As You Sow, a non-profit shareholder advocacy group, recently found that 60 of 94 ESG funds failed to adhere closely to the principles of ESG investing, making it impossible to tell the difference between a true ESG offering and a greenwashed fund. The researchers shared these findings with the SEC in hopes the agency would enact stricter rules.

Let’s take a closer look at the recent study, why greenwashing is a problem, and how investors can best align their portfolio with ESG goals.

Be sure to check out our ESG Channel to learn more.

Study Finds Widespread Greenwashing

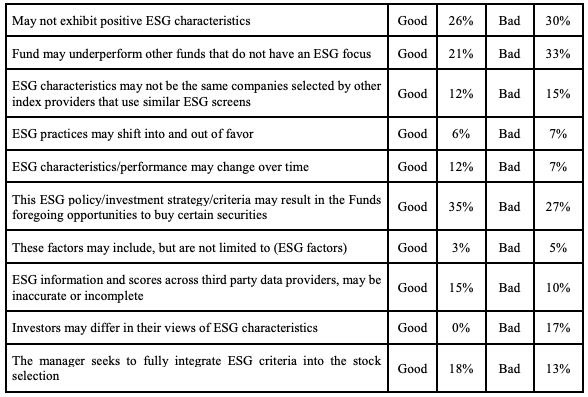

While terminology alone couldn’t accurately predict greenwashing, the researchers determined that 60 of the 94 funds held a significant number of non-ESG stocks in their portfolios. The team also found defensive phrases were common among good and bad funds, making it hard for investors to determine their actual impact.

The advocacy group met with the SEC to share their findings and recommendations. While the SEC has threatened potential ESG investigations, greenwashing remains prevalent across the market. As You Sow recommended that prospectuses be produced in a machine-readable format to analyze ESG wording and more easily identify greenwashing.

How to Avoid Greenwashing

Another way to avoid greenwashing is to seek inclusionary ESG funds. Rather than removing low-rated companies, these funds seek out companies that actively address ESG-related concerns. JPMorgan’s new Climate Change Solutions ETF (TEMP) is an excellent example of a fund that invests in companies addressing climate change.

Finally, many rating companies are incorporating ESG into their offerings. For example, Morningstar has a sustainability tab that looks at each ESG pillar and assigns a score based on the fund’s portfolio. You can also easily see the percentage of a portfolio invested in fossil fuels and a carbon risk score while comparing the fund with its peers.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

The Bottom Line

Make sure to visit our News section to catch up with the latest news about income investing.