerns and regulation might not be up to snuff in many of these nations. The majority of emerging market countries have relied heavily on fossil fuels like oil and coal—just like the developed world during their industrial phases—to fuel their economic growth. Nonetheless, this isn’t without consequence. The United Nations pegs that 92% of the Asian and Pacific population is exposed to air pollution, which comes with significant health risks.

Corporate governance can also be a headache when it comes to EMs. High insider and family ownership stakes can result in fewer internal controls. Bribes and kickbacks are sometimes part of normal business routine, while accounting standards across the world are different. Social factors can also be a problem, with different governments having different levels of ‘freedom’ and rules.

To that end, it takes a different and more active approach to applying ESG to emerging nations. It’s not just looking at a corporate level; ESG managers need to also focus on the nation and region-level when applying screens. Looking at all sorts of factors—from what a nation is doing to help its environmental standards and ending corruption to how it conducts elections—needs to be included in the analysis. At the same time, a different set of criteria needs to be applied to individual stocks within this framework. The one-two punch is how ESG can succeed in the developing world.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

Better Returns

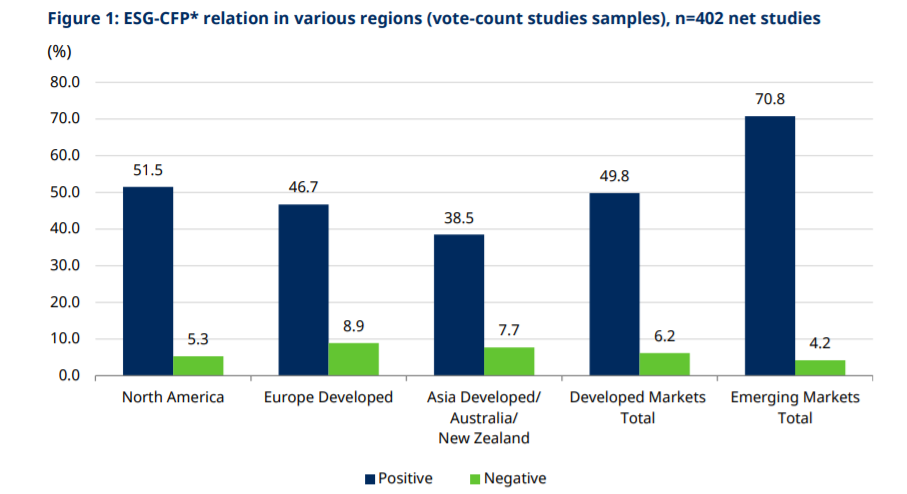

Source: Schroder’s

As for actual numbers, the MSCI Emerging Markets ESG Leaders Index has managed to outperform the regular MSCI Emerging Index every year since its launch in 2008. Better still, the index has managed to produce positive returns when the broader non-ESG index has produced negative returns. Moreover, the ESG focused index has done so with less risk and overall volatility.

Making an ESG Play in Emerging Markets

Due diligence is key. Just as the developed market focused FlexShares STOXX US ESG Select Index Fund (ESG) and SPDR S&P 500 Fossil Fuel Reserves Free ETF (SPYX) track different ESG indexes/themes, the same can be said for many emerging market ETFs and funds that cover ESG. Investors and advisors need to focus on the funds that align with their goals and risk profiles.

Additionally, index versus active management styles need to be considered. For example, the iShares ESG Aware MSCI EM ETF (ESGE) takes a passive approach, while the GS ESG Emerging Markets Equity Fund (GEBIX) is actively managed. Given the additional needs of ESG in emerging markets, actively managed funds could be the best way to get the edge.

The Bottom Line

Make sure to visit our News section to catch up with the latest news about income investing.