Let’s take a look at how ESG’s growing popularity has led to increased government scrutiny and efforts by the industry to police itself.

Be sure to check out our ESG Channel to learn more.

ESG’s Growing Popularity

Some of the most significant U.S. ESG funds include:

| Fund Name | Assets Under Management | Expense Ratio |

| PRBLX | $29.4 Billion | 0.84% |

| ESGU | $21.6 Billion | 0.15% |

| VFTNX | $14.6 Billion | 0.12% |

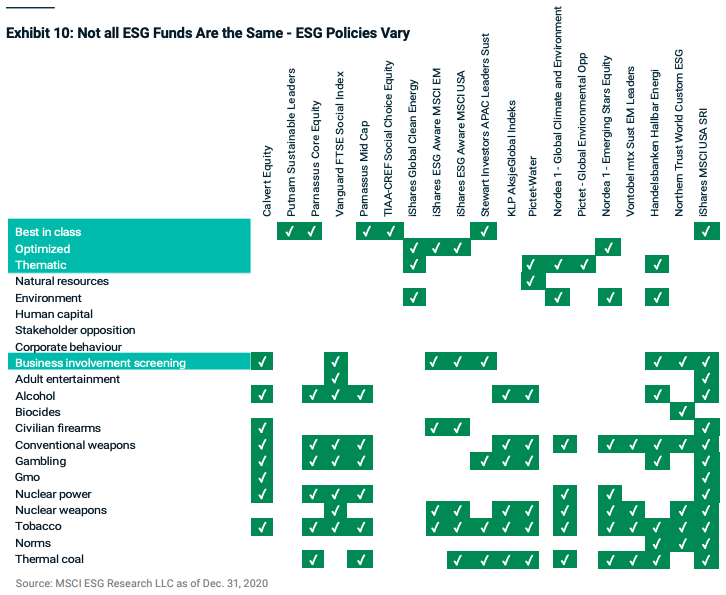

As MSCI points out in a recent report, each ESG fund has its own unique approach to the market. For example, some funds exclude certain non-ESG businesses, such as tobacco companies or weapons manufacturers. In contrast, others take a thematic approach by preferentially choosing certain companies, such as clean energy companies.

Government Tightens ESG Standards

In response to the new rules, Allianz Global Investors, DWS Group, and other large fund managers began dropping the term ‘ESG integrated’ in their public documents, according to Bloomberg reports. U.S. and German regulators have also been looking into greenwashing accusations from Deutsche Bank’s former sustainability head, Desiree Fixler.

The U.S. is starting to have the same conversations, suggesting that ESG regulations could be forthcoming in the world’s largest financial markets. In fact, SEC Chair Gary Gensler said that ESG disclosure regulations would be central to his tenure.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

Mega Funds Push for Standardization

To that end, CALPERS, Carlyle, Blackstone, and other asset managers with more than $4 trillion in assets under management banded together to standardize ESG data. The group’s goal is to develop a common language by aggregating emissions, diversity, and employee data across closely-held companies (e.g., private equity).

In addition to self-regulation over the long term, the group wants to streamline the process over the short term. Carlyle Group’s Megan Starr told Bloomberg that her firm receives more than 40 ESG information requests per month, asking for different sustainability metrics, translating to a lot of time and effort.

The Bottom Line

Make sure to visit our News section to catch up with the latest news about income investing.